AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

Disclaimer: AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition. Whitetail owns Chainlink, Ethereum, and Miggles. Advantage Blockchain owns those + AERO, BMX, and OP.

Institutional allocators struggle to understand where crypto should fit in traditional asset allocations. It is an emerging asset class that blends the line between equity, debt, and traditional investments. Is a token equity or debt? Who has claims on the IP in terms of a bankruptcy? What if there is a token and equity? Does it depend on the specific scenario? There are many diligence questions that must be answered before even reaching custody.

Retail investors intuitively get that crypto fits into the risky portion of their investment portfolio. Coinbase or a smart wallet with hardware device is enough for them. The Horcrux model works well. Retail is not worried about specific risk / return and where assets fit in traditional portfolio construction. They were never converted to the religion of the 60-40 portfolio.

Crypto is a unique asset class. We believe that the market finally started to understand the benefits of Bitcoin once it became easily accessible to institutions (ETFs launched in January 2024). Traditional financial institutions, such a Fidelity, have begun to bullpost why even a small percentage of Bitcoin helps portfolio construction. In the eyes of Fidelity and BlackRock, fees are fees. Comparing Bitcoin to digital gold is a narrative that took many years to establish. The rest of crypto is more nuanced.

Ethereum has established itself as the leading blockchain for tokenization, capital, innovation, and developers. No matter what coordinated FUD campaigns say, Ethereum is still the Crowned Prince. Both Bitcoin and Ethereum have reached a level of blue chip maturity.

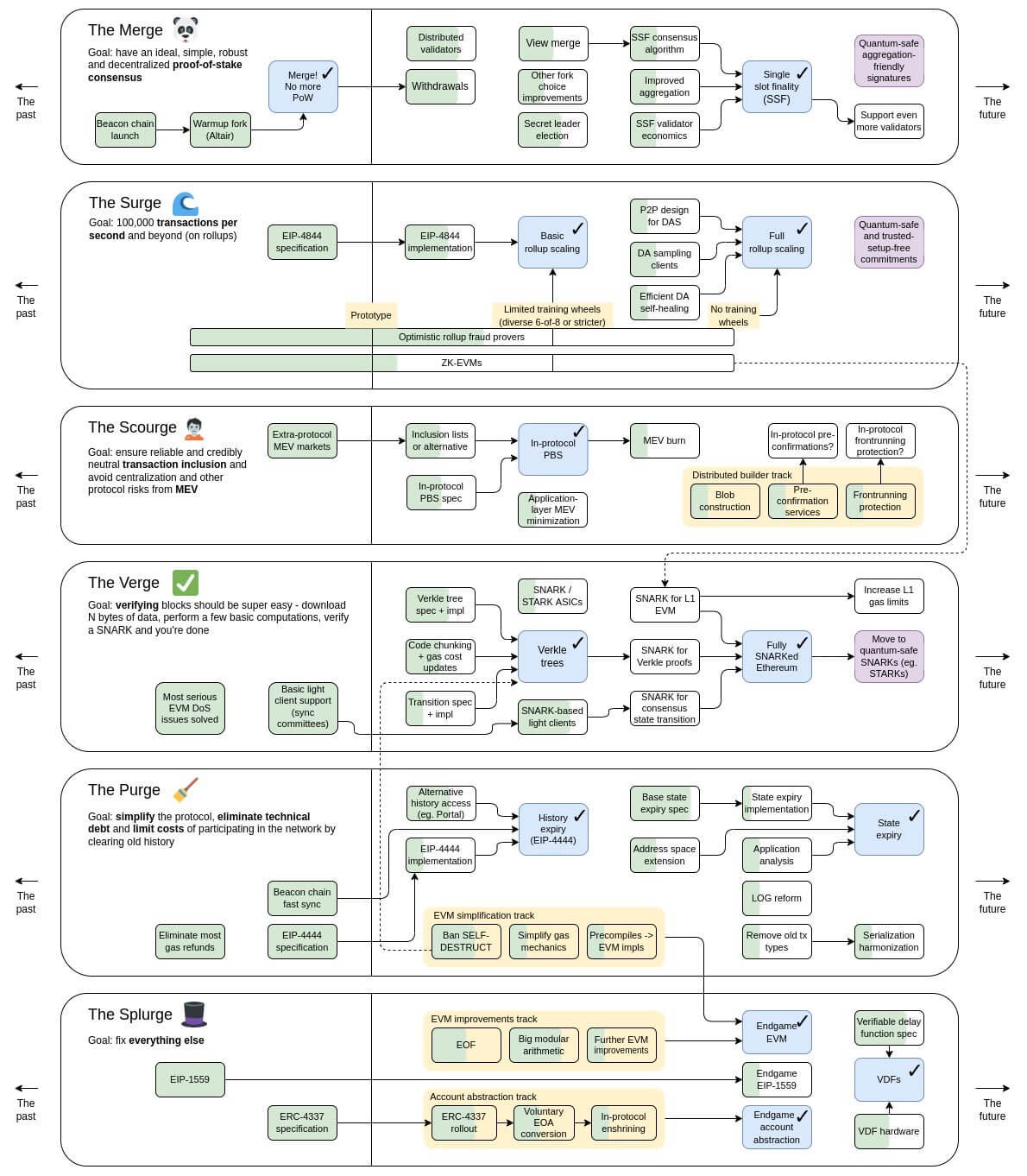

Ethereum is a permissionless computer (and Dark Forest). Like the Internet in the 1990’s, it was hard to predict Uber and Venmo. Ethereum has many attractive attributes. It is a store of value (like Bitcoin) that is being exported as the native asset across the EVM (show above). Ethereum’s tokenomics (economics of crypto networks) results in lower inflation than Bitcoin (1.45% for BTC vs 0% for ETH since 2022). Ethereum has a native yield over 2% for stakers. Persons can easily generate loans up to 80% LTV (Loan-to-value). I think Ethereum is the best asset in the digital world.

Ethereum has undergone Forks (upgrades) over the past few years that have significantly improved the network. In August 2021, the London upgrade introduced EIP 1559 which allowed dynamic fee burn. In September 2022, the Paris upgrade introduced Proof of Stake (The Merge) reducing the inflation of the network by +95%. In March 2024, Dencun introduced EIP 4844 making transaction fees on Layer 2s significantly cheaper. Pectra is upcoming in 2025 and will include EIP 7702, introducing account abstraction (allows wallets to become smart contracts). These upgrades are the broadband equivalent for the Ethereum network. Innovation will turn from infrastructure to the application layer.

Ethereum ETFs have a chance to give Boomers the yield they love. It is only a matter of time until someone builds a JEPQ-like ETF for Ethereum. The JPMorgan Nasdaq Equity Premium Income ETF seeks to deliver monthly distributable income and Nasdaq 100 exposure with less volatility. It currently offers a 30 day SEC yield of 9.76% with net fees of 35bps. Ethereum has more volatility than the Nasdaq 100 so the distributable income from selling calls on a similar product should be higher.

Almost everyone, even Elizabeth Warren’s Anti Crypto Army, agrees that crypto is an inefficient market. In our eyes, this means the rest of crypto outside of BTC and ETH is akin to venture capital with one key differentiator - increased liquidity. This makes liquid token investing very attractive. Usually as an asset class gets more inefficient it loses liquidity, that is not the case with crypto tokens.

This attribute alone makes the asset class very attractive. Crypto is a very inefficient market - yet there is constant liquidity. In an era when venture firms struggle to generate DPI (return capital to investors), liquid token investing allows liquidity from the day of the investment.

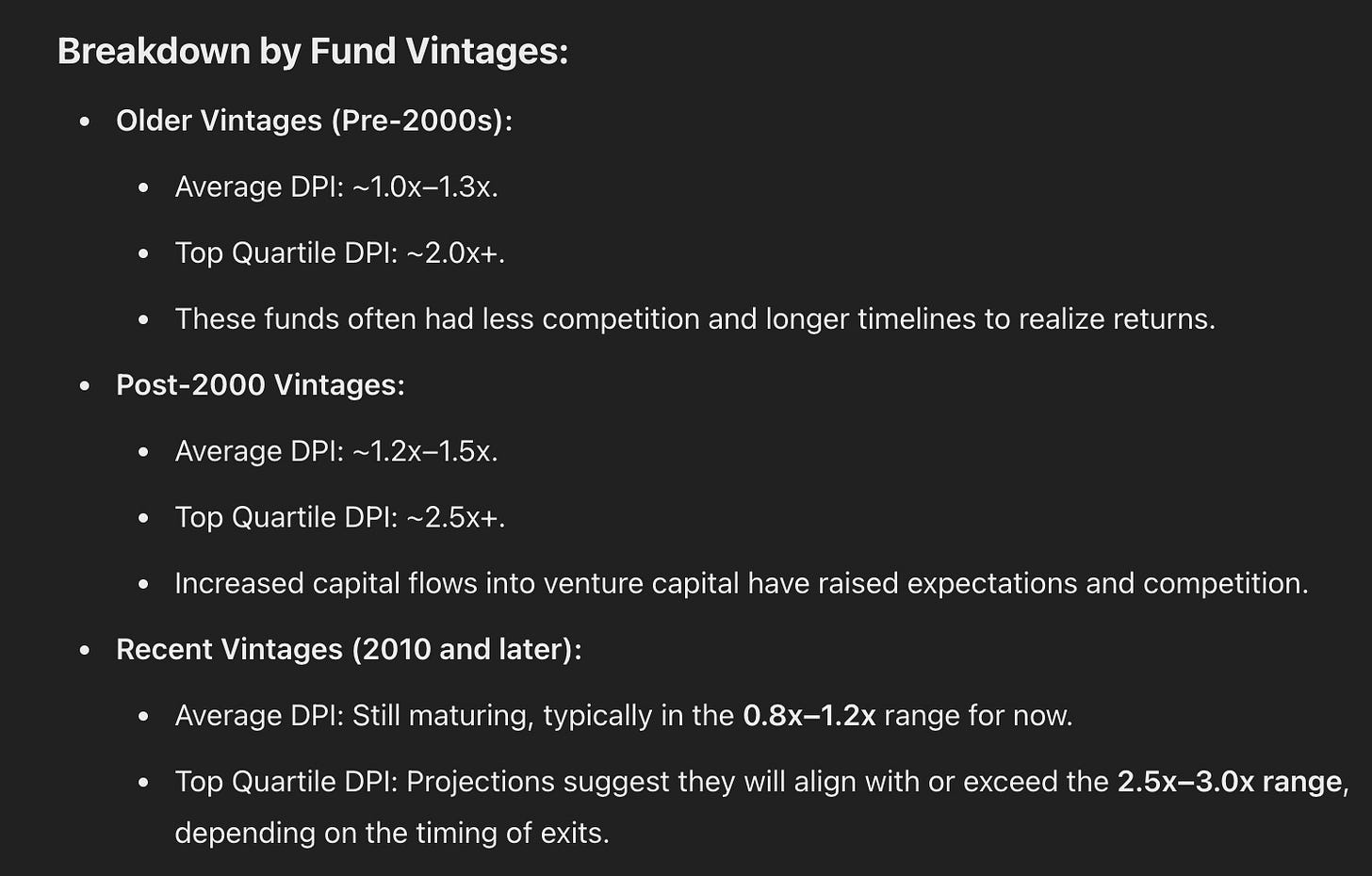

Even top quartile venture funds struggle to generate significant dollars returned to LPs (DPI or distributions to paid in capital) - liquid crypto funds can surpass that during instances of irrational activity from markets. Usually this is taking out the initial investment after a quick pump or buying down 50% during one of the many cascading liquidations in a bull market.

As a Firm in 2024, AB chose specifically to dive into the Base ecosystem for a few reasons. Base is built on the OP Superchain Stack (AB has been bullish on since 2021). We believe that Coinbase (100M+ users) would execute and that distribution is king. While some investors worried about the lack of native token, it wasn’t clear why a Layer 2 network needed one. In hindsight, we were right. In just over a year, Base has become the leading Layer 2.

Borrowing terms from traditional private markets, here are some examples of different crypto investment stages in the Base ecosystem and crypto at large:

Not all crypto investments are equal. There are new metrics that investors need to look for when considering an investment (e.g. tokenomics, users, onchain capital flow, influencers). Outside of Bitcoin and Ethereum, it helps to have professional management evaluate these risks for you. Adverse selection is one of the biggest risks for part-time crypto users. Advantage Blockchain is here to help, please feel free to reach out.

Cheers,

Whitetail & Co

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.