AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition.

Blockchains are a new technology and investors are learning how to properly value these assets. Advantage Blockchain looks for metrics that we feel represent actual growth and help users maximize UEV (user extracted value). In public markets, common valuation metrics include price to sales (P/S), price to earnings (P/E), and earnings per share (EPS). In private markets, it is distributions to paid-in (DPI), internal rate of return (IRR), and multiple on invested capital (MOIC). Crypto is starting to have its own standard valuation metrics.

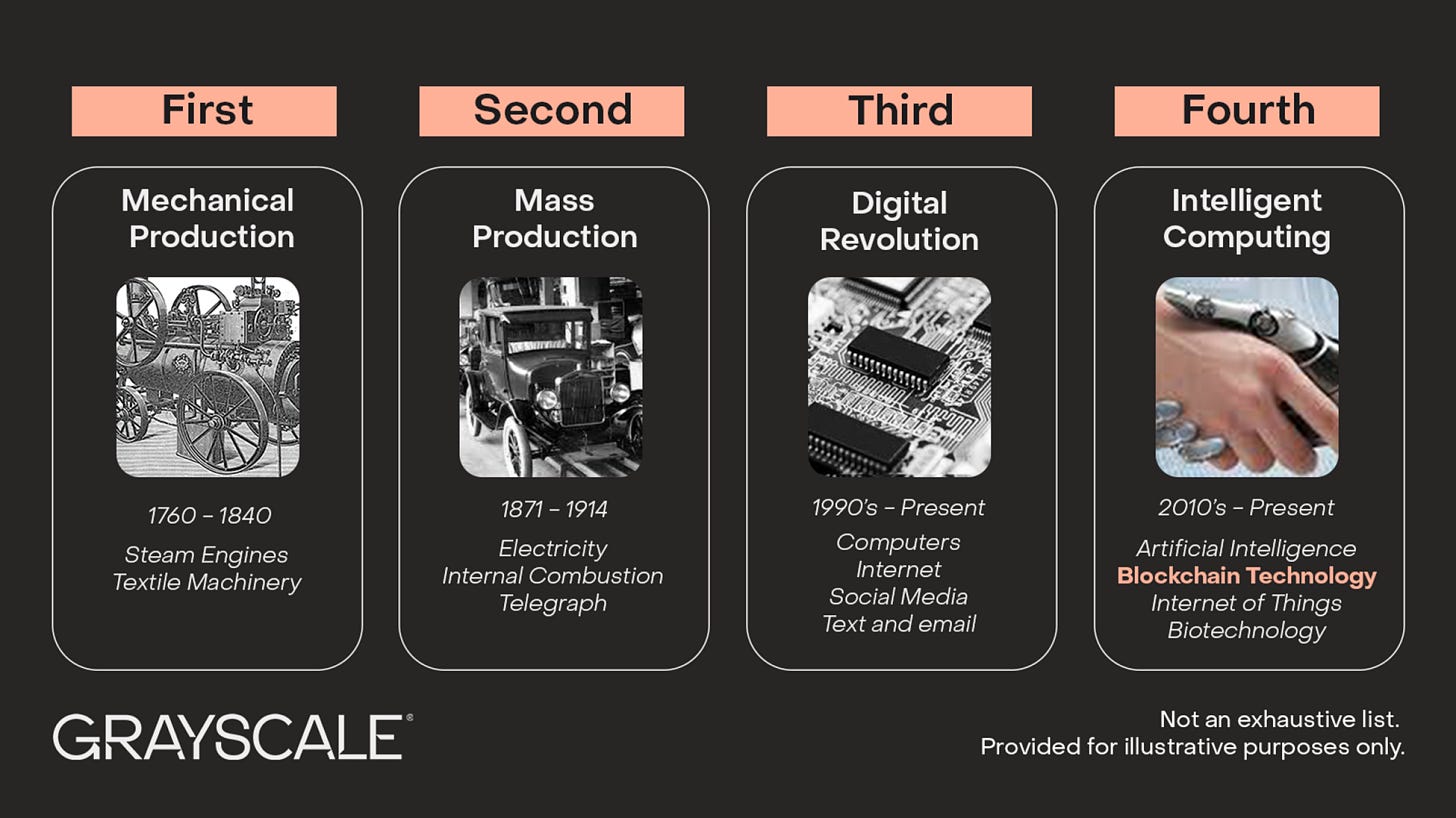

In the first decade, 2009 - 2019, crypto evolved rapidly. People used to send Bitcoin over email because the infrastructure used today was not invented yet. Crypto was on the fringe of the internet. People literally gave away Bitcoin (pictured below). The value proposition was there; a trusted medium of exchange with anyone in the world. Bitcoin solved the incentive problem with proof of work and a hard cap of 21 million.

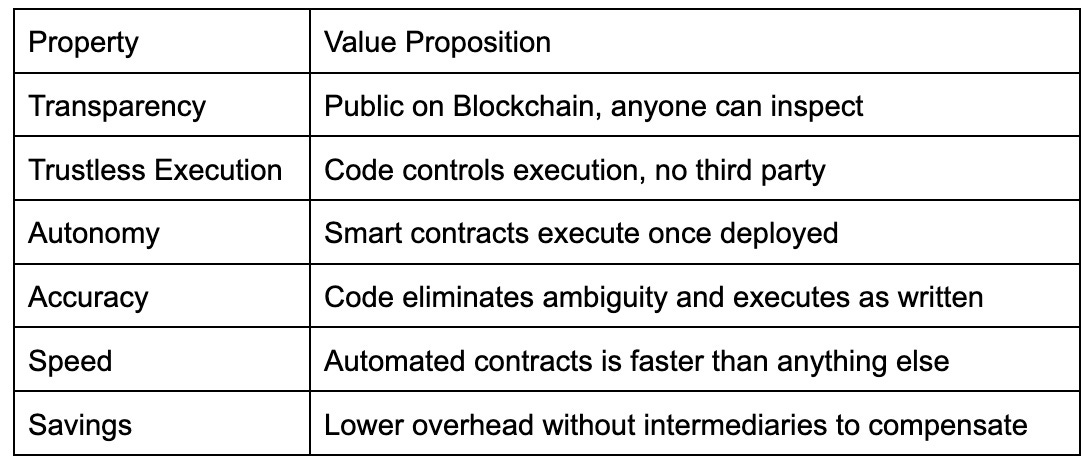

As the crypto ecosystem continued to advance, Ethereum unlocked smart contracts. Smart contracts have features that fundamentally change how persons are able to interact with each other. Trust code not people. Smart contracts include: Transparency, Trustless Execution, Autonomy, Accuracy, Speed, & Savings.

Lets define these properties:

Increased programability (smart contracts) and standards (ERC or Ethereum Requests for Comments) allowed infrastructure to be built. Ethereum Name Service (ENS) turns the address into a name (e.g. Whitetail.eth). Layer 2s are cheap to use. Oracles allow blockchains to interact with the outside world. There have been hacks and scams but crypto continues to advance. The only way is forward.

“If you see the President, tell him from me that, whatever happens, there will be no turning back.” — Lt. Gen. Ulysses S. Grant May 5, 1864

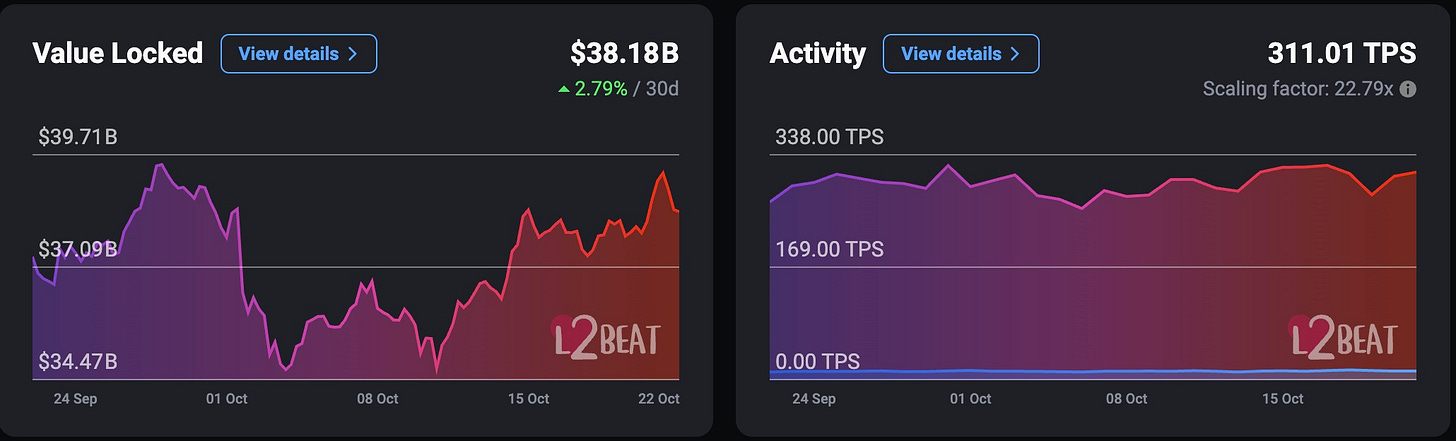

Successful blockchains create economies around their respective technologies. Ethereum’s scaling solution has been working, Layer 2 activity is at all time highs.

Historically people viewed new addresses as a way to determine blockchain growth. That evolved into number of transactions and total value locked (TVL).

That are now more metrics and it is important to be vigilant. In crypto, there are always bad actors trying to separate us from our coins (exchange valuable ones for worthless coins that they market to seem valuable). As mentioned above, each blockchain is evolving to become its own ecosystem.

Ethereum is the United States and each Layer 2 is similar to a state with its own laws. Texas and California agree to some of the same standards (federal laws) but have wildly different interpretations of others (state laws). Regardless of the differences, growth is measured by a common metric: gross domestic product (GDP).

Two large (Layer 2) economies built on Ethereum are the Optimism Superchain and Arbitrum One. Instead of GDP, Advantage Blockchain is looking at Revenue Generating Smart Contracts (RGSC). Layer 2’s are smart contracts built on Ethereum and Grow The Pie shows the economics of these RGSC. We view RGSC as businesses built onchain. In the past year, Layer 2’s built on Ethereum generated $327 million in revenue with $161 million in profit (~50% margins). With the introduction of EIP 4844 in March 2024, the average profit margin for Layer 2’s has increased to ~80% (with more profitable ones consistently above 90%). These are very efficient businesses.

Additional examples of RGSC:

Blackrock BUIDL fund automatically distributing dividends.

Liquidity pools on Aerodrome pools with incentives.

Yield farming that auto compounds the rewards via applications like Extra Finance.

Stake.link which uses smart contracts to secure networks and issue rewards to those who put their capital at risk.

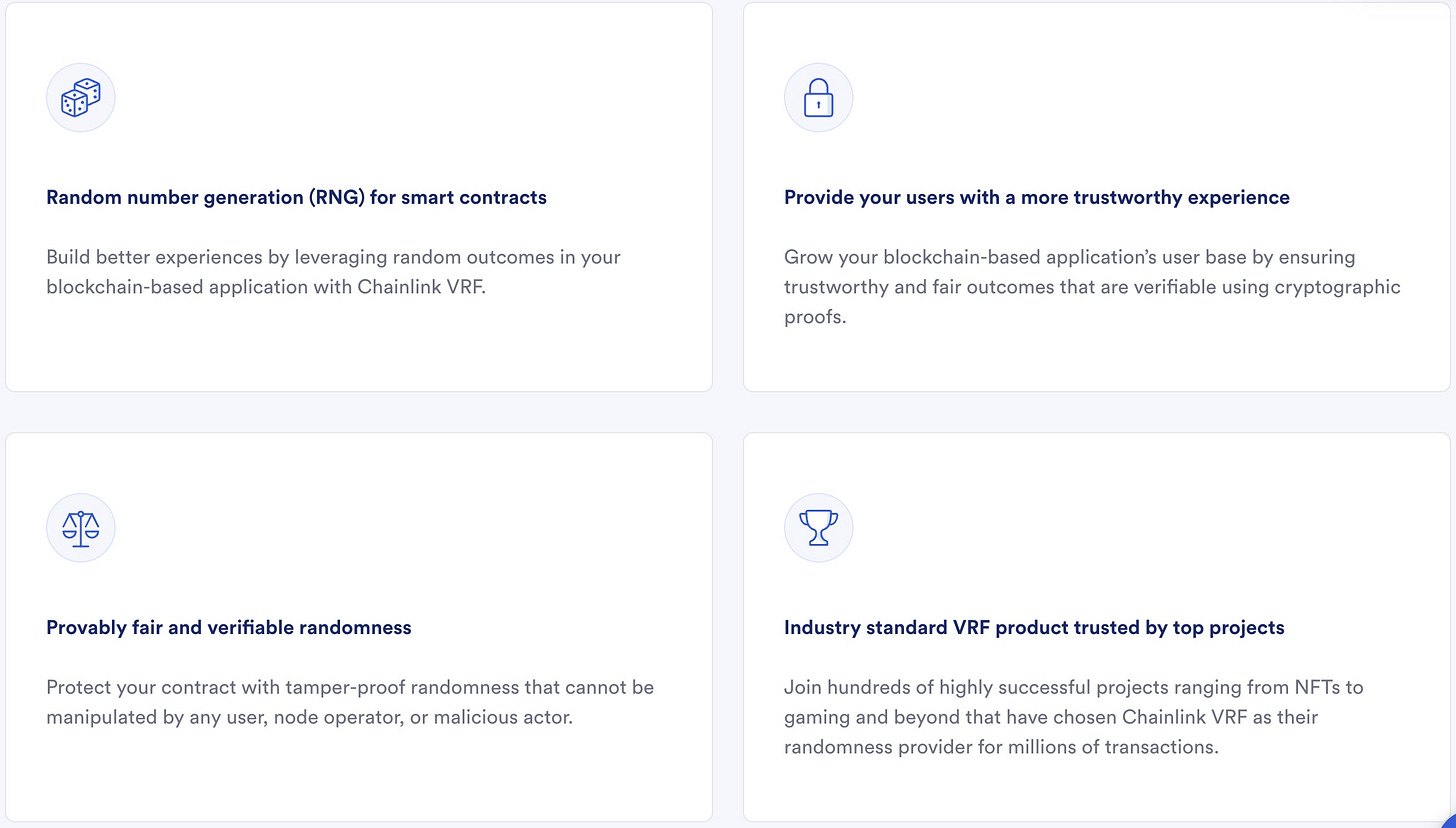

Chainlink's Verifiable Random Function (VRF) is a cryptographic system that provides provably fair and tamper-proof randomness for smart contracts. It is widely used in blockchain applications that require random outcomes, such as lotteries, gaming, and NFT minting.

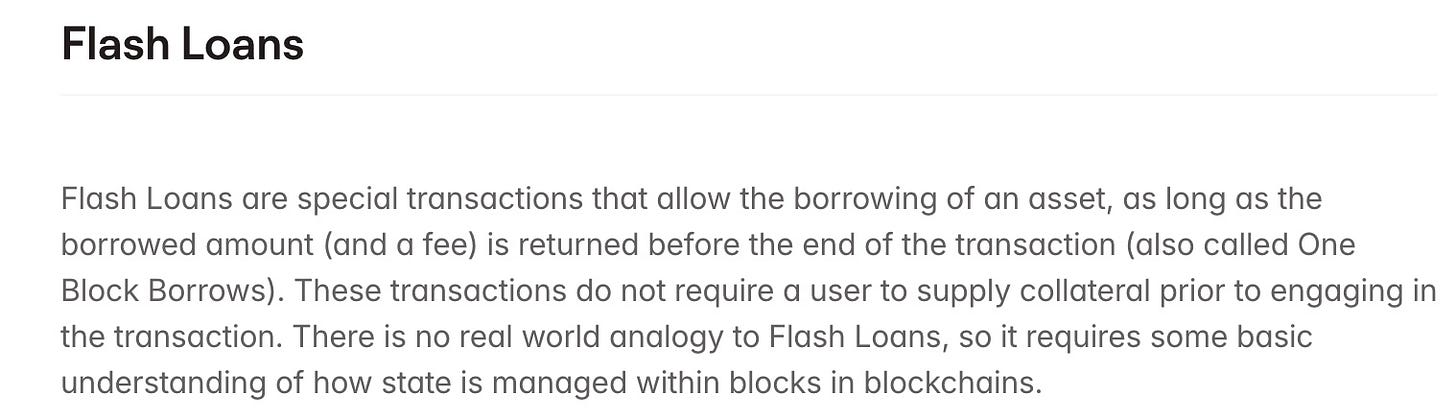

Liquidation bots on Aave and MakerDAO that run software to see if conditions are met then take out flash loans to liquidate bad debt and receive the incentive fee.

The infrastructure that has been built over the past three years is impressive. It takes less than 2 minutes to get USDC off a Layer 2 into Coinbase and withdraw it to a bank account. The longest part is waiting for the bank.

Looking forward it is clear that smart contracts will automate workflow, reduce costs, and increases transparency. Combined with stablecoins, it will increases velocity of money and makes use of idle dollars. The amount of stablecoins it is at all time highs. More smart contracts are being deployed every day. This is the power of being onchain. Revenue generating smart contracts for the win, lets create more of them.

Cheers,

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.