AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

October 2025:

One Month Out

Collateral

RWA News

AB Portfolio

Additional Alpha

One Month Out

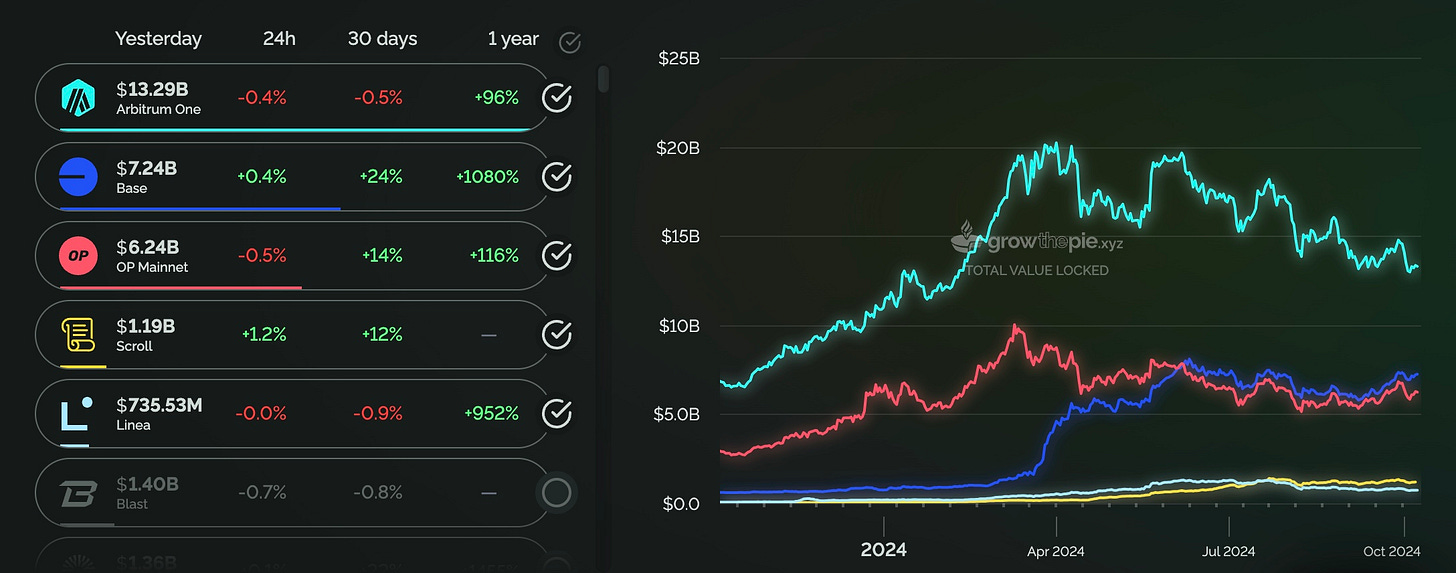

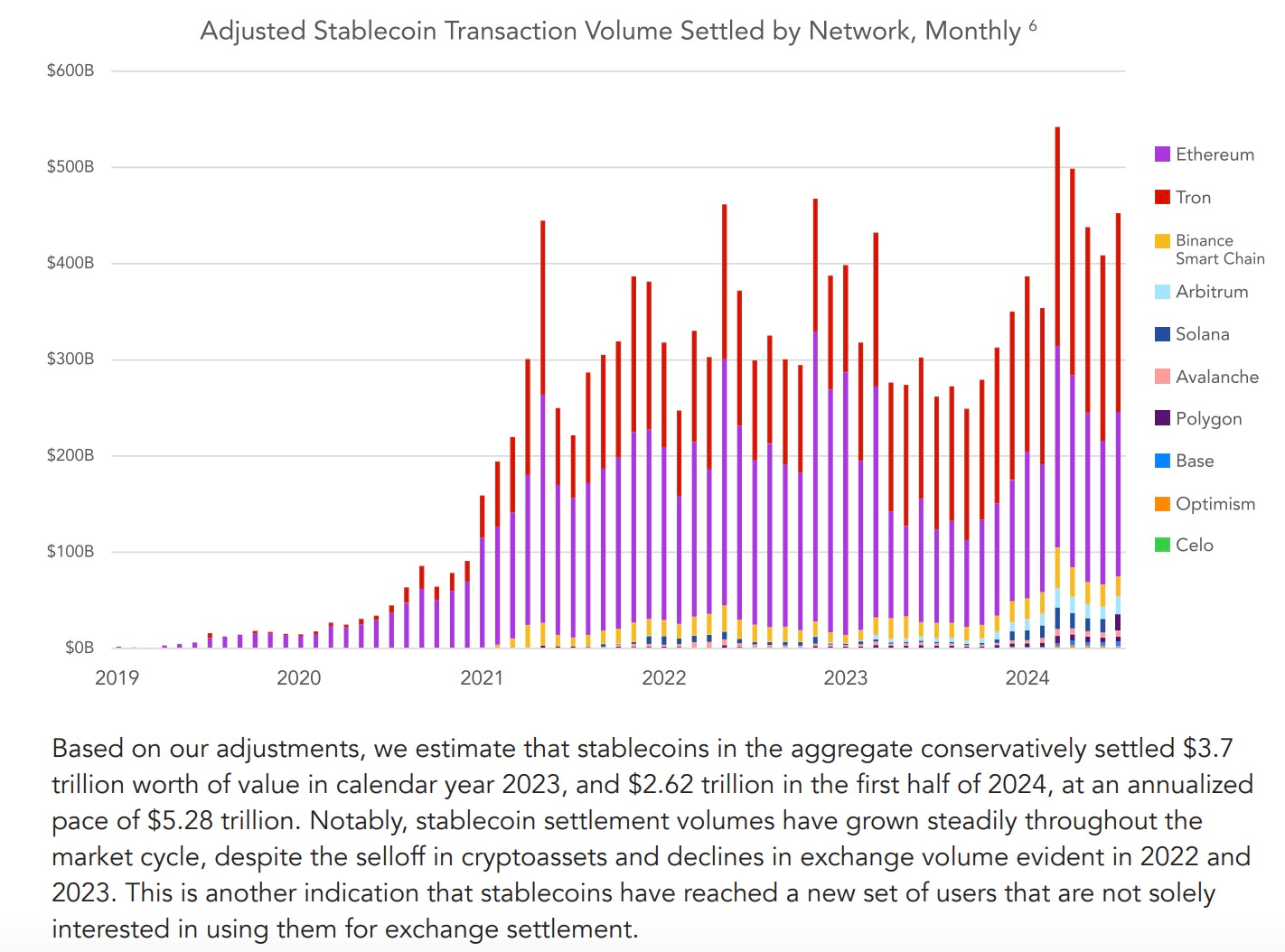

Crypto is a global phenomenon. Adoption is happening regardless of price or politics. The stablecoin data below helps show that.

Stablecoins have seen steady adoption since inception, regardless of how many times crypto is vilified or pronounced dead by the MSM. Stables work. People everywhere want dollars.

However, entities in the United States are hindered in their ability to adopt crypto. The SEC, under Gary Gensler, has adopted regulation by enforcement and Congress has yet to pass clear regulation. Nothing makes this more obvious than the list of American based crypto companies that the SEC has sued: Coinbase, Uniswap, Kraken, Crypto.com, Gemini. This prosecution weakens American companies. Rules like SAB121 prevent existing financial firms from touching crypto (without going through legislation!).

If Kamala Harris wins, expect more of the same. She has taken many Biden administration players into her campaign and will likely delegate crypto to someone with their own agenda. Crypto is being illegally harassed and debanked. It is finally being reported on by Nic Carter and Veronic Irwin.

If Trump wins, a lot will change. People in key positions on the transition team such as Howard Lutnick (CEO Cantor Fitzgerald - manages Tether’s reserves) & RFJ Jr understand crypto. Trump’s considering Dan Gallagher (Robinhood CLO) for SEC commissioner. He literally sells NFTs on Ethereum. Trump wants America to win in everything, including crypto. He has talked about a Bitcoin reserve!

Polymarket shows Trump with the 7 point lead over Harris. Crucially, he is winning Pennsylvania (+9), North Carolina (+20), Arizona (+33). For Michigan, Nevada, Wisconsin it is all within 5 points in favor of Kamala. One month out. Can’t wait to be done with this political season. It’s at the point where it is very impactful on crypto. Go Vote.

AB Researcher: @whitetail

Collateral

Secured lending, also referred to as asset-based lending, comes in many flavors and has been around for a very long time. In fact the concept dates so far back, it was mentioned in The Code of Hammurabi around 3,000 BCE which included provisions about using livestock and land for secured loans.

Fast forward to today, whether we’re talking about a pawnbroker accepting a wide range of items as collateral such as a pearl necklace or very specific collateral agreements involving biotech patents, the idea is essentially the same. One party (the borrower) owns an asset with a fair market value and another party (the lender) is wiling to take “ownership” of that collateral in exchange for dollars/value. Because most assets experience price volatility, lenders often require a dollar value exceeding the amount they to give to the borrower.

MakerDAO (now rebranded to Sky) popularized this concept on Ethereum in 2018 with Collateral Debt Positions (CDPs). MakerDAO created and deployed a suite of smart contracts that held the collateral asset (Ether), and operated on a predetermined set of rules allowing the owner of that smart contract to borrow up to ~65% of that Ether’s value in DAI (65% LTV) - an Ethereum stablecoin pegged to the dollar. This opened the door to more functionality for Ether as an asset. Paired with the innovation of Uniswap, DAI and ETH were easily exchangeable creating a one stop shop to leverage underlying assets.

Since 2018 the CDP market has developed quite a bit to where now you can use more than just ETH as collateral (Staked ETH, Wrapped Bitcoin, Uniswap LP positions), the amount you can borrow as a percent of collateral (50-80% LTV), and the amount a borrower pays (variable or fixed) varies from protocol to protocol (3%-10%). As more real world assets come onchain, I believe there will be many benefits for potential borrowers to use Ethereum for establishing a secured loan. However, to get to that point we need a few things to be well established to make each party feel more comfortable such as smart contract insurance, wallet security upgrades (account abstraction at protocol level), and thoughtful legislation.

DeFi and digital asset collateral might’ve kickstarted the last bull market from a narrative standpoint but it most likely won’t do it again. I see it more transitioning into a backbone blockchain feature comparable to the ease and accessibility of moving digital assets across exchanges/wallets has been for the past few cycles.

AB Researcher: @l2explorer

Real World Assets News

Bitcoin Miner Marathon's Anduro Unveils Tokenization Platform, Starts With Whiskey

Marathon-incubated Anduro has developed a platform for issuing and investing in RWAs on Bitcoin. This is the first ever RWA tokenization on the Bitcoin network, facilitated by tokenization issuance platform and former Advantage Blockchain client “Vertalo”.

Tokenization is the issuance of a digital representation of a real world asset as blockchain backed tokens. The RWA industry has taken off recently, with Blackrock, KKR, Wisdom Tree, Hamilton Lane, Visa, and more getting involved, but mostly on Ethereum and other EVM compatible chains.

Visa Debuts Tokenized Asset ‘Sandbox’ to Promote Blockchain Integration

The Visa Tokenized Asset Platform (VTAP), is now available on Visa’s development platform to allow its banking partners “to create and experiment with their own fiat-backed tokens in a VTAP sandbox.”

Spanish bank BBVA is currently testing VTAP sandbox functionalities, including the issuance, transfer, and redemption of tokens on a testnet blockchain, along with testing smart contracts for automation purposes.

The bank aims to launch an initial live pilot with select customers on the public Ethereum blockchain next year. Visa cites the benefits of tokenization and VTAP including its ease of integration, programmability and interoperability.

Binance CEO says crypto exchange saw 40% growth this year in institutional, corporate investors

Binance, the largest cryptocurrency exchange in terms of daily trading volume of cryptocurrencies, has seen a 40% increase this year in institutional and corporate investors joining the platform, according to CEO Richard Teng.

As most institutions are still doing diligence on the digital asset industry, it is important to note that this uptick in institutional adoption is just the beginning of what could be a large entrance into the market for banks and asset management companies. As the crypto industry is only ~$2.6t, there is still an incredible amount of room for growth.

AB Researcher: @AlecBeckman

AB Fund Portfolio

Disclaimer: Our buys/watchlist should not be takin as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update.

This is not investment advice, but a view into our strategy for educational purposes.

AB Researcher: @Rocketpilot

Additional Alpha:

Throughout the month, the AB Research team gathers and curates a list of high quality resources for readers to continue learning outside of the content we produce. Crypto is open source, the alpha is out there. We’re here to help you find it.

AB Research:

Basic:

Inside the Biden Adminstrations attempts to debank crypto

Are Regulators violating the law by limiting access to crypto?

Advanced:

Making Ethereum Alignment Legible

Stablecoins: The Emerging Markets Story