AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

Disclaimer: AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition. Whitetail owns ETH.

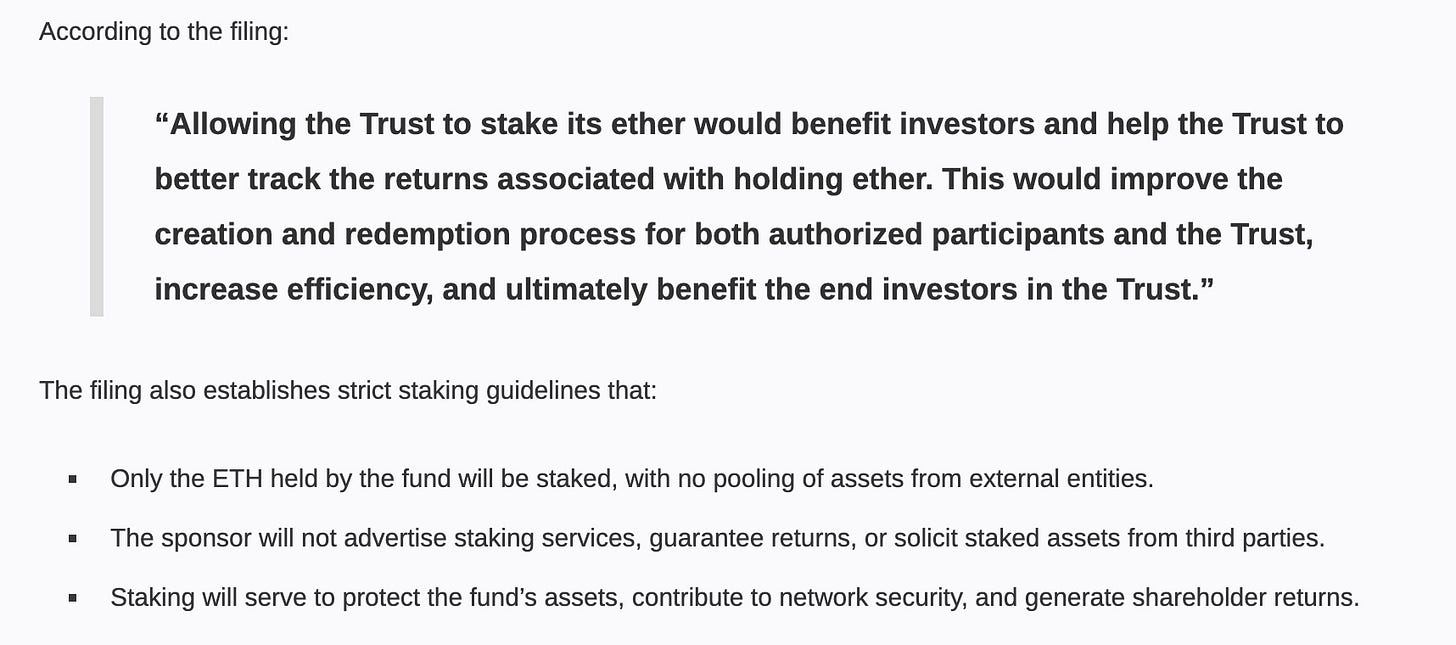

On March 11th 2025, Fidelity (via CBOE) filed for the ability to stake the Ethereum held in their ETF (FETH) to generate yield. For those unaware, Fidelity has been involved in crypto since 2014 and is more crypto native than one would expect. In my opinion, BlackRock and Fidelity are the two ETF issuers worth paying attention to.

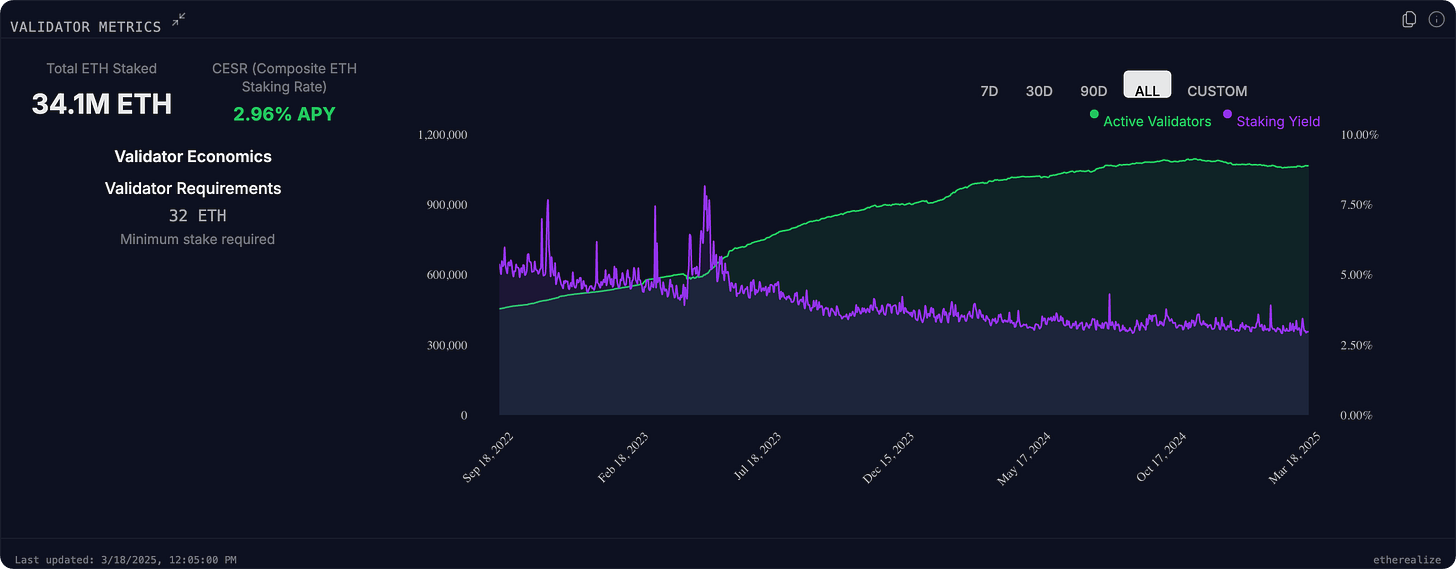

Some investors (Boomers) love yield. If you can get +2.75% yield from the ETF, it becomes much more attractive. Staking in the ETFs will bring more questions. Fidelity and BlackRock will run their own nodes but what about smaller issuers? Do they use Rocketpool, Lido or Coinbase? Regardless this gives increased legitimacy to the Ethereum Network (EVM). As Vitalik Buterin wrote, the most important scarce resource is Legitimacy. Unfortunately to date, ETH ETF flows have been underwhelming compared to my personal expectations.

That is the result of a previous regime. The current US administration’s pro crypto stance will have major implications. I can’t wait for SEC commissioner Paul Atkins to get confirmed in April. JD Vance (VP), Scott Bessent (Treasury Secretary), and Howard Lutnick (Commerce Secretary) are both pro crypto, along with the Paul Atkins and the Heads of the CFTC & OCC.

Fidelity isn’t the only major financial firm making forays into digital assets. Recent job postings from Schwab and BNY Mellon shows that custodians don’t want to miss this trend.

Actions speak louder than words. Institutions are preparing to market crypto to their investors. *Queue the institutions are coming jokes from previous cycles*

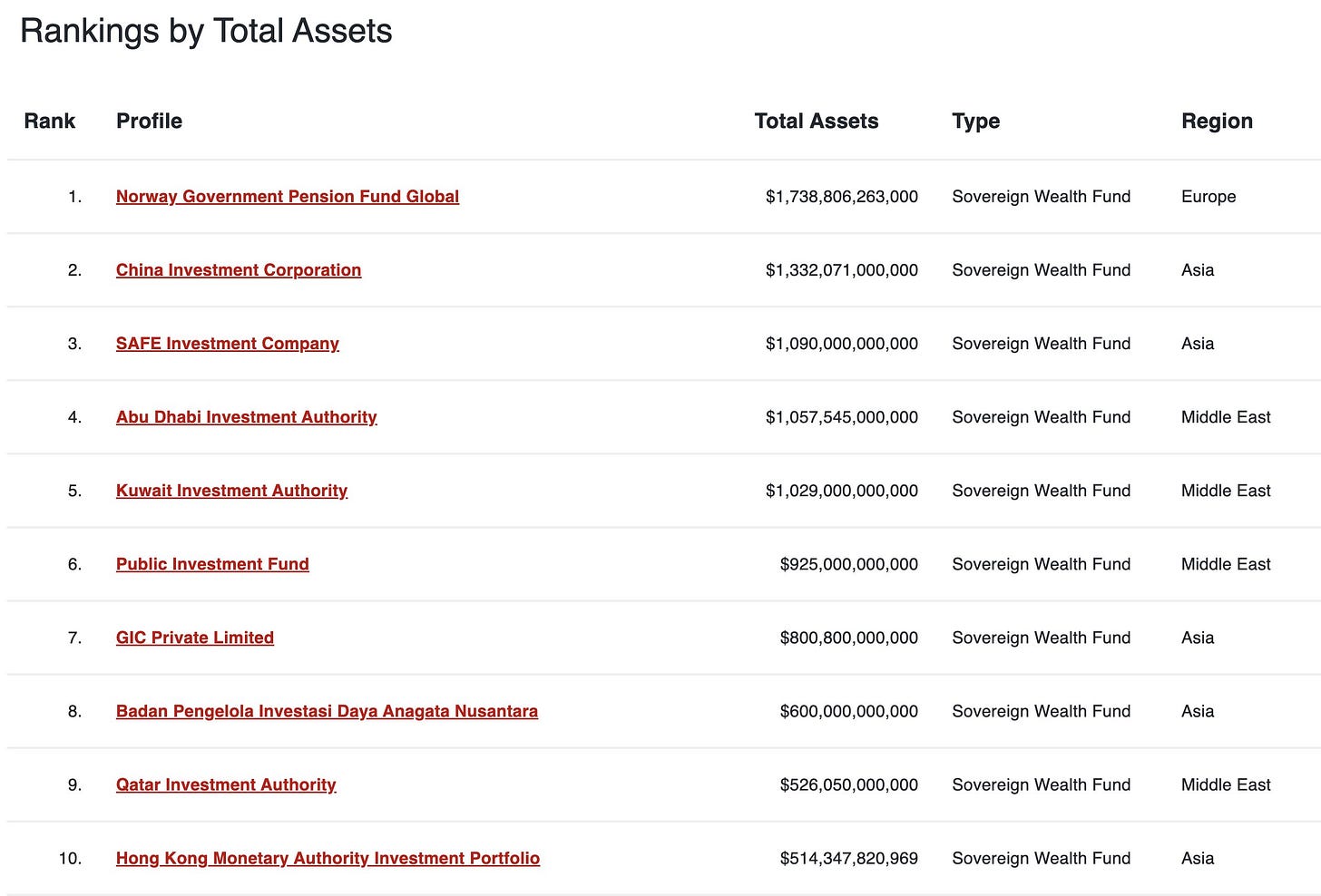

Governments around the world are beginning to understand and stockpile Bitcoin. Below is a list of the top holders (excluding North Korea who has the best hacking group in the game - Lazarus and is only behind the US and UK in Bitcoin held). The list below is only ETF exposure. It would make sense if additional governments have much more in cold storage somewhere from constant mining. That’s the strategic move vs letting everyone see what you own.

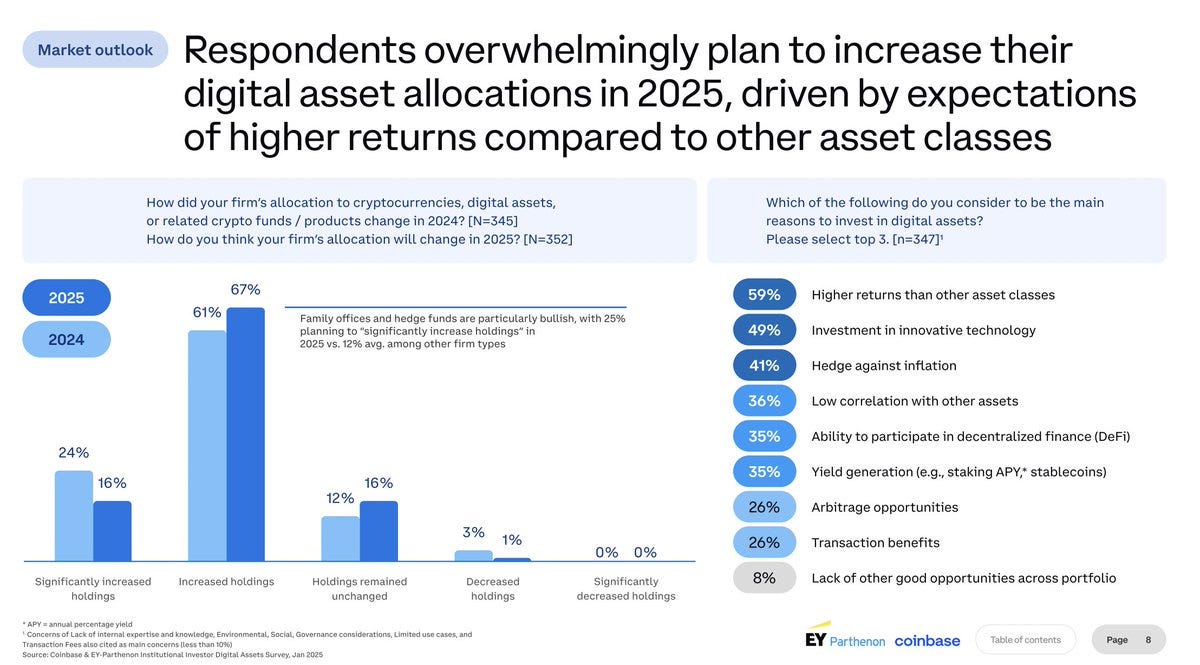

There is only one other institutional quality digital asset. Ethereum. Regardless of what the previous SEC stated, Ethereum is a commodity and it will be strategic for countries to own it. Like Gold, the supply of Bitcoin and Ethereum are increasing slowly each year. The supply of Gold increases on average 2%, compared to 0.83% for Bitcoin and 0.76% for Ethereum. With regulatory clarity, institutions are beginning to increase exposure to digital assets outside of Bitcoin. Institutional ownership of ETH ETFs increased from 4.8% in Q3 to 14.5% in Q4 2024. From the coinbase survey below (biased because they’re responding to coinbase) 83% of institutional investors plan to increase their digital asset exposure. Returns are returns.

Recently, Securitze ($2B in onchain assets) and Ethena ($6B in onchain assets) launched Converge, an institutional focused EVM L2 that requires KYC. This is a logical step in the evolution of the EVM. Some investors need to know who their counterparties are.

Another reason they launched Converge is because successful L2s are extremely profitable. Making Ethereum L2s a value add to each organizations bottom line is very important. From the Etherealize dashboard, Coinbase makes 95% margins on base. Impressive.

The goal of Ethereum right now is to expand its mindshare and bring more users into the EVM. The world is coming onchain and it should be on Ethereum but that is not a guarantee. I believe the market is valuing Ethereum like a cash cow when it is in extreme growth mode. Fees generated now are nothing compared to when 50x the amount of people are using the EVM (whether they know it or not). Institutional investors will get exposure via ETFs. They want to keep their money inside the current system. That is fine as long as it pumps our bags.

The market can stay [REDACTED] longer than most people can stay solvent.

Play the long game.

Cheers,

Whitetail & Co

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.