ETF Approved

Ethereum's Golden Age

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition.

AB Researcher: @Whitetail

The Ethereum ETF is approved.

Finally, it seems US regulatory headwinds are turning to tailwinds as both political parties try to coerce voters heading into the 2024 election season. May 20th was the largest single daily candle for Ethereum. Ever. We can all thank the Don?

Trump made crypto political. The Biden Administration has been anti crypto and was caught off guard. They even had to update the Statement of Administration Policy.

I wish I was a Crypto Baron. The 180 turn from the Biden Administration caught many by surprise, including the Bloomberg talking heads who respectively had the Ethereum ETF approval at 25%.

Ethereum bulls like Anthony Sassano , Vance Spencer, and Evanss6 pointed to a different outcome. ETF Approval. If you can’t forecast well, forecast often. Careful of talking heads who pretend they have all the answers. This is a prime example of doing your own research and knowing what you own. Paul Ryan is comparing stablecoins to Eurodollars and BlackRock is putting $400M onchain! Crypto clearly has peoples attention.

The FDIC and SEC have been the most crypto-hostile US regulatory agencies. On May 21st, FDIC chair Martin Grunberg announced his resignation, amid a months-long scandal over sexual harassment and other misconduct at the top bank regulator. Why is this important? This guy led Operation Chokepoint 2.0. He was an Elizabeth Warren Goon.

The SEC seems to be another government agency in shambles. The agency continuously lashes out at the good crypto companies in the name of investor protection while losing high profile court cases such as Ripple and Greyscale. The charade it over, it is clear that Gary Gensler is a hypocrite.

There was little reason for back and forth between the SEC and issuers regarding the Ethereum ETF due to how similar it was to the Bitcoin ETF. People misconstrued this silence with denial. It is possible the SEC learned from the Bitcoin ETFs that everything would get leaked to the press.

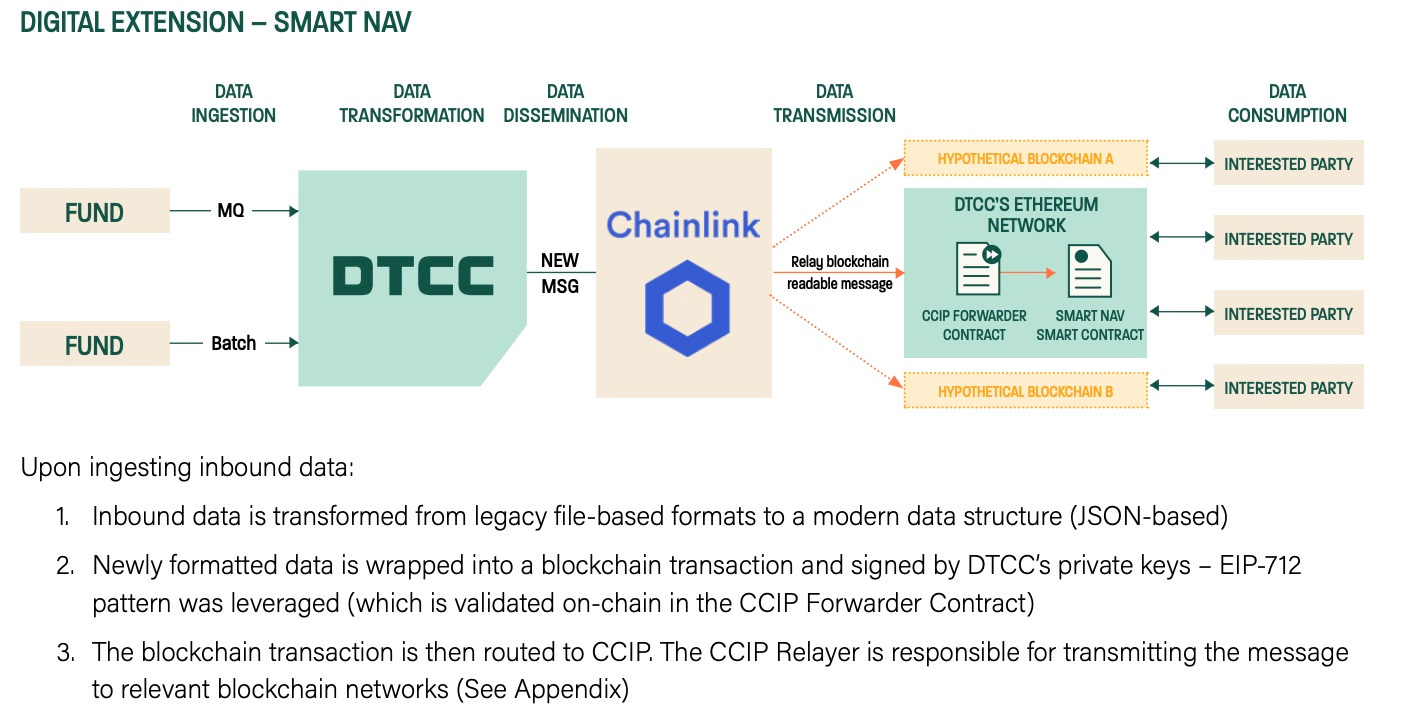

Regardless, I cannot overstate the importance of the Ethereum ETF. It gives institutions the green light to develop, invest, and use Ethereum. It is ironic that “smart money” will be buying our bags without the ability to vote or validate any proposals onchain. ‘INSTITUTIONS ARE COMING’ was meme’d into oblivion but now there actual case studies from the Brookings Institute and along with DTCC trials using Chainlink.

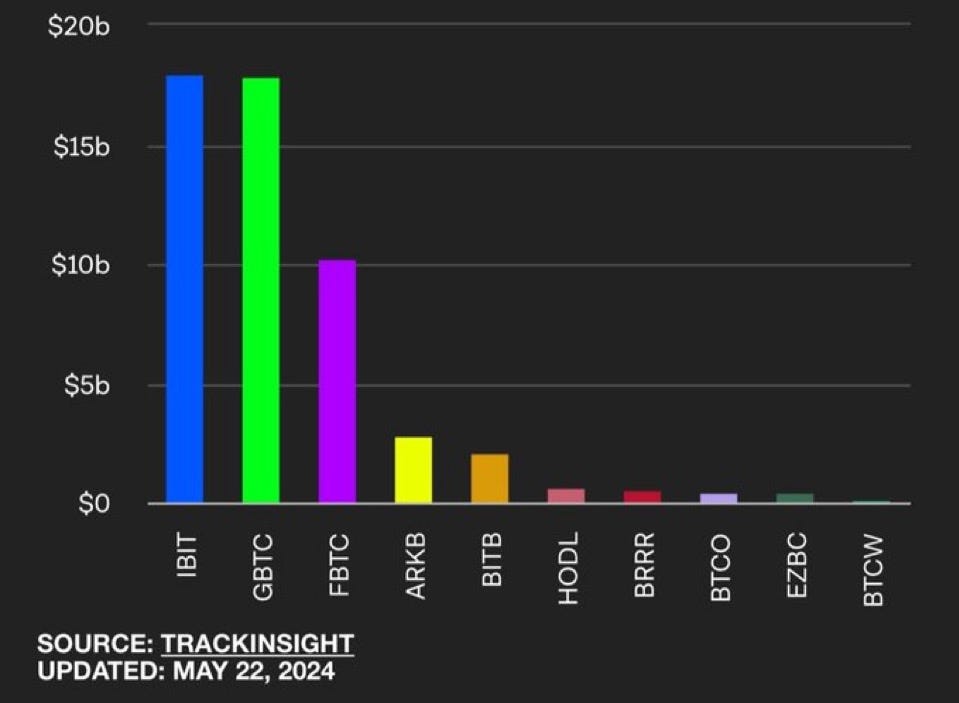

In the three months that the Bitcoin ETFs have been active they reached ~$50 billion, resulting in the most successful ETF launch of all time. It would not surprise me if the Ethereum ETF became number two, there is clearly demand for crypto assets.

The Ethereum ETFs will not include staking. This is actually bullish, for a few reasons:

Staking yield is not diluted

Stakers % ownership of the network increases every year relative to ETF holders

The possibility of staking with the ETH ETFs is another moment to look forward to, good or bad.

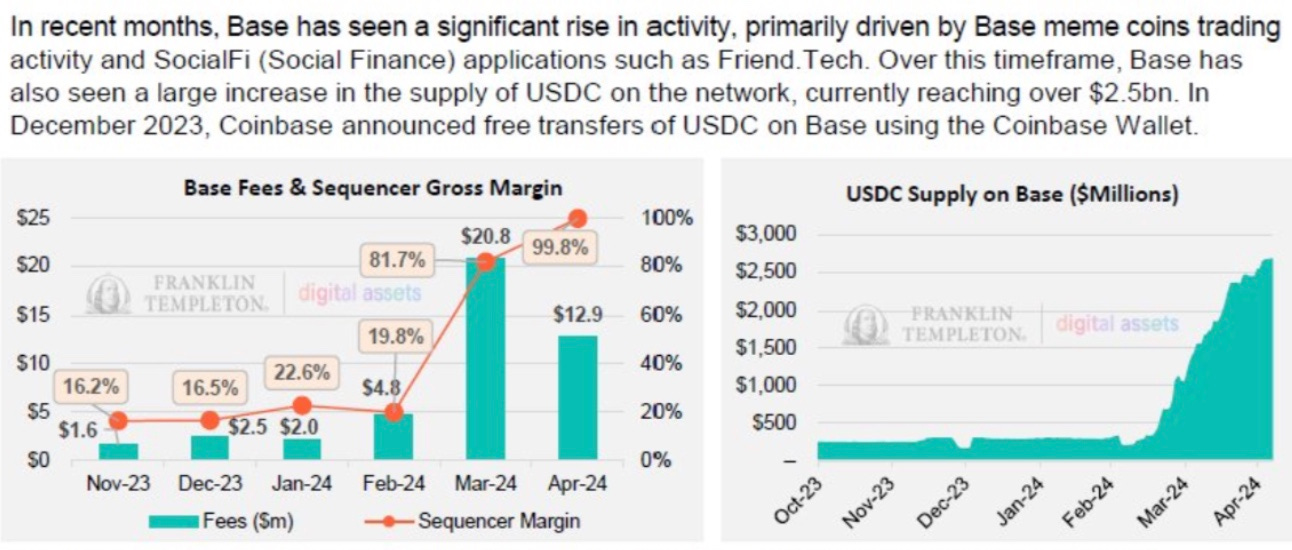

So big picture, what does this mean for Ethereum? As someone with a background in alternative investing, I view this as unlocking trillion of dollars in value. No longer is there a career risk in buying Ethereum. Crypto will become a core part of portfolio allocation. Fidelity is already doing it. It also means that even at $4 or $5K, Ethereum is still extremely undervalued. Throw Coinbase in the undervalued camp as well, Most of Wall Street probably doesn’t even know what Base is. 99.8% gross margins.

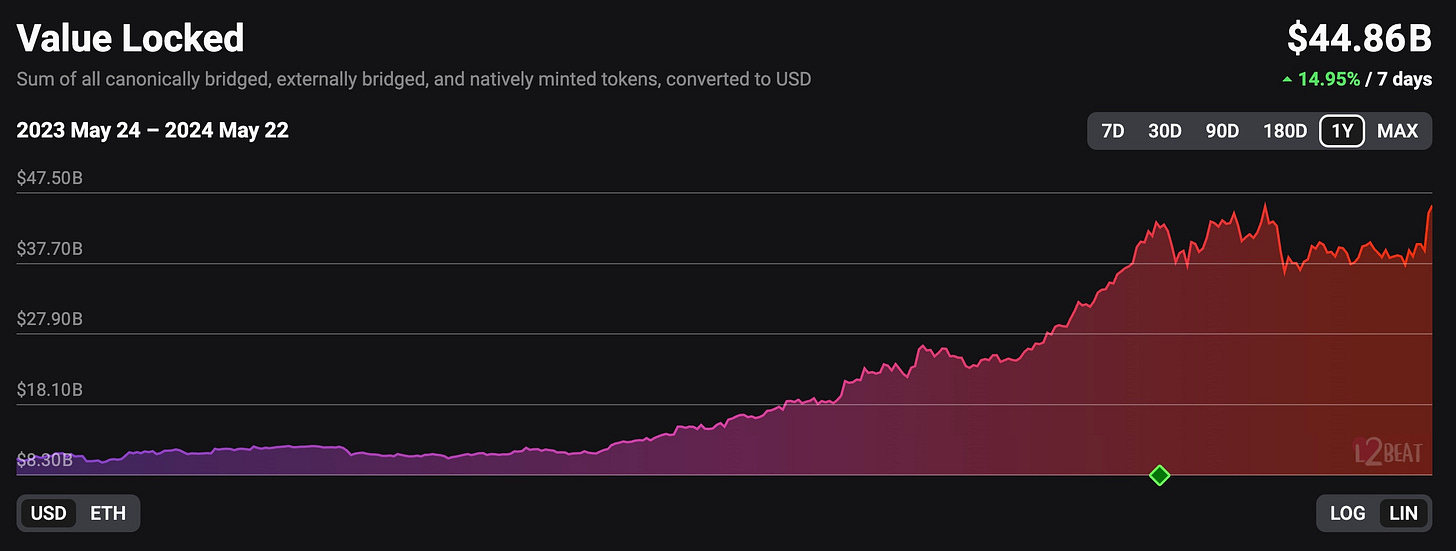

As the ETFs come live, there is a chance for a supply side crisis. Commodities are priced on the next available unit, which results in which situations like WTI going negative in 2020. With the ETF demand, there could a situation where Ether is hard to find. Looking at current exchange metrics, there is only ~12-14 million ether on exchanges, down from 32 million in 2022. With the attractive yield on Layer 2’s, ~three years of burn, restaking, DeFi lending, NFTs, hacks, lost keys, etc there might be less Ether available then people assume. Combined that with reduced inflation and we might get some fireworks.

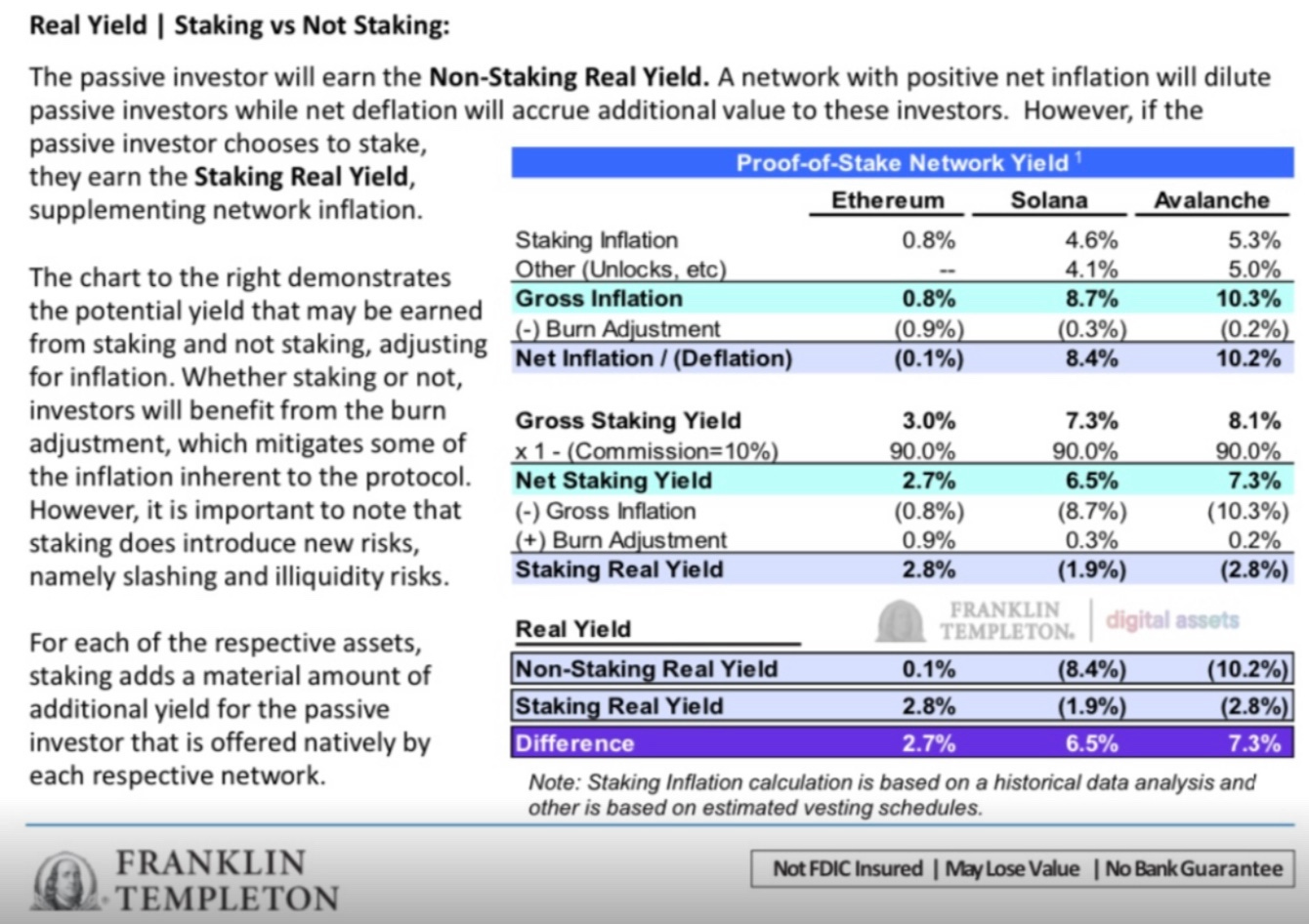

As legacy financial institutions become more entwined with crypto, the liquidity of blue chips (BTC+ ETH) will increase and there will be complex financial instruments built on the protocols. Looking at Ethereum, the real yield is 2.7% and you can hedge the Ethereum exposure. That is very attractive to some traditional financial investors. I view the Ether staking rate as a benchmark rate for crypto similar to SOFR in traditional finance. There will be interest rate derivatives built on top of it. Another example is a currency carry trade between a weak currency and Ethereum or USDC. Franklin Templeton is already looking at real yield, I bet 2.7% has quants licking their lips.

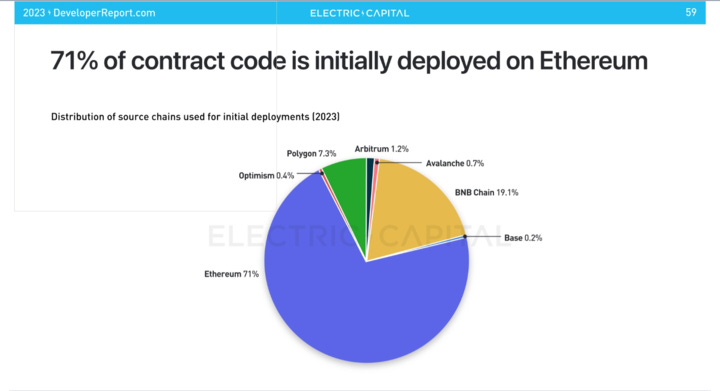

Crypto markets are still very inefficient, which is why there are opportunities for extreme alpha. These will not always exist. Ethereum is a global commodity and the USA is but one player. The world is becoming increasing competitive. Ethereum continues to attract developers globally. Looking at almost every metric, the Ethereum Virtual Machine (EVM) is growing like a weed.

Ethereum is a blackhole for talent. I am excited to see where innovation takes us in the future. Ether is the most pristine collateral on the blockchain. The world is becoming increasingly digital. Think about what will happen to the value of the best digital collateral.

It was a long path for Bitcoin and Ethereum to receive ETFs. One CME study took multiple years. This will continue structural advantage for Bitcoin and Ethereum on the way up. Beware though, once the bull market fades, Hedge funds can short crypto using these same instruments. However, important people seem to like Ethereum.

I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we're going to be going. - Larry Fink

Here is the video. Worth the watch. He starts talking about tokenization at the 4 minute mark.

Ethereum could be your last investment.