AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition.

The US financial system is the best in the world. There is a reason the US has the largest capital markets ($6.1T) with 9.6% annual growth. The US market’s ability to provide allocative, operational, and informational efficiency are in large part why the US financial markets are unmatched. Capitalism works, don’t believe anyone who says differently.

Every week millions of Americans receive their paycheck and deposit it in the bank. When you deposit money into a bank, it changes from dollars in your hand to a number on the screen. Most people do this and move on with their lives. But what happens behind the screen?

Jeremey Alliare, CEO at Circle talked about this and made a few observations:

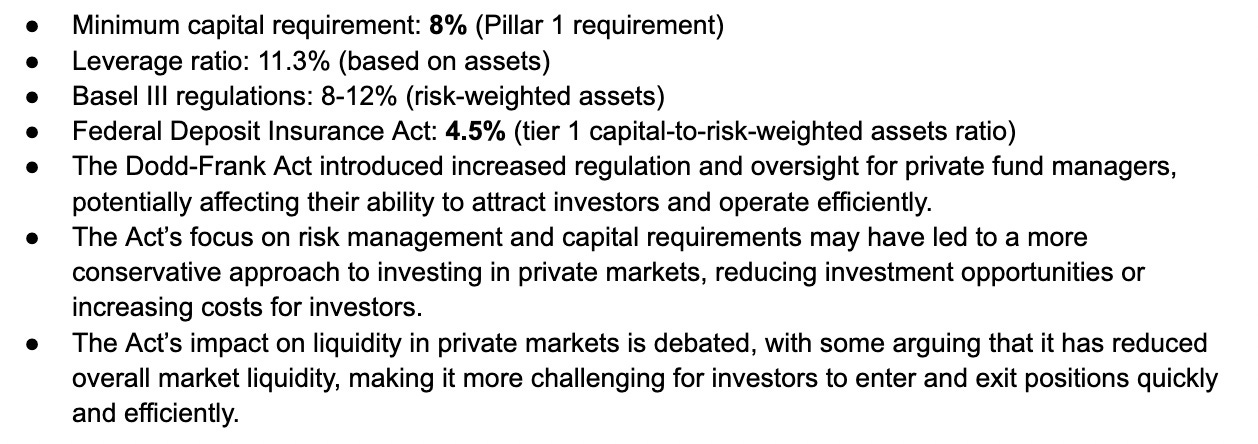

Money in the bank is an IOU, they only have a fraction of the capital available. Some estimates are 8-12%.

Most of the balance is a credit balance, banks are money printers and they get permission from the regional federal reserves to print money.

Banks underwrite risk to generate a yield. They’re generally risk averse which is why so many thought buying US debt was safe prior to this most recent hiking cycle. That didn’t work out too well.

Looking at history, it is easy to find examples where trusting bankers has blown up. The First Republic/Silicon Valley Bank collapse, subprime mortgages during the GFC, and the savings & loans crisis during the late 1980’s are three prominent examples.

To recap, the system trusts bankers to underwrite risk. Yet due to Dodd-Frank, experienced investors are going to private markets. Banks face increased regulation and oversight leading to more conservative investing. There are many reasons why the amount of public companies in the US has fallen since 2000 but it is impossible to ignore the compliance cost (~$300k-$2M per year) of being a public company.

Banks solve the problem of being trusted middlemen. The OCC and FDIC ensure banks enforce the rule of law. Persons that misbehave are subject to court systems and enforcement actions. But what happens when these entities/agencies abuse their powers? There is a clear history of asset seizures by governments from gold during WWII to the Canadian truckers in 2022. Currently, crypto friendly banks that are being targeted by the US Government. The Biden Administration is taking illegal action to debank our industry. This should not be ignored.

Bitcoin’s original thesis was peer to peer electronic cash system. The wealth creation that crypto has experienced over the past decade led to the demand for lending markets. Investors want access to capital without selling their underlying assets. The problem that emerged was the borrower could be anywhere in the world and currently there are no rules or standard operating practices for this kind of activity. The new financial system can be built to eliminate the need for trusting third parties.

Ethereum’s emergence as the leading smart contract platform provided the opportunity to satisfy the demand for lending markets. Although the initial stablecoins launched pre-Ethereum, the additional programmability from smart contracts in the Ethereum Virtual Machine (“EVM”) allowed them to flourish. Users want to transact in something stable and people want to borrow stable debt. This led to the creation of stablecoins and DeFi applications like Sky, Compound, and Aave.

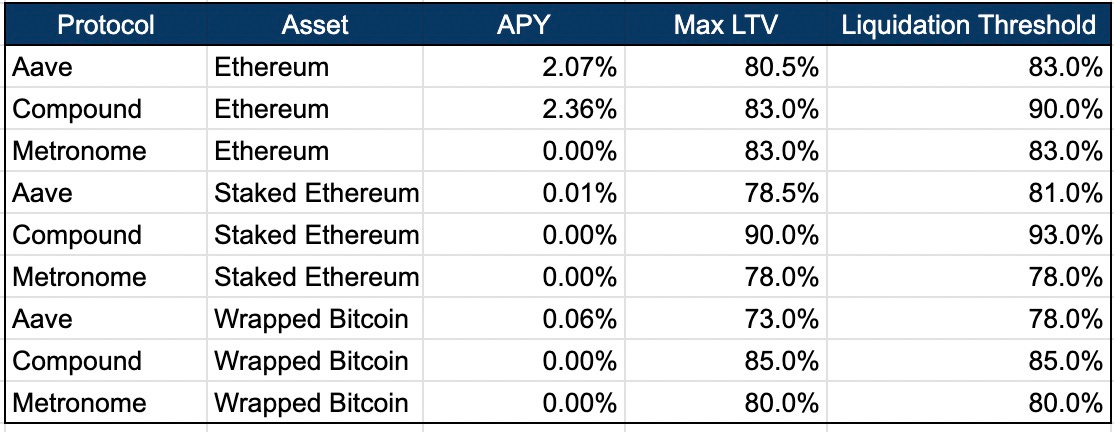

Since the blockchain is transparent (anyone can see transactions), overcollateralized lending emerged as the first DeFi use case. These DeFi protocols (Sky, Aave, Compound) required users to deposit Bitcoin / Ethereum and borrow up to 70-80% LTV. The key here is that if the collateral dropped below the liquidation value, the protocol had built in incentives where sophisticated users to liquidate it on the market eliminating any bad debt. By requiring custody of the collateral, DeFi has become the senior secured creditor on any loan it provides.

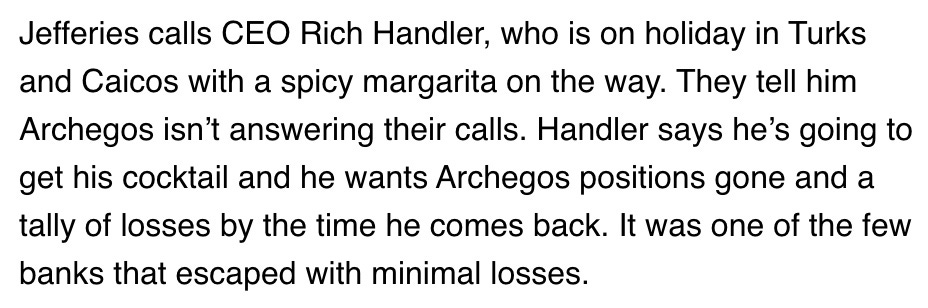

This is a stark contrast to situations such as Three Arrows Capital, Genesis Global, and Archegos where all the lenders had was a bunch of worthless IOUs. Rich Handler of Jefferies had an all time response to the Archegos situation:

This is not the case in DeFi. Historical examples of DeFi protocols getting paid back before other creditors include Celsius and Alameda. The reason is simple, since the loan is overcollateralized it would be dumb not to pay back the loan to receive the collateral. The exception is highly illiquid tokens such as the famous CRV Loan that would nuke the price of the token more than the loss of the collateral. It is up to the DeFi protocols to set good risk parameters.

The largest risk in DeFi is not bad loans, its bad code. Especially with anonymous teams, there is an incentive for the team to write bad code and hack the protocol themselves. An argument can be made that was the case with the majority of smaller DeFi hacks over the past few years.

Looking at specific borrowing metrics for DeFi there are a few that come to mind: APY, loan to value and liquidation threshold. APY is the yield the underlying asset earns, max LTV sets the limit of borrowing, and liquidation threshold is the point at which the collateral becomes insufficient. The transparency in the market helps keep it competitive between protocols as shown below. There is no charging different rates like banks do with their UHNW clients.

It is important to be able to underwrite digital collateral. Some assets pretend to be DeFi tokens while actually being part of centralized entities. Examples include CEL, FTT, and LUNA. There are increased risks with exposure to any token issued by a centralized entity which make it hard to evaluate and underwrite them. The flip side is BNB (Binance coin) with it’s great performance. Casual observers struggle to distinguish between the two, bad companies can have good marketing.

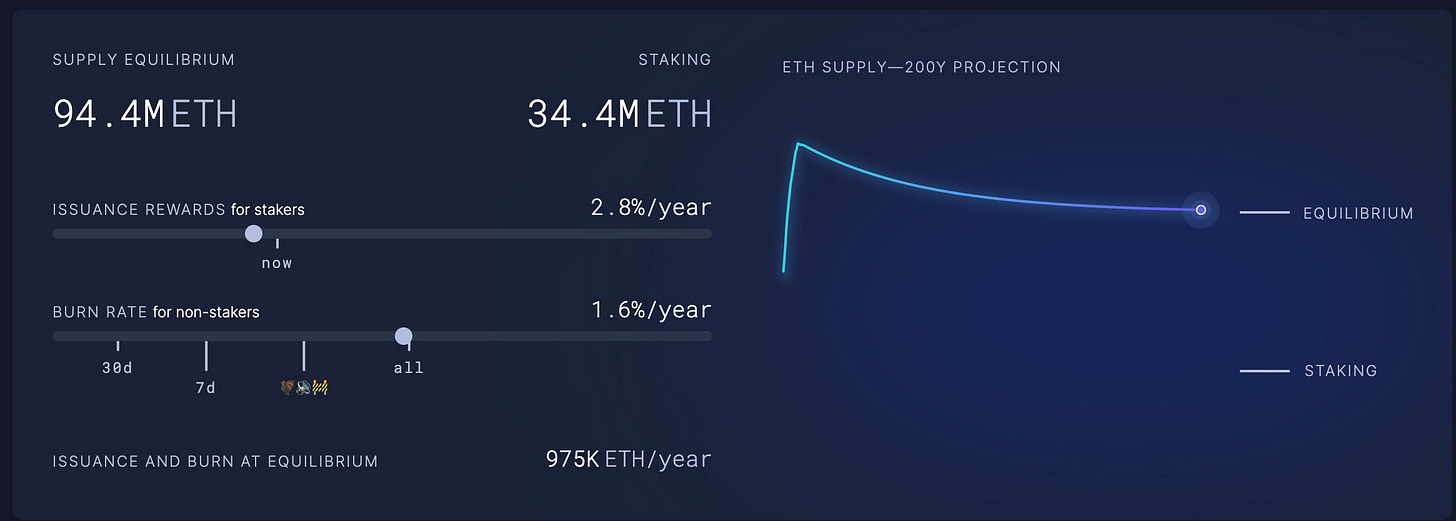

Since the Merge in 2022, I view Ethereum staking yield as the baseline interest rate in crypto. Historically it might have been the Bitcoin hash rate. The Ethereum staking rate is more important because it will allow risk in the EVM to be priced based on a standard rate. The real yield is staking rate + burn rate.

DeFi is still being built out. It is in its first decade. There is risk but more transparency and capital efficiency. It removes many of the extractive middlemen which plague traditional finance.

We’re in the early innings of it. The product market fit is here and there are battle tested protocols emerging as blue chip DeFi products. The market is starting to introduce synthetic assets which could be the next bubble if somehow people are allowed to lend out assets they might not actually have. One bad protocol hack could knock over a house of cards. Can’t wait to find out.

Cheers,

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.