AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

Disclaimer: AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition. Whitetail owns Ethereum. AB Fund owns Ethereum.,

Ethereum was under attack over the past four years. There is no denying that. The SEC under GG was extremely hostile to crypto after missing the biggest fraud since Madoff. GG and SBF were trying to shape crypto regulation to attack DeFi.

GG met with SBF a dozen times and yet was unable to protect consumers from the mess that was FTX. Neither did he protect investors from Celsius, Terra’s Luna/UST or BlockFi. In response, like General Sherman during the Civil War, the SEC tried to burn everything down. Luckily the decentralized nature of crypto prevented complete destruction. However the cost of dealing with hostile regulators, lawsuits, and a talent exodus left the industry with scars.

The nightmare is over. The Trump Administration released an executive order on January 23rd titled Strengthening American Leadership In Digital and Financial Technologies. It is worth a read. Crypto finally learned how to lucid dream.

After going into Helm’s Deep to survive the attack. The Ethereum Ecosystem now beats the drums of war.

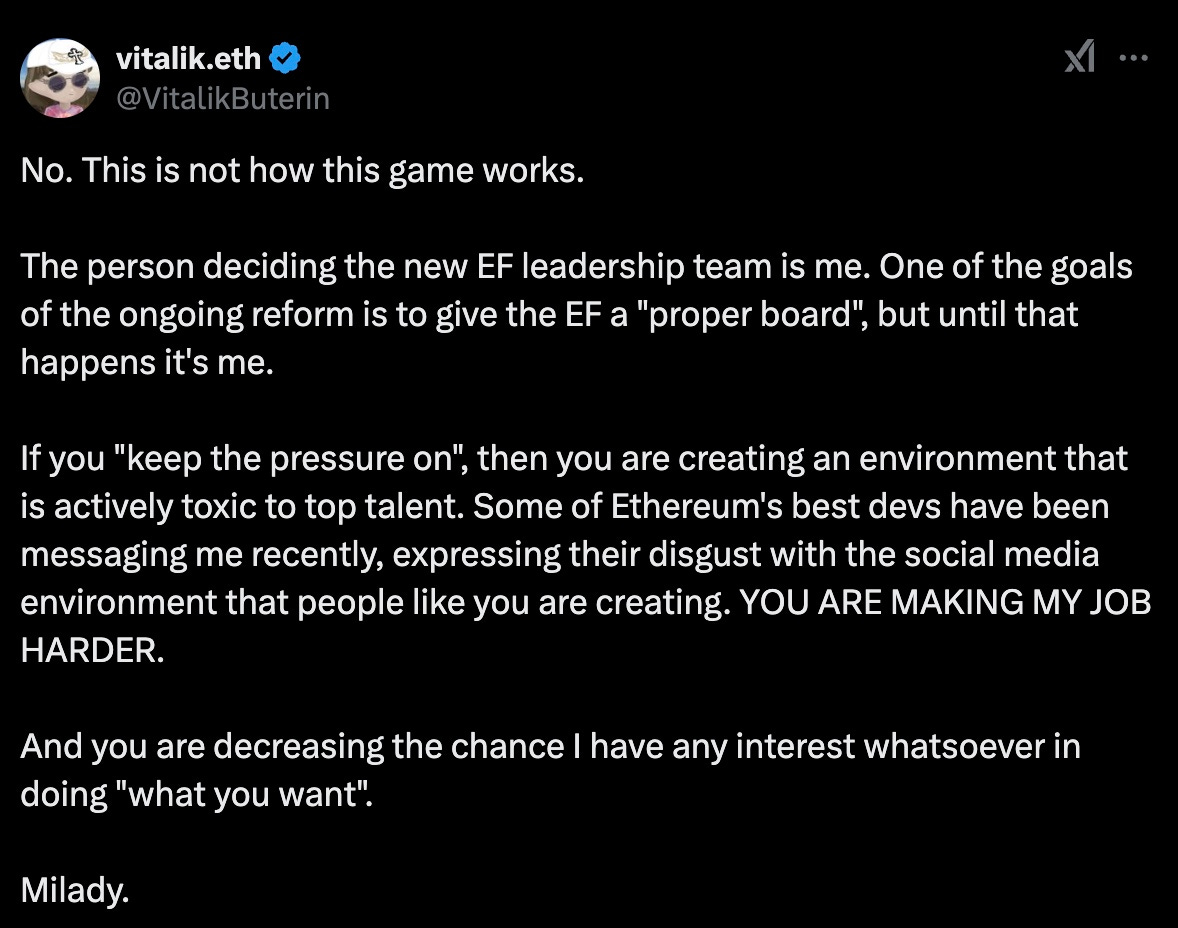

Recently, there has been controversy over the opaqueness of the Ethereum Foundation and many calls on X for the Executive Director Aya to resign. The rumblings got louder and more targeted. It became impossible to ignore. In situations like this, great leader’s emerge.

Vitalik is flexing his influence and becoming a Chad. He clarified the goals of the Ethereum Foundation (“EF”) as being a research driven, ecosystem supporting foundation that maintains its credible neutrality. Vitalik even recently changed his PFP (profile picture) to a Milday to symbolize he is back in the Ethereum trenches.

On January 22nd, Etherealize came out of stealth introducing itself to the world. Etherealize was launched by Vivek Raman with support from Vitalik, other Ethereum cofounders, the EF, and key community members at large. The north star of this new organization is to be the institutional product and marketing arm of Ethereum allowing the EF to maintain its credible neutrality.

Tldr? Etherealize is going to convince traditional institutions to use Ethereum by speaking their language.

It is time to solidify the narrative that Ethereum is the blockchain for institutional use and tokenization.

Vivek posted thought pieces describing the attractiveness and benefits of Ethereum while supporting all those claims with data. The Etherealize Dashboard is Ultrasound.money on steroids.

The first four thought pieces are great:

Each of those pieces is clearly targeted towards professionals in traditional finance instead of crypto native folks. There are many reasons why institutions will adopt Ethereum and it is best to hear it from the Horse’s Mouth.

In addition, Vitalik recently released a blog post titled Scaling Ethereum L1 and L2s in 2025 and Beyond. This is the first time we’ve seen Vitalik write about the economics of ETH the asset. It is the ultimate triple point asset as shown below.

The Ethereum Economy doesn’t work unless ETH the asset accrues value. Full Stop.

The vibe shift is real. Prepare for Ethereum Acceleration. “Shipping faster helps Ethereum regardless of your vision of it.” The Ethereum community heard the rally cry. It is no longer scared of prosecution and lawsuits. The engines of war are revving. It is an exciting time for the Ethereum Economy. Milady.

Cheers,

Whitetail & Co

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.