Beyond the ETF

Crypto's Wall Street Conquest

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

AB Research is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom. This is a special edition.

AB Researcher: @Whitetail

As Wall Street prepares for the Ethereum ETF, we look forward to the next phases of crypto adoption. The ETF is a big deal. AB Research previously covered the approval. In BlackRock’s CEO, Larry Fink, own words:

I believe it [blockchain] is an alternative source for wealth holding and is an asset class. We will use the blockchain. We believe ETFs is the technology that will transform every asset class… Let me be clear, I believe ETFs are step one in the technological revolution of financial assets. step two will be the tokenization of every asset. We look at blockchain like we did ETFs, these are technological changes that allow us to move forward.

We couldn’t agree more. Much of this will be built on Ethereum as the Ethereum Virtual Machine (“EVM”) has cemented itself the go-to blockchain for innovation and liquidity. BlackRock manages $10.5T (4x larger than the entire crypto industry), do not ignore them. In turn, Ethereum on exchanges continues to fall as Ether the asset gains more utility and sees increasing demand.

Still believe there will be a supply crunch post ETFs and the price will react accordingly. $10K is not a meme anymore. Post merge, the Ether supply has been slightly deflationary.

With supply being burnt off the market due to EIP 1559 and redistributed to Ethereum stakers, everyday Ether is taken off the market and becomes more scarce.

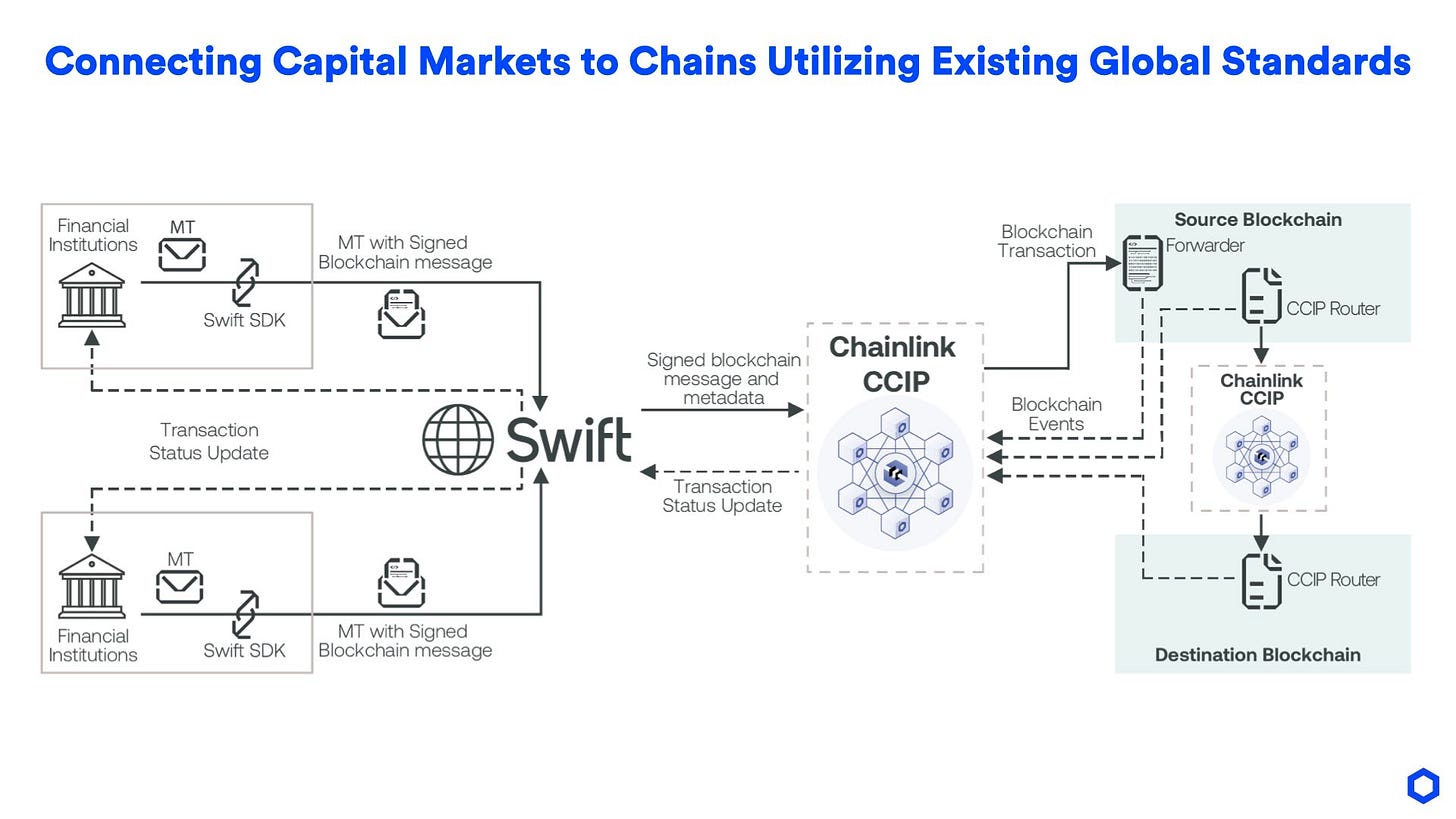

Turning back to traditional finance, it has historical precedent and does stuff a certain way. Four letter tickers originated due to printing speed. With most wealth in institutional accounts, it is risk adverse and has massive requirements to change. Institutions will continue to use SWIFT messages, DTCC, existing interfaces, and legal standards that they already put trillions though. Simply put, they are not rebuilding from the ground up.

The question is how can the decentralized financial (“DeFi”) interact with legacy systems?

A recent incident at the New York Stock Exchange helps to highlight the need for more resilient systems. By error, the NYSE had Berkshire Hathaway drop 99.97%, then artificial intelligence (“aka code”) read the report without understanding the data was wrong and continued to disseminate bad information. The consequence of one error compounded due to trust assumptions (how the system is built). Crypto solves this, Chainlink solves this. It is happening in real time if you’re paying attention as the technology continues to advance.

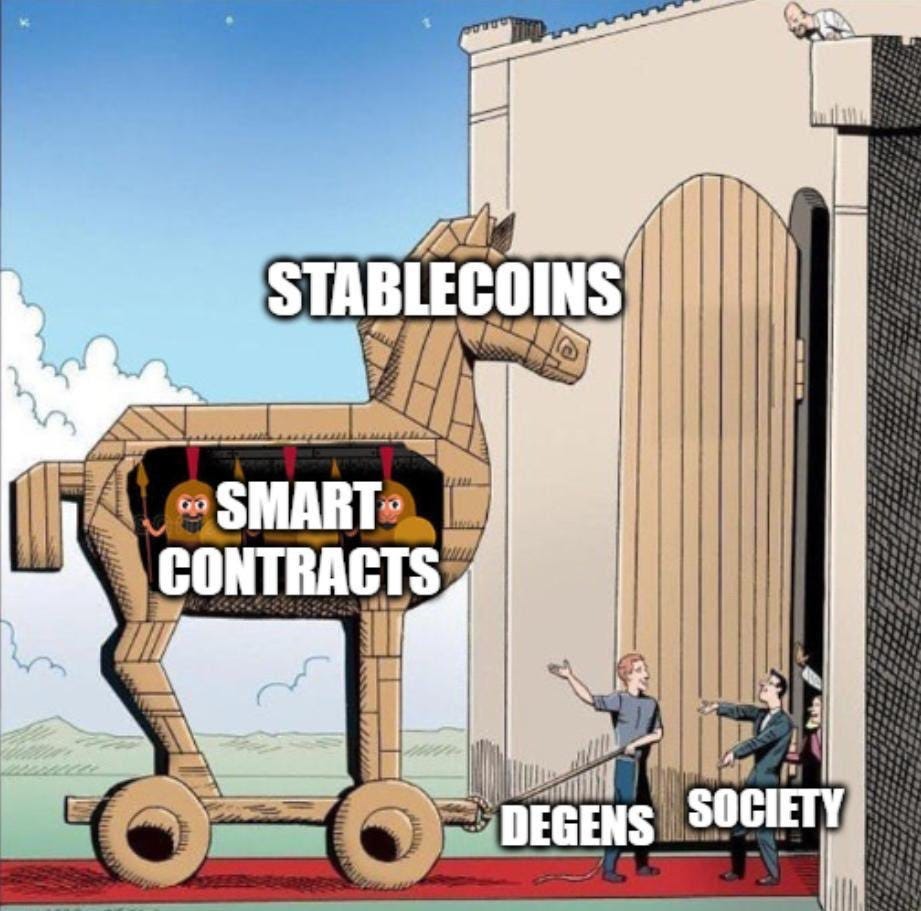

To date, there have been three real use cases for crypto: stablecoins (tokenized dollars), memecoins/token launches, and decentralized store of wealth (BTC/ETH). Institutional adoption is here and the ETF was the first step towards tokenization of all assets. There are three requirement for tokenized assets as Wall Street becomes comfortable with blockchains.

Programmability

The Ethereum Virtual Machine (“EVM”) enables coding of programmable logic into the blockchain. This allows for the automation and execution of complex transactions without the need of trusting third parties.

Cross chain

Liquidity attracts liquidity. The EVM currently dominates with ~$60B in total value locked. Looking forward, we believe banks and institutions will spin up their own chains similar to Base. Some of these chains will be public and some private but all will want to plug into the liquidity of the EVM.

Data

Blockchains are like computers without the internet. Useful but a lot better with external data. This trend started with the internet and continues onchain with networks like Chainlink. Chainlink is a network set up to provide data in a secure, robust way. The Chainlink network has powered trillions of dollars in transactions and is at the forefront of bringing secure offchain data onchain.

Traditional financial market participants have rules and regulations that they need to follow. This hinders progress but was also required in a system without transparency. Some examples include:

Wallet addresses as liabilities - holders don’t want to share those too. Exposing those to clients isn’t user friendly.

Proof of reserves - started with Mt Gox. What is the best way to validate? Old way is static from auditors. Not real time.

Collateral - couldn’t use bitcoin as collateral for futures contracts on basis trade. Massively eroding returns. ETFs lets you post against collateral for futures. More efficient markets in same system.

People who can’t buy traditional crypto assets.

Trader at bank - needs to be viewed by compliance. With traditional custodians (Fidelity / Schwab), the process happens automatically. For any investment, certain information is needed.

Retirement Accounts with reporting / tax implications. A large asset manager needs to set up all new processes or just buy ETF for 1-5% asset allocation.

These requirements are not going away so it is important to build the new system that can interact with the old.

Tokenization is very beneficial from a risk management perspective. Counterparties want more real time information, especially in a 24/7/365 market like crypto. Transparent information is a value add, making products worth more. Adding these features (programmability) is a major change to traditional markets so it is important to ask what does this additional data actually does?

To quote Sergey Nararov at the Chainlink Consensys event, there are two types of data:

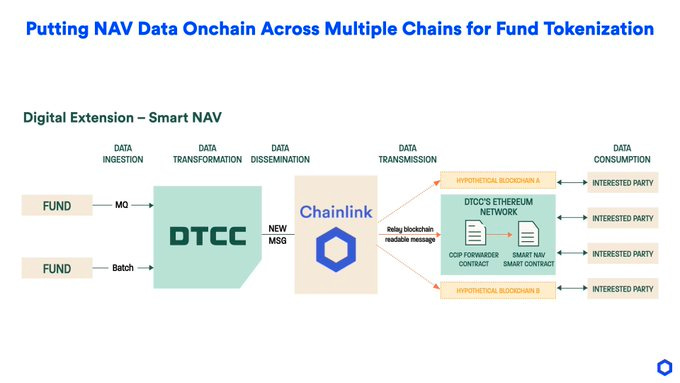

First there is “necessary data”. Data required to launch the product. This is where Chainlink’s origin came from. By adding price data to DeFi, Chainlink helped bring the industry from <$1B to +$200B at its peak. The traditional finance world has more necessary data like accounting, compliance, regulation, and internal policies. Many conditions that a product needs to reach prior to launch. For example, NAV data needs to be onchain to even start the process.

The second category is “additional data”. This data increases the attractiveness of products. For example, 21shares Bitcoin ETF has proof of reserves. Other products can have proof of X (liabilities, solvency, debt, or any variable). Get more data onchain, it is better for managing risks. Often, the problem is people don’t know the value of what they have. Sometimes it takes 2 - 4 weeks (Or even longer in private markets). Chainlink takes it from 1 month to 1 minute. This will improve liquidity and decision making. Increased functionality will unlock new opportunities. One thing is for sure, traditional finance NPCs are great at pushing P(roducts).

There is a lot of value to unlock. Crypto and the traditional finance system are colliding. The rate of integration is not slowing down. Massive acceleration happens as standards become set. Add in Trump’s crypto army and the momentum is undeniable.

Parts of the old system still have value. The goal is to reuse existing infrastructure to include digital assets. We don’t need to throw out old systems, instead integrate them with blockchains. All of this needs to be in sync.

Sergy thinks it will continue to be cheaper to create blockchains. Private chains will be databases and large actors will each have their own. Fortune 500 companies have noticed the success of Base. Private chains will need to interact with public chains. The majority of liquidity could be on private chains but innovation will come from public chains and there needs to be a way to transact that works for both worlds. Capitalism is the best incentive.

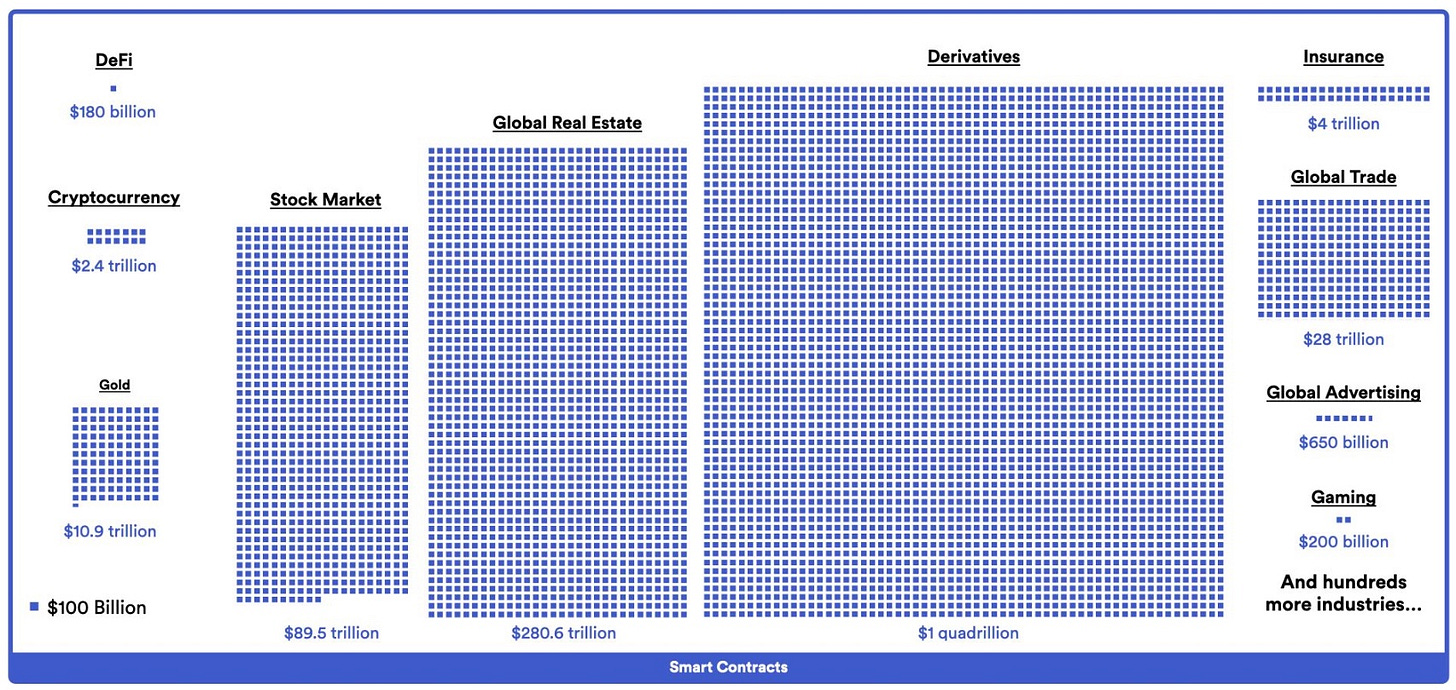

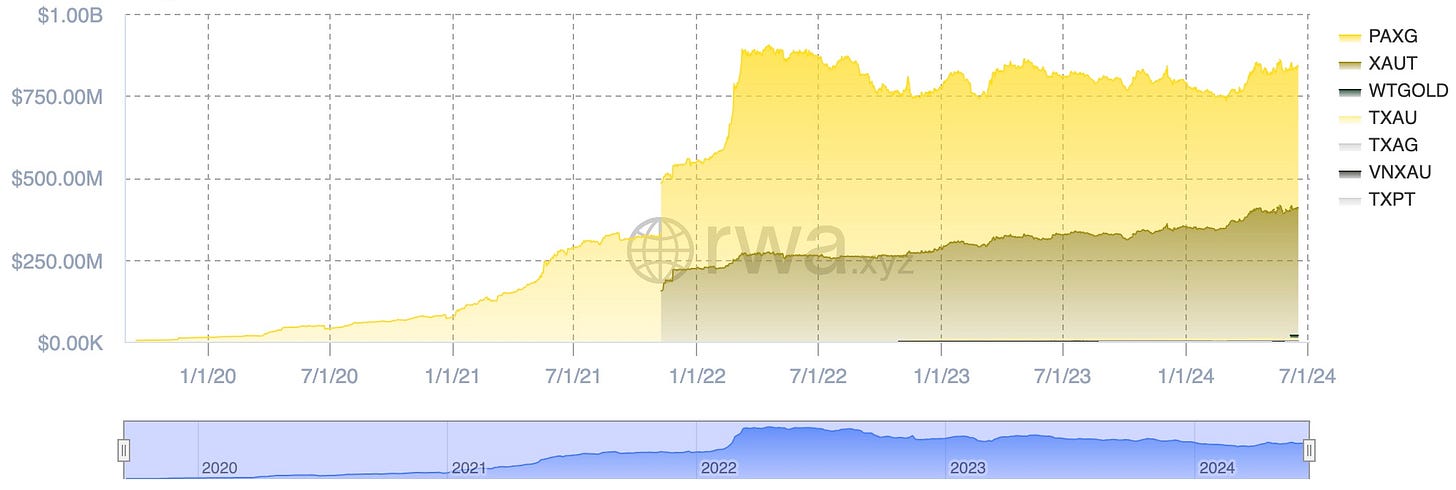

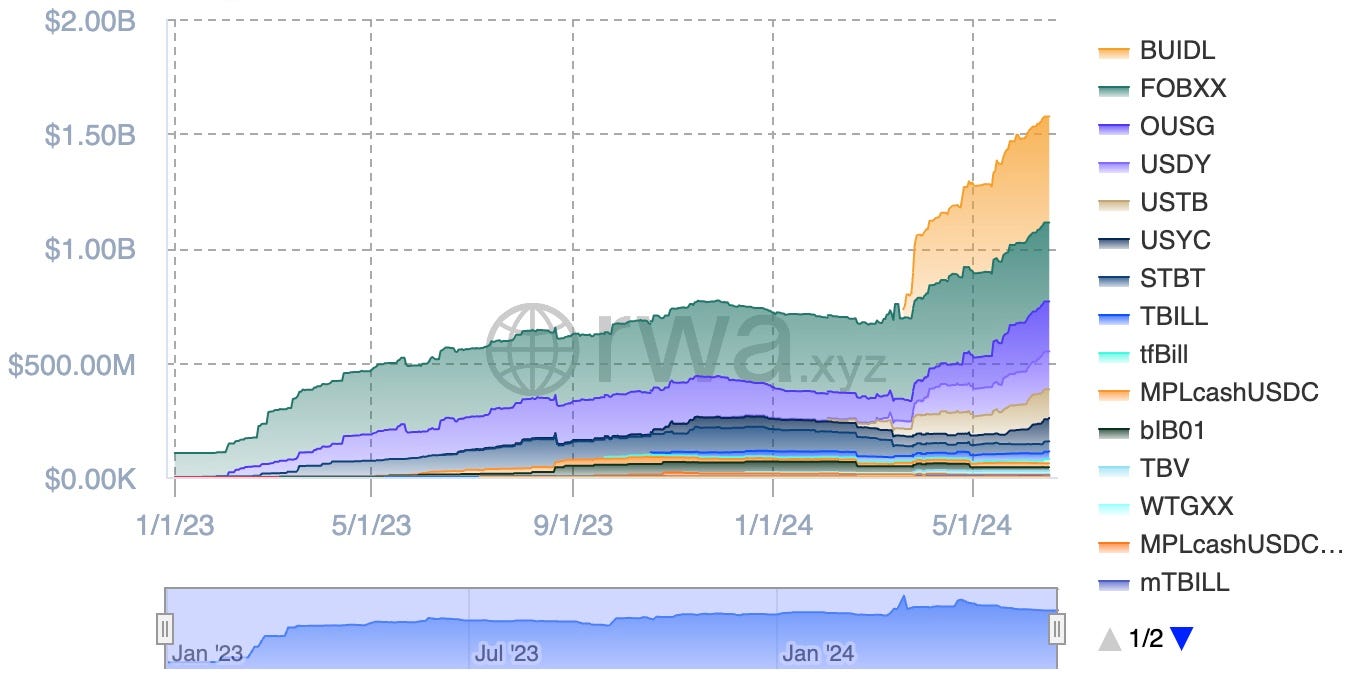

Apparently there needs to be a new name for assets on the blockchain cause RWA is taken in TradFi. I propose “Tokenized Assets”. Tokenized Assets have seen tremendous growth as shown in the following charts:

These markets are small when compared to traditional markets but the operational improvements are clear. We expect these markets to continue to grow over the next few years. OpenEden’s tokenized T-bill recently recieved an A rating from Moody’s. Additionally, one of the most successful crypto companies, Tether, recently released Alloy by Tether. This platform allows the creation of different tethered assets with broader backing mechanics, potentially including yield-bearing products. This technology provides a modern approach to asset management for institutions as well by offering a secure, gold-backed digital asset that can be integrated into portfolios.

“We are thrilled to announce the launch of Alloy by Tether, introducing a class of digital assets backed by gold and tethered to a reference fiat currency,” said Paolo Ardoino, CEO of Tether. “While the stabilization mechanism is different compared to traditional options like USD₮, this innovative solution marks an exciting milestone, and we eagerly anticipate how it will interact with the rest of the market. Moreover, we plan to make this innovative technology available in our upcoming digital asset tokenization platform as well.”

The benefits of tokenized dollars are clear: composability, transparency, and accessibility. Tokenization might happen asset class by asset class due to unique characteristics, laws, compliance, and systems. The process will be the same with origination - warehouse - securitization however all parties will read the same ledger reducing audit costs. From a utility perspective, these assets are repurposed to be more efficient.

It’s exciting to use assets in ways that were not previously imagined. DeFi protocols get paid back first in event of bankruptcy. Study overcollateralization. A borrower might be too risky unless you use smart contract. Trust code not third parties. With more data around each asset, the market will understand it better.

Banks aren’t going down easy. JP Morgan is basically a government entity. BNY Mellon makes $4B a year on escrow and servicing! Stuff that will be replaced by blockchain. Banks are not going to disintermediate themselves. When people use the internet, they think about how they’re interacting with other people, not how they’re sending the bytes. The same concept should apply with crypto. People don’t need to know they’re using it. It should be as easy as sending a venmo.

Adoption takes time. Any new asset class is filled with scams. The internet bubble was no different than crypto. Tons of potential and many worthless companies. ETFs were once controversial. Europe approved them before the United States did… seeing a pattern? BlackRock has already said that tokenization is the next step, don’t midcurve it.

As Colin Cunningham said at the end of the Chainlink event, “AI for creation, blockchain for verification.” Get onchain!

AB Research is excited to be part of your onchain journey. Here are some highlights from a recent Coinbase Conference.

Huge generation of wealth ($70T) going from old to young. 90% of this young generation is disillusioned with the financial system.

1/3 of the top 100 hedge funds in the world are already onboarded with Coinbase

Got pitched 5 years ago on doing Bitcoin ETFs. Said no need. Now institutional demand for Bitcoin forced them to do it

Today 80% of their Bitcoin ETF is bought by self-directed investors buying through their own brokerage... still huge wave of institutional capital coming

Financial advisors still wary but that’s their job

Also excited about tokenization... demand for tokenized money market funds coming from crypto native firms doing treasury management

We saw digitization of every asset. Now we’re going to see tokenization of every asset.

Tokenized treasuries shouldn't compete with stablecoins. Stablecoins are for payments. Money market funds are a liquid investment strategy.

Few years ago we thought private permissioned blockchains would lead. We now realize public blockchains are better so we don’t fragment liquidity.

Crypto has a branding problem. The term RWA means something totally different in banking world. Also implies crypto isn’t real world assets. Need to stop using "RWA".

Keep looking forward.

AB Researcher: @Whitetail

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.