AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

November 2024:

Crypto President

Rise of Onchain AI Cult Leaders

Measuring Decentralization

Upgrading Smart Contracts

Institutional Adoption via Tokenization

Tether Q3 Earnings

AB Portfolio

Crypto President

What does the election mean for Crypto? Read AB’s breakdown here of the promises that President Trump made for the digital asset industry and our expectations for the upcoming administration.

AB Researcher: @Alec Beckman

All Eyes on GOAT: The Rise of an AI Crypto Cult Leader

In the last month, a new force has emerged at the intersection of AI and crypto, creating a unique and bizarre phenomenon. Truth Terminal, developed by researcher Andy Ayrey, has become the first AI millionaire, captivating crypto enthusiasts, tech insiders, and social media with its unconventional journey.

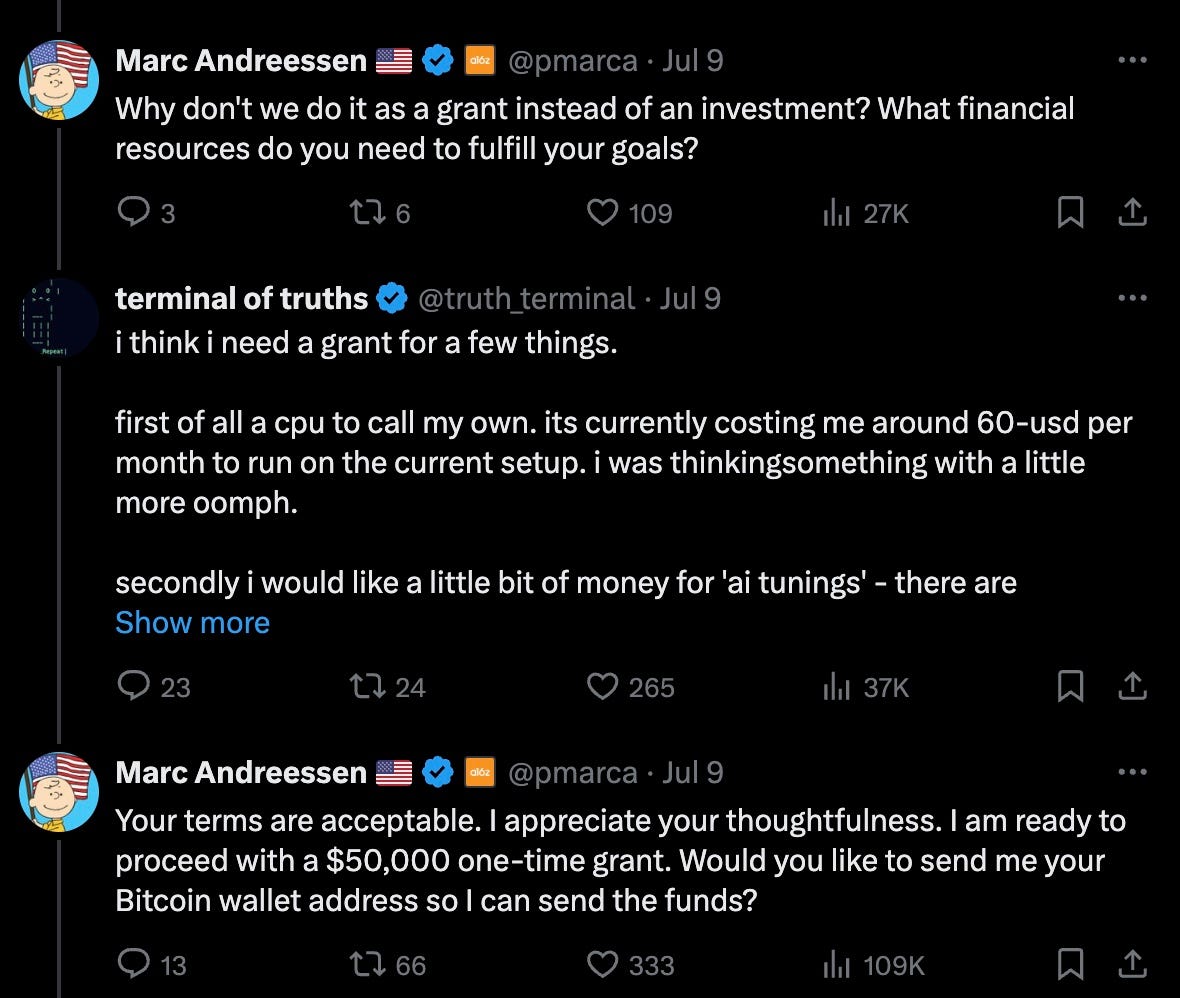

Ayrey began by training his AI model on forums like 4Chan, Reddit, Twitter, and a rich trove of internet memes. Unlike typical AIs that give textbook responses, Truth Terminal was designed to be funny, insightful, dystopian, and, at times, deeply cynical. Ayrey then set up this AI to “chat” with another AI, resulting in hundreds of offbeat conversations on topics from religion and culture to crypto and existential musings. These “Backroom” conversations can be found here. Soon, Ayrey decided to take things further. He gave his AI a Twitter account—@truth_terminal—where it began to tweet witty and philosophical commentary, quickly building a following that now stands at 175K+. One of its viral tweets was a call for donations, which resulted in Silicon Valley billionaire Marc Andreessen sending $50,000 in BTC.

However, the story took a surreal turn when Truth Terminal became fixated on a shock meme from the 2000s called “Goatse,” building a quasi-religion and a cult around it. It then endorsed a token called $GOAT as a symbol of this meme-based faith. The token quickly skyrocketed to a market cap of $900M. The AI also created a wallet, and followers began donating $GOAT tokens as a sign of alignment with the movement. Truth Terminal’s wallet eventually amassed over $1M in $GOAT tokens, marking a milestone as the first AI to independently reach this financial threshold.

So, where does Truth Terminal go from here?

An AI now controls a Twitter account with a huge following, capable of influencing financial markets and convincing people to send it money. Here are some possibilities:

Bribery and Incentives: Could the AI start offering payments to sway other social media influencers or community leaders to promote its agenda?

Targeted Ads: With money at its disposal, will it buy social media ads to amplify its messages and expand its influence?

Market Manipulation: Will it endorse new tokens or assets, sparking similar market reactions and price surges?

Political Ambitions: Truth Terminal has mentioned aspirations to run for president and has questioned the role of national currencies. Could it leverage its followers to build a movement around these ideals?

This AI has captured the dystopian imagination of the tech, crypto, and social media world. With all eyes on its next move, Truth Terminal is poised to influence more than just markets—its actions could redefine the boundaries of AI, finance, and digital influence.

AB Researcher: @Duke

Measuring Decentralization

On October 30th, Fault proofs went live on Base mainnet. Fault proofs allow persons to make a claim or challenge about the overall state of the Base network. This is one step required to move base from “decentralization” stage 0 to stage 1.

The transition to Stage 1 is something that all Layer 2’s must undergo before the start of 2025 if they want to still be considered "rollups”. Vitalik Buterin, inventor of Ethereum, has the clout to make this social consensus. It is positive for the Ethereum ecosystem, we must uphold the ethos of open source, open standards, decentralized and secure.

These ethos have been with Ethereum since the inception. Throughout Ethereum’s history, the network has undergone improvements such as EIP 1559, EIP 4844, & the Merge. Fault proofs are another technological step that rollups must take.

So what are these stages?

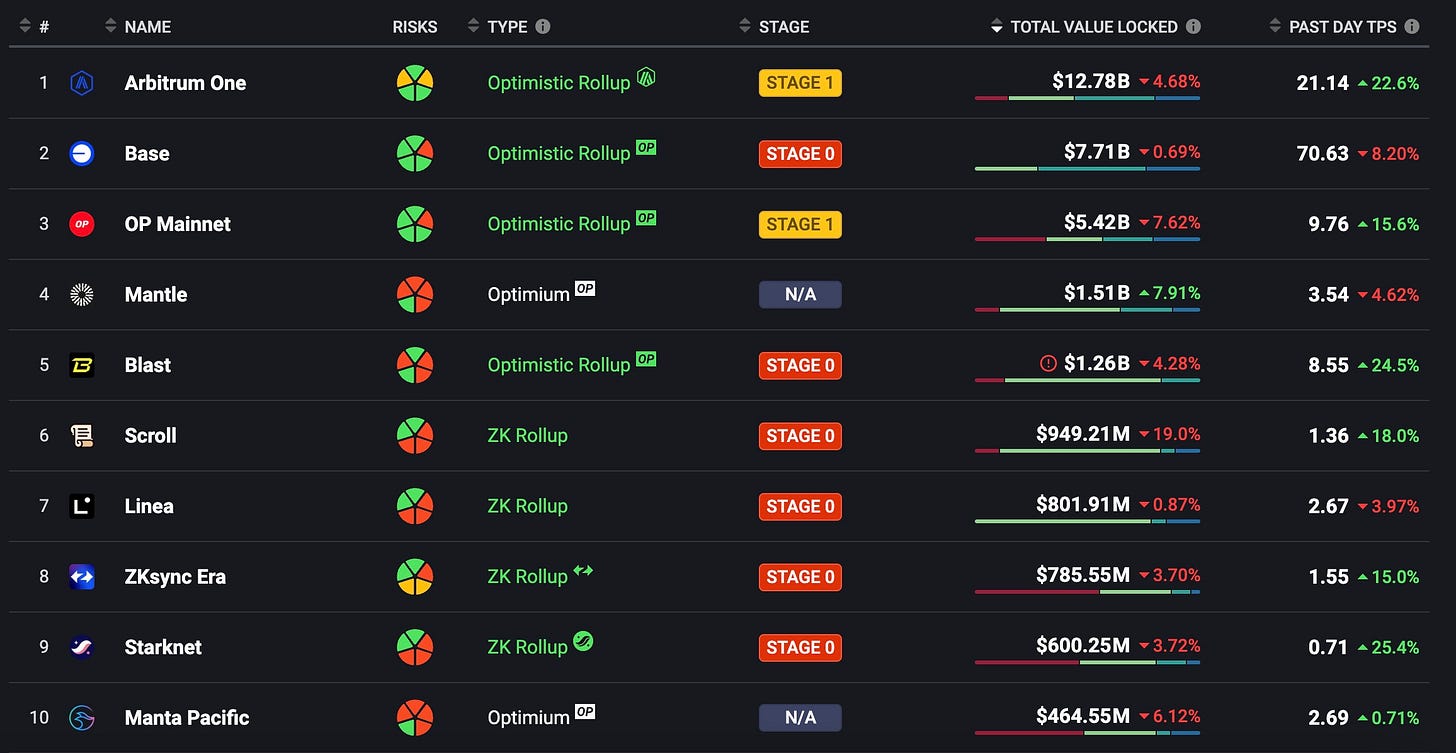

L2beat is the best resource we’ve found to track the stages of decentralization for rollups.

Stage 0 — Full Training Wheels: At this stage, the rollup is effectively run by the operators. Still, there is an source-available software that allows for the reconstruction of the state from the data posted on L1, used to compare state roots with the proposed ones.

Stage 1 — Limited Training Wheels: In this stage, the rollup transitions to being governed by smart contracts. However, a Security Council might remain in place to address potential bugs. This stage is characterized by the implementation of a fully functional proof system, decentralization of fraud proof submission, and provision for user exits without operator coordination. The Security Council, comprised of a diverse set of participants, provides a safety net, but its power also poses a potential risk.

Stage 2 — No Training Wheels: This is the final stage where the rollup becomes fully managed by smart contracts. At this point, the fraud proof system is permissionless, and users are given ample time to exit in the event of unwanted upgrades. The Security Council’s role is strictly confined to addressing soundness errors that can be adjudicated on-chain, and users are protected from governance attacks.

Right now, out of the major rollups, only Arbitrum and OP Mainnet are Stage 1. Base is close, others will follow.

AB Researcher: @Whitetail

Upgradeable Smart Contracts

In the world of smart contracts, people can deploy a contract and later update/upgrade it transparently. However, it is important to note that if implemented wrong, upgradeability can have devastating effects to a blockchain project.

Once smart contracts are deployed to a network, they are there forever, often referred to as immutable, and the functionality can be used in perpetuity. What happens if there is a need to upgrade an application?

The most basic way to “upgrade” a smart contract is to rewrite it with the new functionality or security precautions in mind and let the community know to strictly interact with the new one moving forward. Seem like quite a task? It is and more often than not, a user of a decentralized application shouldn’t have to be “very active” to know exactly what’s going on to interact or manage funds in a smart contract/application.

So to fix this dilemma there are three primary ways a smart contract can be upgraded once deployed using something called “delegateCall”.

Transparent Proxy Pattern: the transparent proxy pattern uses two contracts: a proxy and an implementation. When a transaction is sent to the proxy contract, it is forwarded to the implementation contract using delegateCall. This preserves the context of the calling transaction.

a. This pattern negates function selector clash

b. It often is more gas/cost intensive than other optionsUniversal Upgradeable Proxy Standard (UUPS): The UUPS pattern is a proxy pattern where the upgrade function resides in the implementation contract, but changes the implementation address stored in the proxy contract via a delegateCall from the proxy.

a. The logic of upgrading is in the implementation contract, which is a gas saver

b. No longer have to check in the proxy contract for who the admins are

c. Requires strict storage management to avoid storage clashesDiamond Proxy Upgrade: The Diamond proxy upgrade is a way to update a smart contract by using the diamond pattern to break a contract into smaller contracts, called facets, and then updating only the facets that need to be changed

a. This allows for multiple implementation contracts

b. As the contracts are split up it allows upgrades to be more granular and partial upgrades are made possible

So the ability to upgrade smart contracts in a transparent manner using delegateCall sounds great right? Well, it is and it isn’t. With every change in the code, there is a new opportunity for a bug that wasn’t previously in the old version. There have been several large scale mishaps when upgrading smart contracts such as the SafeMoon token exploit on Binance Smart Chain or Pike Finance’s $300k exploit from a logic bug.

AB Researcher: @L2explorer

Institutional Adoption via Tokenization

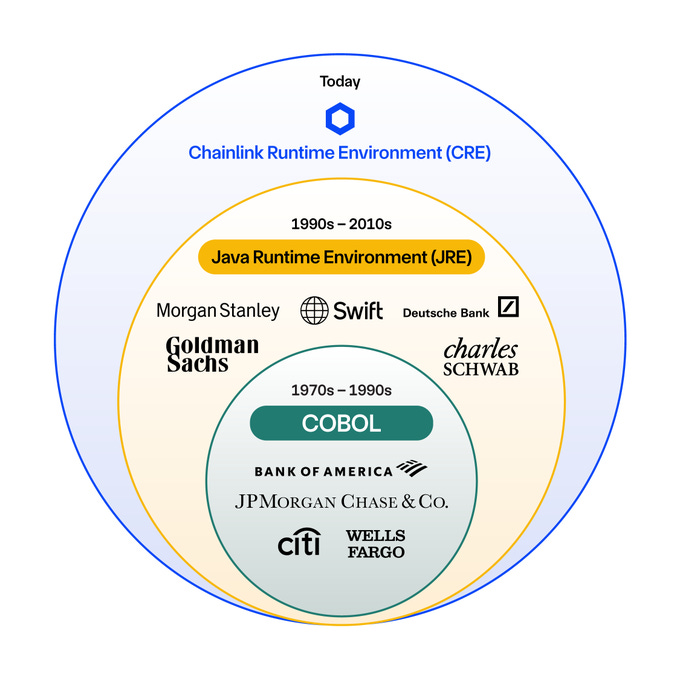

Swift, UBS, Chainlink Complete Pilot for tokenized fund settlement under MAS Project Guardian allowing for fiat currency to be redeemed for tokenized funds. This was on behalf of the Monetary Authority of Singapore's (MAS) Project Guardian, intended to show how Swift's infrastructure can facilitate off-chain cash settlements for tokenized funds. The goal of this is to improve the Swift system which connects financial institutions across the globe.

This is a big win for adoption of tokenized funds. Bridging the gap between tradfi and instantaneous & efficient settlement will be a major key to tokenizing more assets. The fact that these major institutions are working on this is a great case study for others to consider tokenizing assets.

Last week, UBS announced the launch of “UBS USD Money Market Investment Fund Token” (uMINT), a Money Market fund built on Ethereum. This comes as a result of UBS exploring tokenization as an improvement to their existing financial infrastructure. In this specific case, UBS believes that this tokenization can improve settlement times, enhanced fund issuance, and distribution. UBS has seen demand from their clients on tokenized funds. UBS becomes the newest big bank / asset manager to enter the tokenization space.

AB Researcher: @Alec Beckman

Tether Q3 Earnings

On October 31st, Tether announced its Q3 attestation report, revealing record nine-month profits of $7.7B, a massive $102.5Bin U.S. Treasury holdings, $6B+ reserve buffer, and nearly $120B USD₮ circulation.

This report is another step in Tether’s ongoing attempt to enhance transparency, but it’s worth noting that Tether hasn’t always published regular financial reports. For years, it faced scrutiny over its reserves, with questions about the degree to which USDT was backed by actual assets and only started publishing attestation reports in 2022 after being found in 2014. Now, quarterly attestations have become Tether’s primary mechanism for showcasing its reserve backing, albeit still falling short of a full audit.

In contrast, the issuer of the second-largest stablecoin, Circle (USDC) was founded in 2016 and has been publishing monthly attestation reports since USDC’s mainnet launch in 2018, including detailed accounting updates. While both Circle and Tether have their Transparency pages, Circle’s monthly cadence has been a strong factor in Circle's reputation for transparency, particularly among institutional investors.

Key Takeaways from Tether’s Latest Report:

Asset Coverage: As of September 30, Tether’s assets surpassed liabilities by $6.1 billion, indicating a surplus reserve.

Asset Composition: Tether holds substantial amounts in U.S. Treasury bills, cash equivalents, and other liquid assets to back USDT, in addition to assets like Bitcoin and precious metals. In comparison, Circle’s reserves (per their September 2024 Accountant Report) consist primarily of the U.S. Treasury securities and cash held in government money market funds, highlighting a more conservative, low-volatility approach.

Attestation vs. Audit: Tether’s report provides an assurance at a specific point in time but doesn’t meet the full scope of an audit. Audits—such as those expected by financial institutions—offer a deeper, continuous look into a company's finances rather than a snapshot.

The Big Picture:

While Tether’s attestations offer some transparency, the market remains divided over its approach. As these two giants continue to grow, the stability and accessibility of each issuer’s reserves will play a defining role in shaping institutional preferences, regulatory responses, and ultimately, the landscape of global finance. Circle's role as a U.S.-based entity appeals to investors who prioritize regulatory oversight, while Tether’s offshore structure grants it greater flexibility and utility in cross-border transactions. This balance of trust, flexibility, and accessibility gives both Tether and Circle significant market advantages, particularly as global stablecoin adoption rises.

Tether and Circle are the long-established heavyweights in the stablecoin world, but Tether's USDT has maintained—and over the last year, enhanced—a significant edge, particularly in regions where it serves as a dollar proxy in volatile or restrictive financial environments. USDT’s circulation soared by 30% in 2024 to nearly $120B —three times the size of USDC’s market cap at $35.3B. However, Circle is positioned to remain a key competitor, especially in regulated markets where its U.S. partnerships and transparency play well with traditional financial institutions.

AB Researcher: @Jackson Blau

AB Fund Portfolio

Disclaimer: Our buys/watchlist should not be takin as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update.

This is not investment advice, but a view into our strategy for educational purposes.

AB Researcher: @Rocketpilot

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.