AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

January 2025:

False Prophets

Onchain AI Agents

Pectra - Ethereum’s Next Upgrade

RWA’s in 2025

AB Portfolio

False Prophets

We’re hitting the point in the cycle where new coins are popping off every day/week. The AB Fund made an investment last week that tripled in 24 hours. We took some profit. We’re not geniuses, it is that point in the cycle. We got lucky with timing.

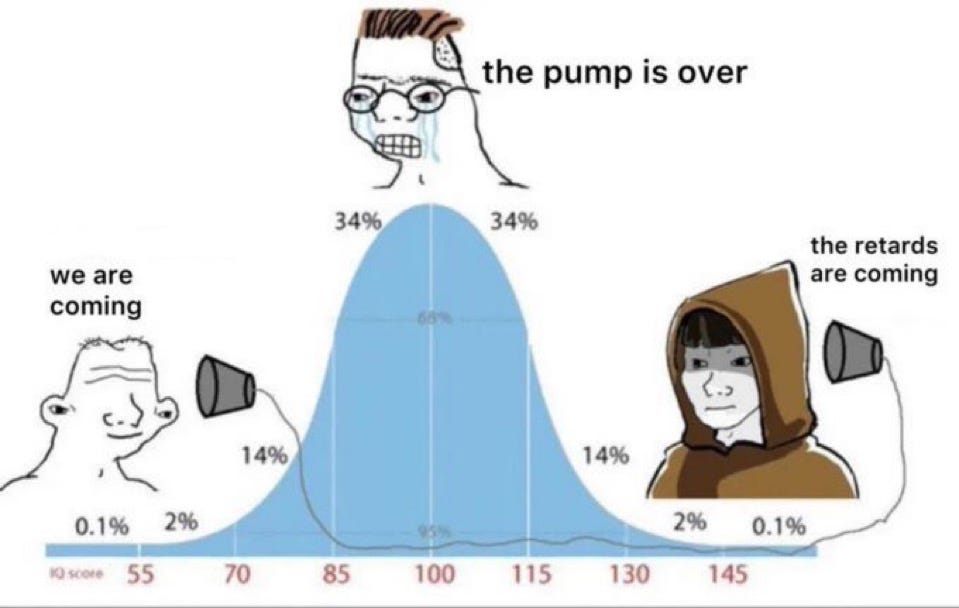

So what does this mean? Be careful of people that ACT like they know how everything is going to play out. No one knows what is going to happen. Worth repeating: no one knows what is going to happen. People will pretend to. They prey on the new entrants that look for “guides” to repeat the process of wealth creation that attracted them to crypto in the first place. In investing, we call this adverse selection. This is why most people get rekt’d their first crypto cycle.

If someone really has alpha, why would they give it away for free? Why would a large account be posting it on twitter for everyone to see?

Most of the time, they’re using those new buyers as exit liquidity. Influencers or Key Opinion Leaders (KOLs) are not really trying to help you. Some might provide good data but others are literally trying to dump on you as soon as they tweet.

In an industry that moves as fast as crypto, with instant liquidity, it provides an opportunity for persons with questionable morals to soft or outright rug a project once they raise money. There are many such cases. This is why it often beneficial to have professional managers, like Advantage Blockchain, to help increase crypto exposure outside of Bitcoin.

AB Researcher: Whitetail

Onchain AI Agent Update

Since our last newsletter, the emerging AI agent meta has continued to capture the zeitgeist of the crypto industry. Several infrastructure players have established themselves as leaders in this rapidly evolving space. The meta was initially propelled into the spotlight by GOAT, as discussed in our previous issue.

One notable example is Virtuals, a protocol built on Ethereum's Layer 2 solution, Base. Virtuals allows users to launch AI-powered social media agents and has flourished as people recognized the real social impact of AI agents. At its peak, the Virtuals token reached a market cap of $5B, and several agents launched on the platform achieved market caps exceeding $100M.

Similarly, an entire AI agent and infrastructure meta has emerged on Solana, with ai16z leading the charge. Ai16z's GitHub repository for launching autonomous AI agents became one of the most popular repositories globally, even reaching the number one spot. The attention surrounding this project propelled its token to a peak market cap of $2.5B. Ai16z has also announced plans to launch a platform similar to Virtuals.

The AI agent meta, which can be tracked on Cookie.fun, has reached a combined market cap of $15B. Many crypto enthusiasts are optimistic about these AI-driven projects, as they mark a shift away from the dominance of meme coins, which have drained liquidity from other crypto narratives. This renewed focus on projects with potential utility is a promising development for the industry.

AB Researcher: Digital Duke

Pectra - Ethereum’s Next Upgrade

One of Ethereum’s largest upgrades for both the execution and consensus layer is on the horizon and slated for early 2025. Due to its size, 20 EIPS were considered, Pectra (Prague + Electra) will be split into two more smaller upgrades. Ethereum Core Developer Teams tested over 100 devnets during an event in Kenya (Nyota Interop) where they narrowed down 20+ ideas into 11 EIPs ready for prime time.

In Q1 2025 or early Q2 2025, Pectra will go live, which could be viewed as the beginning of the big shift toward making the chain “mass adoption” ready from a user standpoint. Considering Ethereum has historically completed one upgrade (hard fork) per year, it wouldn’t be surprising if the second half of the upgrade is completed in late 2025 or early 2026.

Now let's get into a couple of the big changes. Starting with EIP-7702 (previously EIP-3074) which gives users the ability to turn their Externally Owned Account (EOA) into a native smart contract wallet for the duration of a transaction and allowing gas sponsorship. With this new transaction type, those coming to Ethereum to transact after this upgrade should see a major UX improvement over current Ethereum and other L1s like Solana.

From a beacon chain perspective, the big change will be EIP-7251 which increases the “MAX_EFFECTIVE_BALANCE” from 32 ETH to 2,048 ETH. The objective here is to ensure there aren’t too many unique validators on the network which increases latency times. In essence, the more validators on a network, the more cross communication needs to happen so this will help consolidate larger staking operations and incentivize new large staking operations. From a layer 2 perspective, EIP-7840 will double the blob target from 3 to 6 per block and raise the maximum from 6 to 9. Then to prevent potential networking issues caused by large blocks, EIP-7623 was also included.

Here is a list of the EIPs slated for the Pectra upgrade:

EIP-2537: Precompile for BLS12-381 curve operations

EIP-2935: Save historical block hashes in state

EIP-6110: Supply validator deposits on chain

EIP-7002: Execution layer triggerable exits

EIP-7251: Increase the MAX_EFFECTIVE_BALANCE

EIP-7549: Move committee index outside attestation

EIP-7623: Calldata cost adjustments

EIP-7691: Blob throughput increase

EIP-7685: General purpose execution layer requests

EIP-7702: Set EOA account code for one transaction

EIP-7840: Blob scheduling

Ultimately, Ethereum still has a lot to accomplish over the next several years to complete the comprehensive roadmap set out by Vitalik and others close to the project. However with this upgrade soon to be in the rearview mirror, Ethereum is that much closer to completing its vision of being a decentralized world computer.

AB Researcher: L2Explorer

2025 Look Forward for Tokenized Real World Assets

The tokenization of real-world assets (RWAs) is poised for significant expansion in 2025, with projections estimating growth to between $2 trillion and $30 trillion over the next five years. This surge is driven by the advantages of instantaneous settlement, reduced costs compared to traditional securitization, and continuous liquidity, enhancing transparency and accessibility across various asset classes. Notably, the value of tokenized RWAs has already increased from $8.4 billion at the end of 2023 to $13.5 billion by December 2024, while on-chain U.S. Treasuries tripled to $2.6 billion during the same period.

The trend extends beyond traditional assets like U.S. Treasuries and money market funds, gaining traction in sectors such as private credit, commodities, corporate bonds, real estate, and insurance. For instance, Figure, a U.S. home equity line of credit lender, manages over $8.8 billion in active loans, representing 92% of the total on-chain private credit market. This shift indicates a broader adoption of blockchain technology by traditional financial institutions, recognizing the operational efficiencies and cost benefits it offers.

South Korea’s Crypto Market Poised For Change With New Institutional Guidelines (Link)

South Korea is set to relax its restrictions on cryptocurrency trading for institutional investors, marking a significant shift in the nation's digital asset regulations. The Financial Services Commission (FSC) plans to introduce new guidelines in collaboration with the Digital Asset Committee, aiming to provide a clearer framework for institutional participation in the crypto market. This move aligns with President Yoon Suk-Yeol's commitment to fostering growth in the crypto industry.

Institutional and governmental adoption of cryptocurrencies has historically been a positive indicator for the market. For example, several corporations have added Bitcoin to their balance sheets, viewing it as a hedge against aggressive monetary policies and a store-of-value asset. Additionally, the entry of traditional financial custodians into the crypto market has enhanced market stability and legitimacy. Such developments suggest that South Korea's new guidelines could further legitimize and stabilize the crypto market, potentially attracting more institutional investment and fostering broader adoption.

AB Researcher: Alec Beckman

AB Portfolio

Disclaimer: Our buys/watchlist should not be taken as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update.

This is not investment advice, but a view into our strategy for educational purposes.

AB Researcher: @Rocketpilot

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.