AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

September 2024:

Layer 2 Ecosystems

Debate Disappointment

The Evolution of DeFi

Global Adoption

AB Portfolio

Additional Alpha

Layer 2 Ecosystems

Disclaimer: AB Fund owns OP check section 5, @Whitetail doesn’t own OP.

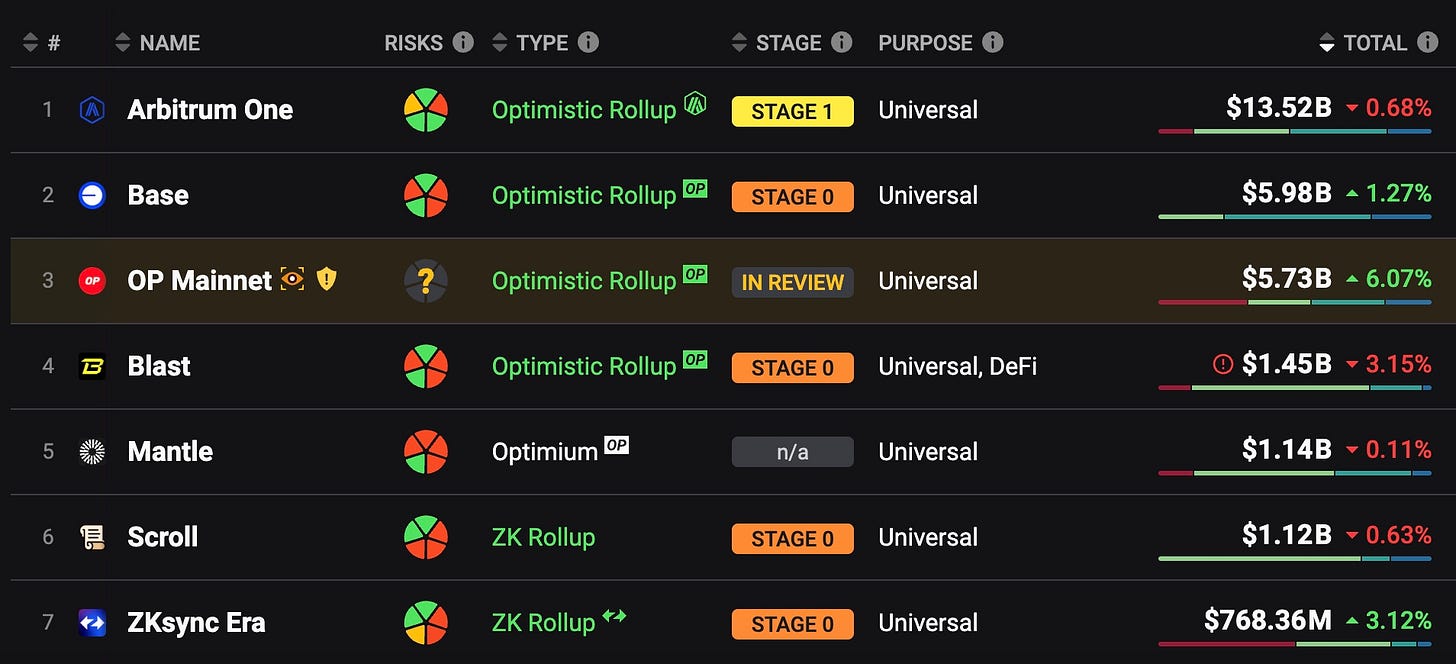

The Ethereum community has continued to execute its Layer 2 roadmap. Four years in the making. As the execution continues to impress, two ecosystems are emerging as winners of the rollup centric roadmap: Optimism and Arbitrum. Unlike most who examine Layer 2s based on technology (fraud proofs vs zero knowledge), we’re looking at them based on users/economic value.

Developed by Offchain Labs, Arbitrum leverages Optimistic Rollup technology to enable faster, cheaper transactions while maintaining the security and interoperability of the Ethereum blockchain. Since its inception, Arbitrum has expanded its ecosystem with various projects, including Arbitrum One, Nova, Stylus, Orbit, and the Arbitrum Bridge. Arbitrum has emerged as one of the leading Layer 2 solutions on Ethereum.

Recently, Arbitrum released Stylus which provides tools for developing smart contracts in performant and secure languages. Any language that compiles down to WebAssembly (WASM) is supported, including Rust and many more. This is because Stylus introduces a co-equal virtual machine that is completely interoperable with the Ethereum Virtual Machine. In english, it helps scale Ethereum by allowing additional coding languages & developers to interact with the EVM without the friction of learning Solidity.

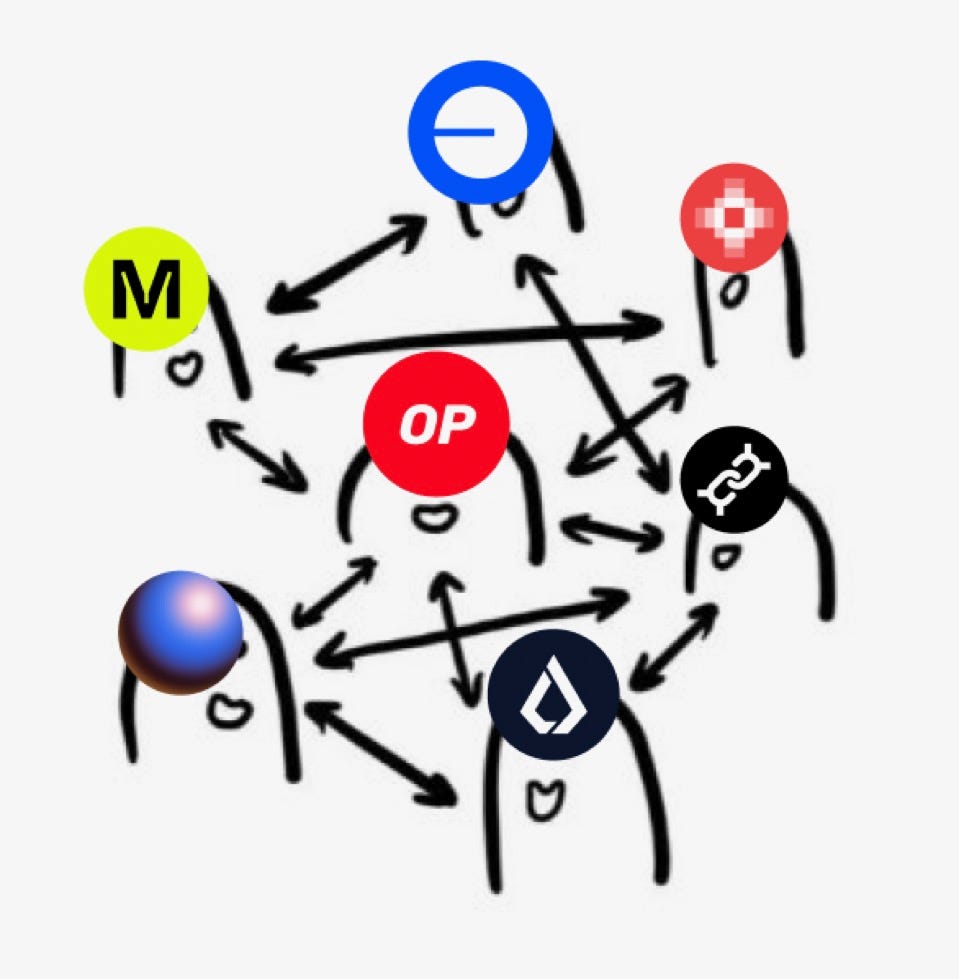

Optimism takes a slightly different approach. It is building a Superchain. Base and Soneium are examples of L2 networks being built using OP technology.

These different approaches represents nation building. In the arms race for talent, each nation focuses on different strengths and value add to underlying users and applications. OP Superchain is trying to create the United States of Blockchain.

the concept of a Superchain: a network of chains that share bridging, decentralized governance, upgrades, a communication layer and more—all built on the OP Stack.

The launch of the Superchain would merge OP Mainnet and other chains into a single unified network of OP Chains (i.e., chains within the Superchain), and mark a major step towards bringing scalable and decentralized compute to the world.

This sounds like creating a union, similar to states joining the United States in the 1800’s. In the world of blockchains, it makes sense that certain nations (companies) align with each other for economic benefits. It is tough surviving on your own.

Since Ethereum is permissionless innovation anyone can spin up and launch an L2. Many have done so. If a tree falls in the forest does anyone hear it? If a blockchain produces blocks that no one uses, is it economically viable? Looking at Blast above, it had all the hype then one misstep in execution and the mercenary capital left. Contrast this with Arbitrum and OP which have persons building with a longer time horizon. That is a competitive advantage. It will be very hard to survive as an L2 without a strong supporting ecosystem. The successful ones will be very profitable.

Luckily all these projects need Ethereum to win.

Researcher: @Whitetail

Debate Disappointment

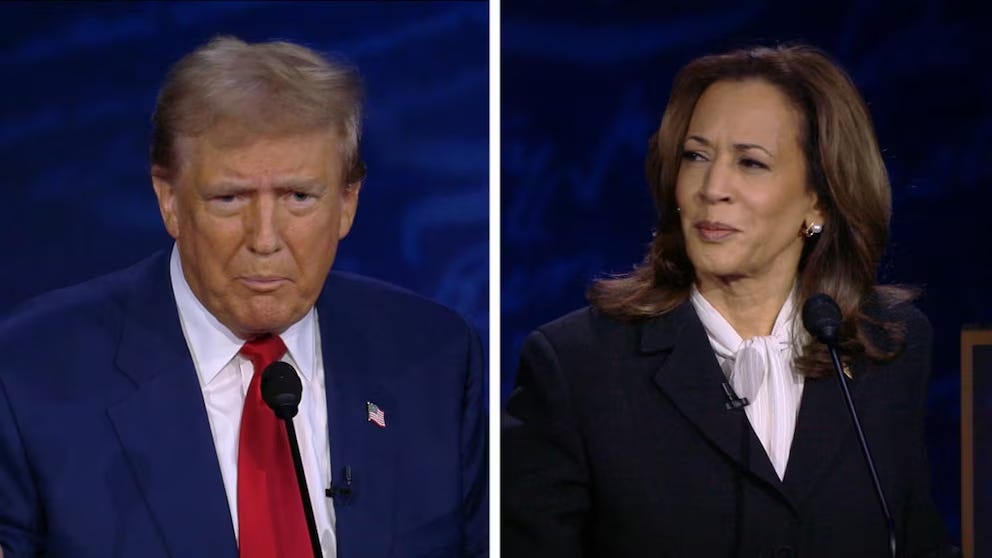

Prior to the first presidential debate between Donald Trump and Kamala Harris, there was considerable hype in the crypto community that it might be the catalyst to turn the market around. Trump has been regarded as a strong supporter of crypto businesses and policies, with a history of launching his own NFT projects. Recently, he even endorsed the World Liberty Coin initiative, which appears to be an AAVE fork and stablecoin. In contrast, Kamala Harris has signaled her intent to promote Gary Gensler, a well-known anti-crypto regulator, whose policies have been seen as stifling the industry’s growth in the U.S. The crypto community was hopeful that, as in Trump’s previous debate with President Biden, a decisive victory would boost his polling numbers and increase the likelihood of crypto-friendly policies being implemented. There was also speculation that cryptocurrency would be discussed during the debate, given its growing relevance to voters. However, none of this materialized.

Trump delivered a disappointing performance, and while some speculators anticipated a decline in the crypto market as a result, it has remained stable. Polls and prediction markets indicate that, despite Trump’s underwhelming showing, the race remains a close contest, with both candidates roughly evenly matched. The crypto industry continues to lobby Donald Trump for pro-crypto regulations, and the market will likely react to any significant shifts in the polls or prediction markets going forward. Crypto wants Trump to win to avoid another four years of purgatory.

Researcher: @Duke

Evolution of DeFi

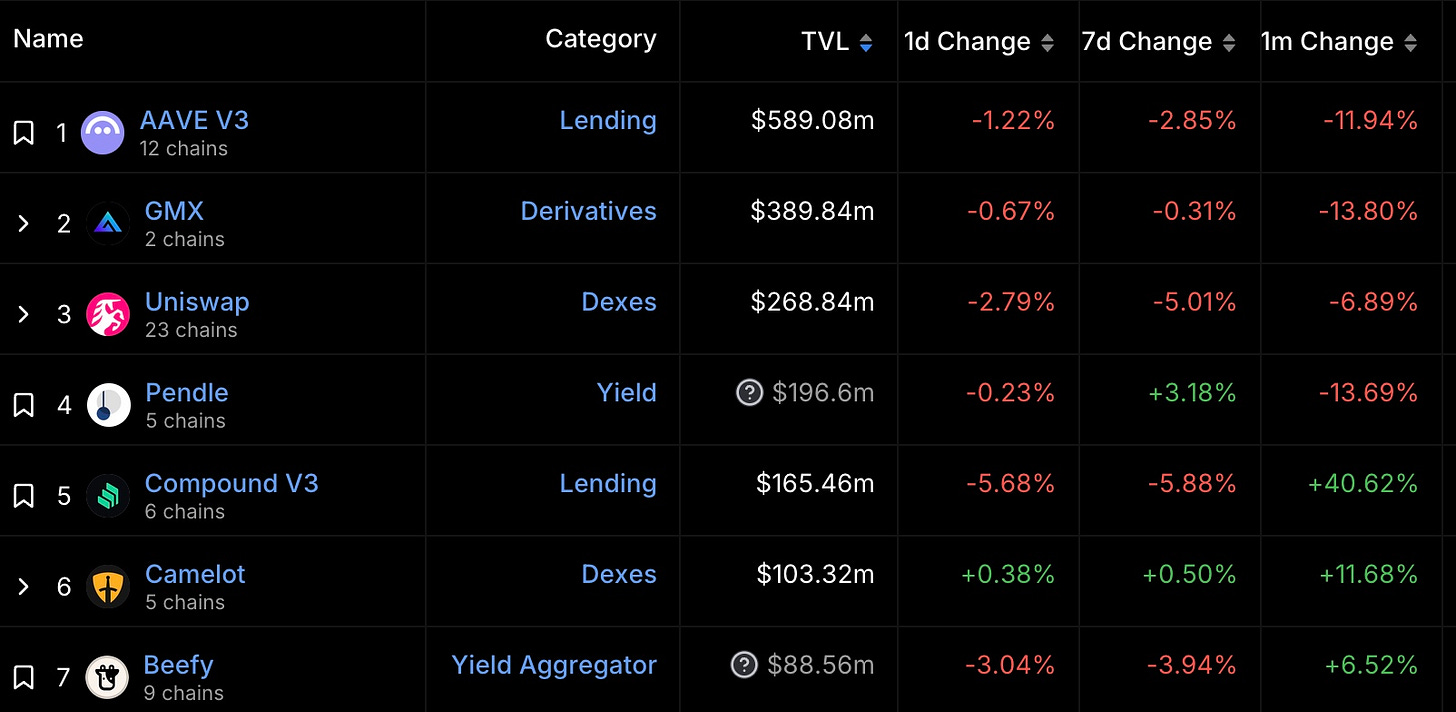

Decentralized Finance (DeFi) was largely made popular on the Ethereum blockchain back in 2018-2020 when several onchain protocols, representing lego pieces, were able to interoperate to create and facilitate the elementary pieces of a financial market. With the ability to swap tokens via Uniswap, create onchain loans in 30 seconds using ETH as collateral in MakerDAO (now Sky), and access competitive lending/borrowing markets through Aave, blockchain users had a way to put their money to work and set the stage for an onchain economy.

The initial protocols/smart contracts however weren’t enough to get everyday people to utilize DeFi. The space needed front-ends, insightful education, strategy tooling, and so on. This also led to very interesting dynamics between protocol competitors like the Sushiswap vampire attack on Uniswap in 2020. In essence, any DEX that wants to compete for traders needed to have robust liquidity to provide minimal slippage and good execution.

So how does a protocol do this? Incentivize the liquidity providers to move their assets! It almost worked too, Sushi Swap was able to “take” (although temporarily) a good portion of Uniswap’s LP capital. This led Uniswap to take action to regain a competitive edge, the famous Uniswap Retroactive Airdrop. Anyone who ever used Uniswap whether to provide liquidity or make a swap (and some additional cohorts like Unisock holders) were able to claim 400+ UNI tokens.

The airdrop sparked a lot of interest and “new money” into the ecosystem. In my opinion no other protocol/app/smart contract will be able to have the same network effect as Uniswap’s airdrop as too many people have attempted to game the distribution mechanisms. If the first blockchain-esque distribution method was Proof of Work for blockchains like Bitcoin, Litecoin, Dogecoin, and Ethereum in the early days, airdrops were very much an attempt at a new distribution method during the last hype cycle. Although airdrops may not be the best distribution mechanism moving forward, I do believe two interesting things came out of it. First being that when a truly revolutionary concept is brought to market with the right app/protocol, it has the potential to spur all kinds of action/attention/innovation. Second being that if a design mechanism is game-able, it will be gamed until it is no longer seen as effective.

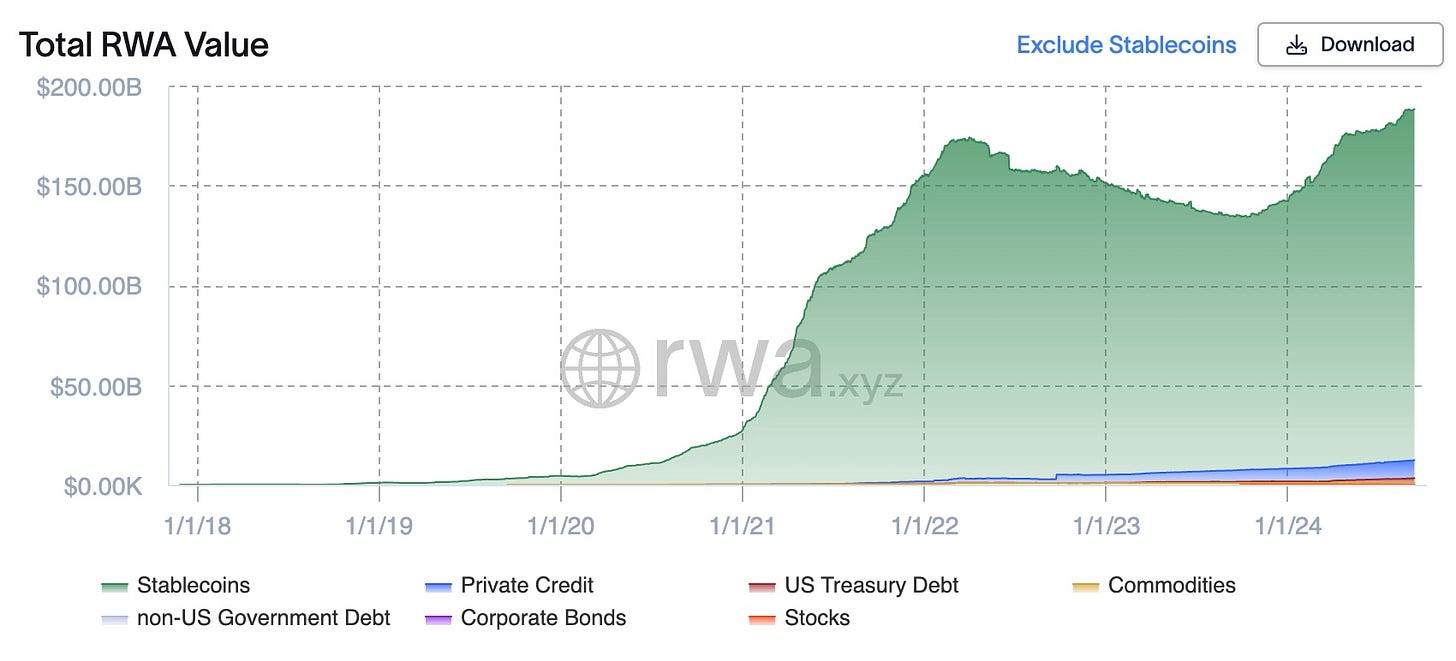

DeFi will need to evolve and create new design mechanisms if it is going to take a real stab at becoming a financial hub for more than just crypto native speculators. Some of the tools from the early era will stick around and remain to be the “bedrock” of DeFi but new tools and assets will need to come to market as well. Some of these assets are Real World Assets (RWAs), and another being onchain credit. A new mechanism and type of interaction onchain that really excites me is the possibility of completely onchain agents (AI) who can go out and complete work tasks with the ability to pay for products/services to complete the job and also be paid for completing the job. This will need to be enabled through crypto rails as at the moment AI agents can not have bank accounts.

Although DeFi has gone through a major correction period, from token price to protocol hacks to lack of interest, several protocols are doing quite well. Uniswap daily volume is up and to the right (thanks to L2 networks like Arbitrum and Base), Aave TVL has been increasing for some time now, and new entrants like restaking protocols and EigenLayer are attracting a lot of ETH. The exact future for DeFi may be unknown but it is apparent that there will continue to be new innovations, desire to access onchain financial markets, and plenty of upside for those clever/strategic enough to create the next big DeFi app.

Researcher: @L2explorer

Global Adoption

One of the most common pieces of FUD (fear, uncertainty, and doubt) people spew is that crypto has no real use cases. Below are clear examples of global adoption.

Japan’s big 3 banks to use stablecoins, Swift for cross border payments: Blockchain use case adoption continues to disrupt modern finance as Japan’s big 3 banks, MUFG, SMBC and Mizuho will choose to use stablecoins rather than correspondent banks for cross border payments. The project, called “Project Pax”, will integrate stablecoins with Swift payment messages so the blockchain piece stays under the hood. This project is to ensure a faster, cheaper, and more efficient payment system that can facilitate 24/7 cross border payments.

Siemens issues $330M digital bond on private blockchain: Siemens AG, the German conglomerate, has issued a 300 million euro ($330 million) digital bond on private blockchain rails as part of a European Central Bank's (ECB) trial. Major German financial institutions BayernLB, DekaBank, DZ BANK, Helaba and Landesbank Baden-Württemberg (LBBW) invested in the bond. Deutsche Bank also participated in facilitating the settlement process.

ENS, Venmo, and Paypal: PayPal and Venmo are now allowing U.S. users to make crypto transfers via ENS addresses. This will make for a better user experience when facilitating transactions over blockchain and add major payment rails for crypto users.

Wells Fargo offering BTC ETFs to clients: One of the United States largest banks and asset managers with $603B in AUM is now permitting their wealth managers to offer BTC ETFs as an investment. More and more institutions are becoming more comfortable with crypto creating more long term holders and less crypto available for sale.

Switzerland’s 4th Largest Bank Zurich Cantonal Bank launches BTC and ETH Trading: Zurich Cantonal Bank, one of the largest banks in Switzerland, is the latest banking institution to enable cryptocurrency trading for its customers. According to an official announcement on Sept. 4, Zurich Cantonal Bank is now offering trading and custody services for BTC and ETH.

Sony’s Ethereum Layer-2 Initiative Will Feature a Japanese Yen Stablecoin With Sony Bank: Sony Bank, the financial division of the tech giant Sony Group Corporation, has partnered with Soneium, a Layer 2 Ethereum blockchain, to investigate the potential of developing a stablecoin tied to the Japanese Yen. The financial institution mentioned that the main goal of this initiative is to use blockchain technology to reduce transaction fees and enhance payment processing. It also aims to address the high transaction costs that have been persistent in traditional financial systems.

Slowly slowly than all at once.

AB Researcher: @Alec Beckman

AB Fund Portfolio

Disclaimer: Our buys/watchlist should not be takin as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update. This is not investment advice, but a look into our strategy for educational purposes only.

AB Researcher: @Rocketpilot

Additional Alpha

Throughout the month, the AB Research team gathers and curates a list of high quality resources for readers to continue learning outside of the content we produce. Crypto is open source, the alpha is out there. We’re here to help you find it.

Basic:

Advanced:

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.