The AB Newsletter is for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Moonletter🚀 is a culmination of research & perspectives from the diverse minds of the AB Team. Ultimately our focus & mission is financial freedom. Letter #5💰 includes:

Highlights:

On-chain Activity Skyrocketing . . . due to Memes?

Physical Gold, Digital Rails - Real World Asset Tokenization

TradFi (Traditional Finance) - Macro Update

Altcoins: Buys & Watchlist

1. On-chain Activity Skyrocketing…due to Memes?

Over the past two weeks, on-chain transactions for both Bitcoin and Ethereum have soared, largely thanks to memes. Both chains have seen an influx of meme coins, which have significantly increased total network volumes.

What is a meme coin?

^These are memes.

^These are meme coins.

Much like memes, meme coins are a an absolute jape. A mockery, or joke. Cryptic by nature, usually a copycat or slight iteration of another blockchain network, meme coins typically serve the sole purpose of ‘entertainment’. ‘Typically’ is important, because this is not always the case. As people are learning, entertainment has value. And value in large magnitudes will always create markets.

Pepe

Enter Pepe, the newest meme coin on the block. As per Pepe’s website, Pepe touts itself as a "meme coin with no intrinsic value or expectation of financial return. There is no formal team or roadmap. The coin is completely useless and for entertainment purposes only." Despite this self-proclaimed lack of value, Pepe has seen astronomical growth since its inception, showing a staggering 2,526% gain. Pepe has garnered over 100,000 on-chain wallet holders in less than 30 days time making it the fastest adopted token on Ethereum. This value surge has transformed modest investments into sizable fortunes, with some top traders reportedly making paper profits of up to $92.6 million.

This is important because the massive boost in Pepe trading activity has spurred a rise in on-chain transactions on Ethereum, leading to an increased ETH supply burn rate. The Pepe token contract has burned over 900 ETH in the past month alone. This deflationary trend is typically viewed as bullish for Ethereum investors, as it reduces supply, which increases demand, which could in-turn increase the asset’s value.

Of course there are many dynamic factors at play, but regardless of whether you buy Pepe or don’t touch it with a 30 foot stick, the Ethereum network is benefiting from this activity increase. Holders of ETH and ETH network participants continue to reap rewards within the network. Long story short .... buy ETH?

Bitcoin Tokens

Bitcoin Tokens? Yes, you read that right. Although unusual for Bitcoin, a few new token standards have been created on Bitcoin’s chain, allowing for the development of tokens. Despite Bitcoin not typically being a hub for such development, these BRC-20 tokens have generated significant interest and have garnered a market cap of around $500 million.

Most of these assets are also meme coins with no technical purpose — but still all of this is worth paying attention to as a useful applications can emerge from this sandstorm of new digital assets mixed with a highly active user base.

Authors: Digital Duke, AB RocketPilot, UEV Bro (User Extractable Value)

2. Physical Gold, Digital Rails - Real World Asset Tokenization

Tokenized Gold Surpasses $1B in Market Cap as Physical Asset Nears All-Time Price High. “This type of stablecoin pegs its price to gold, while the tokens on the blockchain represent ownership of physical gold managed by the issuer.” - Coindesk reports.

A multitude of asset issuers have created blockchain based investment products that allow investors to gain exposure to the price of gold. This is a major milestone in the asset tokenization/security token sector of the blockchain industry.

Asset issuers typically will hold physical gold in an SPV and issue shares in the form of a token as a representation of the physical asset. This can work beyond gold, in the form of stocks, debt, private equity, and commodities — which essentially is the purpose of the ‘security token’ market.

Using blockchain infrastructure for these payment systems has the capability to allow for any asset type to be made more efficient, accessible, and transparent as an investment product. As many of these are assets and not currencies, this is why the language of ‘crypto currencies’ does not fully embody all productive blockchain projects, and is why at Advantage Blockchain we are advocates of the language Digital Asset Industry, rather than Cryptocurrency industry.

Author: Chexco

3. TradFi (Traditional Finance) - Macro Update

Its been an eventful start to May for financial markets, as investors continue to digest the recent turmoil surrounding regional banks along with the latest batch of economic data, including the Consumer Price Index (CPI) and Producer Price Index (PPI).

The CPI and PPI metrics both came in slightly lighter than expected, at 4.9% and 2.3%, respectively, against consensus estimates of 5.0% and 2.5%. Fed Chair Jerome Powell also spoke on their recent decision to raise interest rates by 25 basis points, citing tight labor market conditions as justification for the decision. However, the Fed has seemingly begun to take a more dovish stance on additional rate hikes for the remainder of the year, as they have officially omitted prior language on the topic of additional hikes for the remainder of 2023.

As the Fed signals its pivot, the impact of the rapid increase in rates has yet to materialize in the labor market. However, a separate Labor Department report Thursday showed that jobless claims for the week ended May 6 jumped to 264,000, a rise of 22,000 from the previous period. The total was well above the Dow Jones estimate for 245,000 and the highest reading since October 30, 2021. This could very well be the tip of the iceberg when it comes to the effects of rate hikes on the labor market.

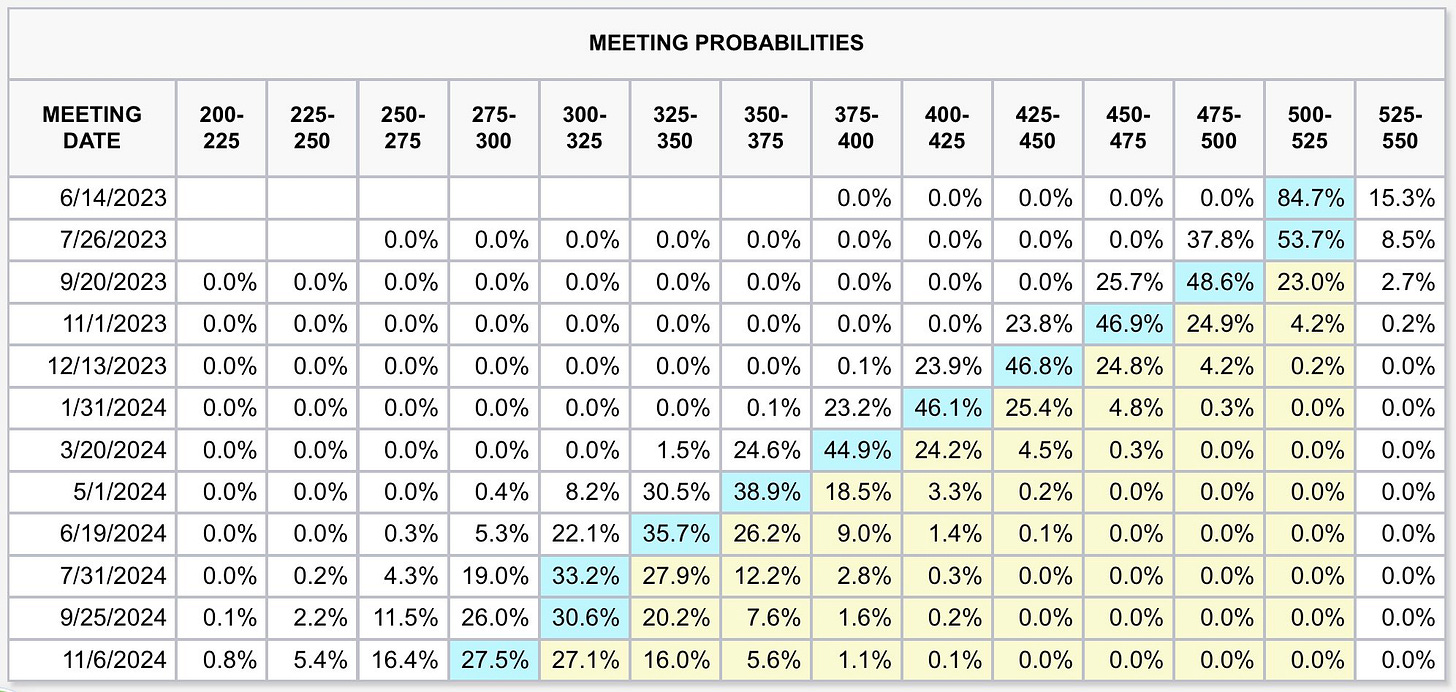

Markets are now pricing in a 38% chance of rate cuts beginning in July, much sooner than previously expected. Meanwhile, regional banks continue to rapidly depreciate, led primarily by PacWest ($PCW), Western Alliance ($WAL), and Metropolitan Bank ($MCB). The news comes after First Republic Bank ($FRC) was officially acquired (bailed out) by JPMorgan for $10.6 billion after the stock price plummeted 97%. The acquisition followed the FDIC seizure of First Republic as investors aggressively removed deposits from the failing bank. The FDIC effectively bailed out First Republic’s loan book, which included debt instruments outside of US Treasuries.

Investors are also paying close attention to a potential catastrophe brewing on Capitol Hill as lawmakers continue to spar over a decision to raise the debt ceiling before the June 1st deadline. Republicans have continuously opposed the decision to raise the ceiling, calling for spending cuts rather than tax increases if Democrats want to get a deal done. “Biden signaled an openness to Republicans demand to claw back some unused money for COVID-19 relief, which is less than $80 billion. Meanwhile, the White House reiterated its backing for legislation speeding government permitting of energy projects by setting maximum timelines." Although Republicans seem firm in their stance, the economic impact of a default would be disastrous for the US, making the probability of default unlikely

Author: 8Ball

4. Altcoins: Buys & Watchlist

Disclaimer: Our buys & watchlist should not be takin as financial advice nor investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects and ecosystems we are actively researching/participating in. Always invest responsibly. And remember…Fundamentals over Pumpamentals!

Recent Buys

Uniswap (UNI) @ $5.98

Dogecoin (DOGE) @ $0.09

Arbitrum (ARB) @ $1.23

Optimism (OP) @ $2.24

Polygon (MATIC) @ $1.13

Ethereum (ETH) @ $1,693