AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition.

How do we value assets? The price someone is willing to pay for it?

Assets like stocks are valued based on earnings.

Others like commodities react to supply / demand changes.

The first company to issue a dividend was The Dutch East India Company. Founded in 1602, The East India Company is often considered the world’s first publicly traded company and issued the first dividend in 1610. The first dividend was “mace (nutmeg) valued at 75% of nominal value” or what we call now an in-kind dividend. The first cash dividend was issued in 1612.

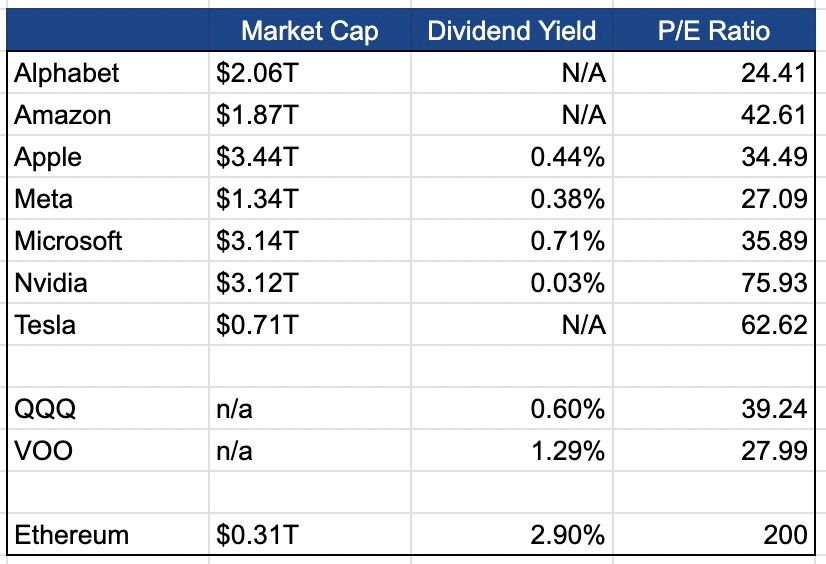

It wasn’t until the 1925 when Benjamin Graham released “The Intelligent Investor” that dividend yield became popularized as a valuation metric. A decade later, “The Theory of Investment Value” by John Williams in 1938 valued stocks based on price to earnings ratio (P/E). These are two metrics to examine Ethereum and equities with. We will use the S&P 500, the NASDAQ, and the Magnificent 7 (Alphabet, Amazon, Apple, Facebook, Microsoft, Nvidia, Tesla). The QQQ represents the top 100 stocks in the NASDAQ and VOO is the S&P 500. These are good measures of the U.S stock market.

For the Mag 7, dividends ranges from 40 to 70bps, and mid 20 P/E to above 60 P/E in the case of Nvidia and Tesla. High P/E and low dividend yield but also some of the strongest free cash flow. There is a reason they trade at a premium.

Add in Ethereum to the chart.

Ethereum has the highest P/E and dividend yield by significant margins. The market has not seen an asset like Ethereum. There are no standardized valuation metrics. Ethereum is the most pristine collateral in the Ethereum Virtual Machine (“EVM”). This means that as the L2 ecosystems grow (Base, Arbitrum, Optimism, Soneium) it will increase demand for Ethereum due to its utility. Outside of just price appreciation and yield, Ethereum drives liquidity. This is one of the reasons why Ethereum on exchanges is reaching an all time low, it is being used onchain!

Turning to oil/commodities, when the world is transporting more goods, oil prices tend to increase. The same thing happens when there is increased activity on Ethereum. What tends to drive the price of commodities? Supply and demand. This is why crude was able to go negative in 2020. This could also be one of the reasons for the wild price swings in crypto (trades like a commodity).

There is no consensus on valuation metrics for crypto. People look at protocol developers, total value locked, unique users, economic security, or real yield (yield - inflation). A safe assumption is that an ecosystem will highlight whichever metric makes it look the most attractive.

Bitcoin and Ethereum have predictable long term supply schedules, unlike commodities or stocks. We know that each Bitcoin block currently produces 3.125BTC and will be cut in half every four years. Ethereum nodes that are selected to propose a block get consensus layer rewards + MEV tips. It is enforced by code and Ethereum’s supply is increasing at a lower rate than bitcoin. In an increasingly changing world we believe the market is heavily discounting this. No new oil fields will be discovered like Guyana or absurd stock based compensation. To fulfill this demand, new buyers will have to purchase Ethereum from existing holders. The same people that by definition are [redacted] as they invested in magic internet beans in the first place! Every flush out like earlier this month transfers from weaker hands to stronger hands. Over the next few years, additional demand for Ethereum will come from many types of buyers.

The Ethereum ETFs went live in July 2024. They will be a net buyer of Ethereum over the next 3-5 years.

No nationstate has publicly came out and bought Ethereum yet but they have with Bitcoin. Companies are starting to collect Ethereum. Nations and multinational corporations will increase the demand for Ethereum over the next 3-5 years.

As more L2s spin out, the best way to bootstrap/drive liquidity is to attract Ethereum. Sony recently launched Soneium, as the latest example of a company just to launch a Layer 2 on Ethereum. This increases the demand for Ethereum over the next 3-5 years.

Ethereum is the most pristine collateral in Decentralized Finance (“DeFi”). The growth of this industry increases the demand for Ethereum over the next 3-5 years. BlackRock is building on Ethereum.

Noted above, Ethereum’s dividend is significantly higher than other technology companies. Since Ethereum is proof of stake, the network economics (tokenomics) secure the network by paying existing holders. By staking Ethereum, users have a chance to be selected to propose the next block on the Ethereum network and receive rewards. There are two types of rewards: consensus layer and execution layer. The consensus layer is directly from the protocol itself and execution layer is other users paying you tips + MEV (maximum extractable value) to order transactions in the proposed block a specific way.

To simplify it, Ethereum stakers are the ones helping to run the network and get paid for doing so. Ethereum’s supply is currently increasing at about 750bps per year, so with staking, in theory every year long term holders should own more of the network. The difference between owning raw ether, owning staked ether, and using staked ether in DeFi is shown below.

Even with the hostility towards crypto from the current administration, there are clear signs of product market fit. $150B dollars onchain exported around the world. Polymarket is the leading prediction market and has captured the attention of the public. The Trump family is launching the Defiant ones, bringing attention to DeFi. Vance Spencer is on TV articulating the value proposition of owning the crypto that is starting to see institutional flows. The signs of global adoption are here. Get onchain.

Coins must flow.

AB Researcher: @Whitetail

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.