AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

February 2025:

Conviction

Why Define Ethereum? Let’s Not Constrain It

Bullish Regulatory Shifts For Ethereum

BlackRock & MicroStrategy’s Bitcoin Play

AB Portfolio

Conviction

Conviction - a firmly held belief or opinion.

Conviction is something that is essential to surviving in crypto. Yes there are people that make a quick million trading shitcoins. You always see positive PnL’s and rarely the negative ones. The crypto casino continues to attract customers.

Inevitably these people get taken out as they parlay their gains again and again until the -99% that comes with a bear market. It is easy to make a successful trade, it is hard to be a successful trader. Human psychology is very powerful. People keep chasing the next thrill.

Conviction is important because it allows us to weather the storm. As Ethereum recently fell from $3,400 to $2,150 AB considered buying more instead of panic selling because we believe in the Ethereum Economy. When good assets get cheaper, there is less risk. When assets get more expensive there is more risk, yet that is when most people pile in. Everyone wants to buy the asset that went up 50% last month, not the one that is down 50%.

It is hard to borrow someone else’s conviction which is why AB does fundamental research and understands every asset we own and why we own it. This is why AB survived and profited from multiple cycles in crypto.

AB Researcher: Whitetail

Why Define Ethereum? Let’s Not Constrain it

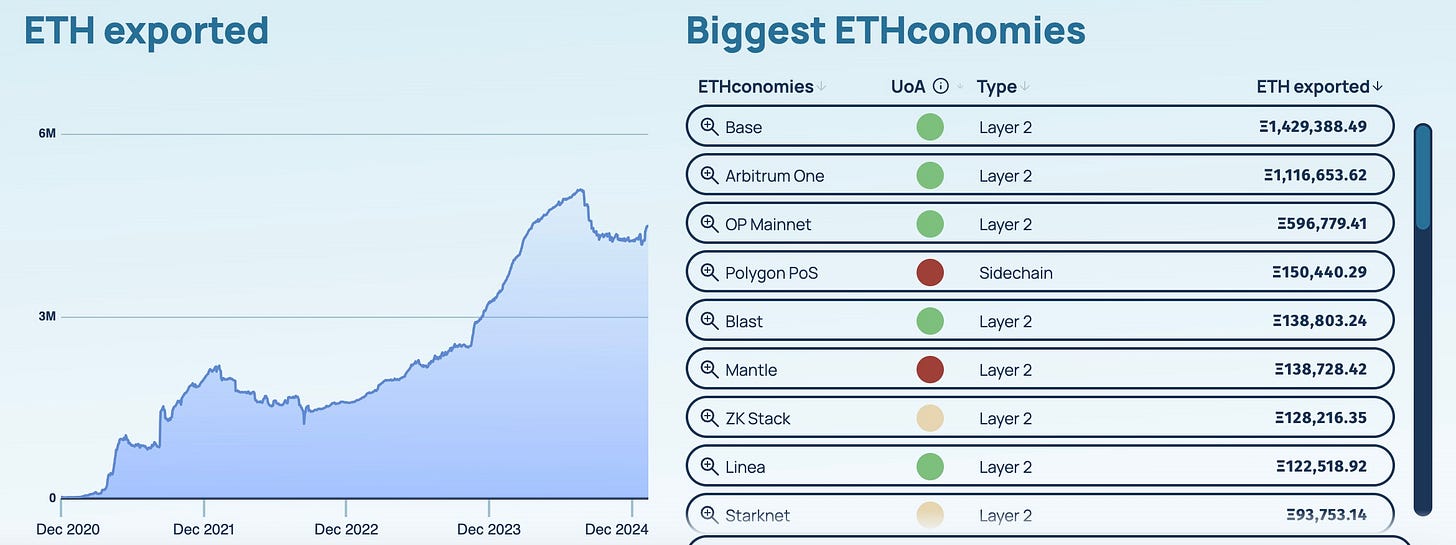

Over the last decade Ethereum has provided investors exposure to innovation - a smart contract enabled blockchain. Early adopters noted it acts like a commodity because the native asset Ether is needed to transact (deploy and interact with smart contracts) on the Ethereum blockchain. Investors also found it as a form of value to invest in projects (infamous DAO or ICOs like Golem, Status, and OmiseGo). With the emergence of DeFi, Ether became a stronger form of collateral as it could be used to create an overcollateralized loan through MakerDAO or provide liquidity to earn trading fees on Uniswap.

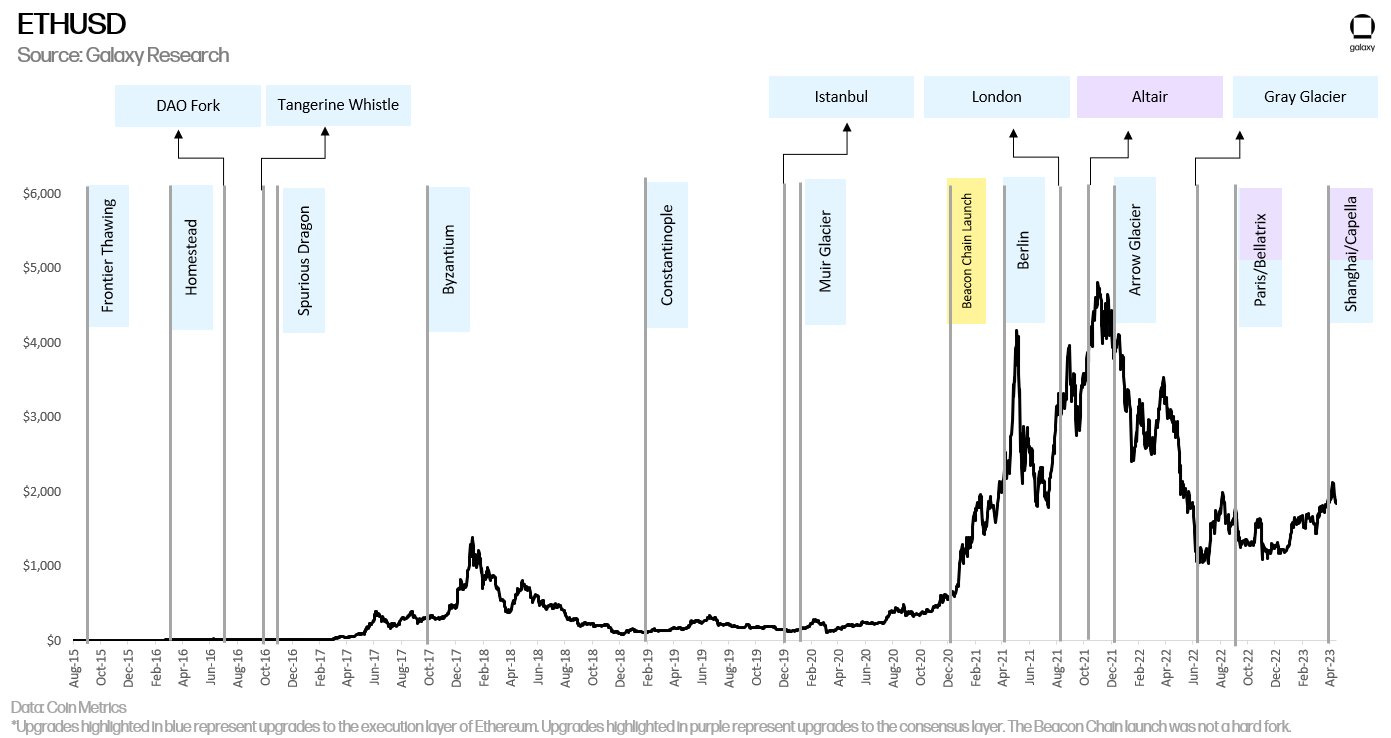

When the Beacon Chain launched (December 2020), holders could stake (secure the network through Proof of Stake) their Ether and framed it as an "Internet Bond". After EIP1559, Ether and its improved monetary policy started to be referred to as ultrasound money because with increased use of the network, the supply dwindles due to a burning mechanism.

In 2025 investors are holding/buying/selling Ether in ETFs, smart contract wallets, hardware wallets, exchanges, etc… Developers are using it to pay for gas when deploying contracts to Ethereum Mainnet or any of the numerous Layer 2 networks. Layer 2 networks are using Ether to post blobs (data) to Ethereum Mainnet. Finally, users of the Ethereum blockchain, and its layer 2 networks like Coinbase’s Base and Arbitrum One, are using Ether as all of the above! Ultimately, Ether and the Ethereum network can be whatever the community wants it to be, all it takes is user demand, developers, well thought out Ethereum Improvement Proposal (EIP), and community discourse!

If Ethereum is going to realize its goal as “The World Computer”, the community needs to stop trying to fight over what Ether already represents and start realizing improvements to make it a triple point asset.

How does this play into the greater crypto world with BTC dominating the ETH/BTC ratio and even SOL performing better than ETH so far this cycle?

People are migrating to the extreme sides of the spectrum. Whether that be political affiliations, religious views, defining right/wrong, etc… people are trying harder and harder to convince others they are indeed “right” and by doing so are going to the EXTREMES. If you’ve been in the space long enough you know Bitcoin has a very strong social layer, they fought over block size (digital cash vs. digital gold), there is no chance of increasing the 21m coin hard cap to a bitcoiner, and Proof of Work (PoW) is the single best solution for a consensus mechanism.

My fear with the Bitcoin network is that a better solution could come about and the Bitcoin community would cast it aside. On the other hand we have a competitive smart contract blockchain with a different virtual machine infrastructure (which does have some benefits over the EVM!) in Solana's SVM who’s community has gone all in on giving the crypto community what they “want” (I will caveat this point with this is primarily the people who are most active onchain today) so they cater to gambling and speculation. Memecoins and what they represented in the early days of crypto have been tainted because they no longer represent a light hearted joke/meme to make something so abstract as blockchain and digital tokens more relatable.

Memecoins and creators seem to care more about what can get the most attention and create a quick pump. This, in its current form, is not sustainable in my opinion - there are a lot more people who use a Visa card or use the App Store on their phone daily than who gamble daily. So where I’m going with this is Ethereum is getting a lot of flack right now because many in the Ethereum community don’t like how far these other communities have gone to “make number go up”. The Ethereum community/technology has two powerful concepts on its side.

First, Ethereum is in the middle of being a fast mover and slow mover from a technology/innovation standpoint, look at the implementation of Proof of Stake. It wasn’t researched or implemented within a year, it didn’t happen immediately after Jay Kwon released the Tendermint White Paper, and it took several years for the community to reach ~30% supply staked. Second, the social layer is willing to adapt! I have always viewed the Ethereum community as being very research driven, sometimes that research can be right theoretically but wrong in practice and that’s okay (when it comes to innovation). Apple wasn’t what is is today back in the 80s/90s was it?? To conclude, Ethereum may be “underperforming” when it comes to price but I truly believe it has “outperformed” when considering practicality and community. Fighting and conforming don’t always create a better outcome in the long term, however - cooperation, integrity, and innovation will. Let’s keep innovating and figuring out what Ethereum (the network and the asset) need to be to create a sustainable and usable network by all.

AB Researcher: L2 Explorer

Regulatory Shifts Signal a Bullish Future for Crypto

Recent developments indicate that the U.S. Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB) are undergoing leadership changes that could significantly benefit the cryptocurrency industry. President Donald Trump's appointment of Rodney Hood, a known advocate for cryptocurrency, as the acting head of the OCC suggests a potential shift in regulatory stance. Hood, the former chairman of the National Credit Union Administration, has previously emphasized the importance of integrating cryptocurrency into financial institutions to maintain competitiveness. This leadership change may lead to a reevaluation of existing OCC guidance that has been perceived as contributing to the disconnect between crypto firms and U.S. banking services.

These regulatory shifts are significant and bullish for the crypto industry for several reasons. Firstly, with more crypto-friendly leadership at the OCC, there is potential for policies that facilitate better integration of cryptocurrencies into the traditional banking system, reducing the challenges crypto firms face in accessing banking services. Secondly, the CFPB's diminished role under the current administration could lead to fewer regulatory hurdles for crypto companies, allowing for greater innovation and expansion. Collectively, these changes suggest a more accommodating regulatory environment, which could foster increased investment and growth in the cryptocurrency sector.

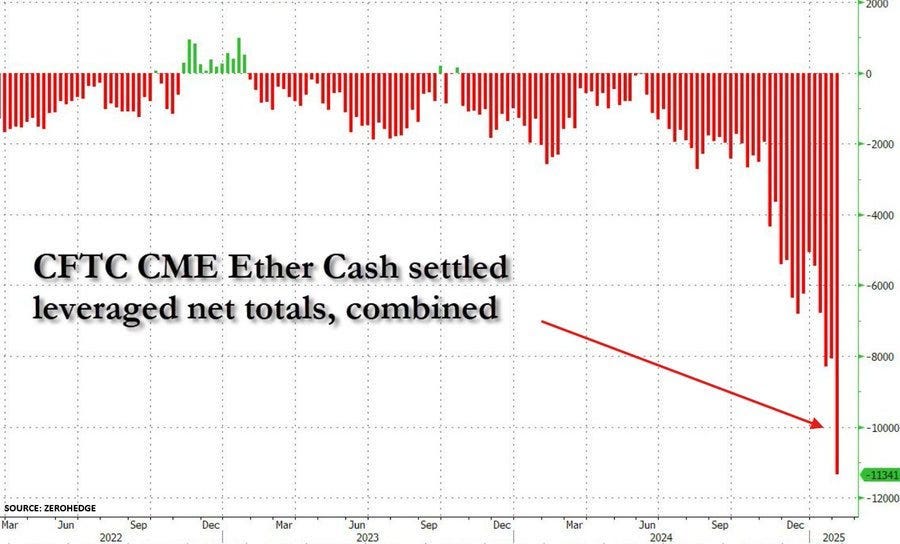

Ethereum's Rising Total Value Locked Signals Bullish Outlook Despite Ether's Price Dip

Despite a more than 20% decline in Ether's (ETH) price this year, recent analyses highlight strengthening fundamentals within the Ethereum network. A Citi research report notes a significant increase in Total Value Locked (TVL) on Ethereum, indicating growing user engagement and confidence in decentralized finance (DeFi) applications hosted on the platform. Additionally, Ether-focused exchange-traded funds (ETFs) have experienced cumulative inflows of $3.2 billion since their launch in July, reflecting sustained investor interest.

These developments are particularly bullish for the cryptocurrency sector. The rising TVL underscores Ethereum's expanding role in DeFi, suggesting a robust and growing ecosystem that attracts both developers and users. The substantial inflows into Ether ETFs demonstrate increasing mainstream adoption and trust in Ethereum's long-term potential. Moreover, the report highlights that President Trump's World Liberty Financial holds over $200 million in Ether, which could be interpreted as a positive signal for the industry's future, especially concerning regulatory support in the U.S.

AB Researcher: Alec Beckman

BlackRock and MicroStrategy’s Bitcoin Play: What It Means for Them, and What It Means for Us

Over the past few years, Bitcoin has evolved from a niche digital asset into a cornerstone of institutional investment strategies. Two names stand out in this transformation: BlackRock, the world’s largest asset manager, and MicroStrategy, the business intelligence company turned Bitcoin evangelist. Their aggressive Bitcoin allocations have reshaped the narrative around cryptocurrency, but while their moves are undeniably strategic for them, the implications for the rest of us are far more complex. Let’s not constrain Bitcoin to a single narrative—let’s explore what this institutional embrace means for the ecosystem and individual participants.

BlackRock’s Bitcoin Strategy: Institutionalizing the Future

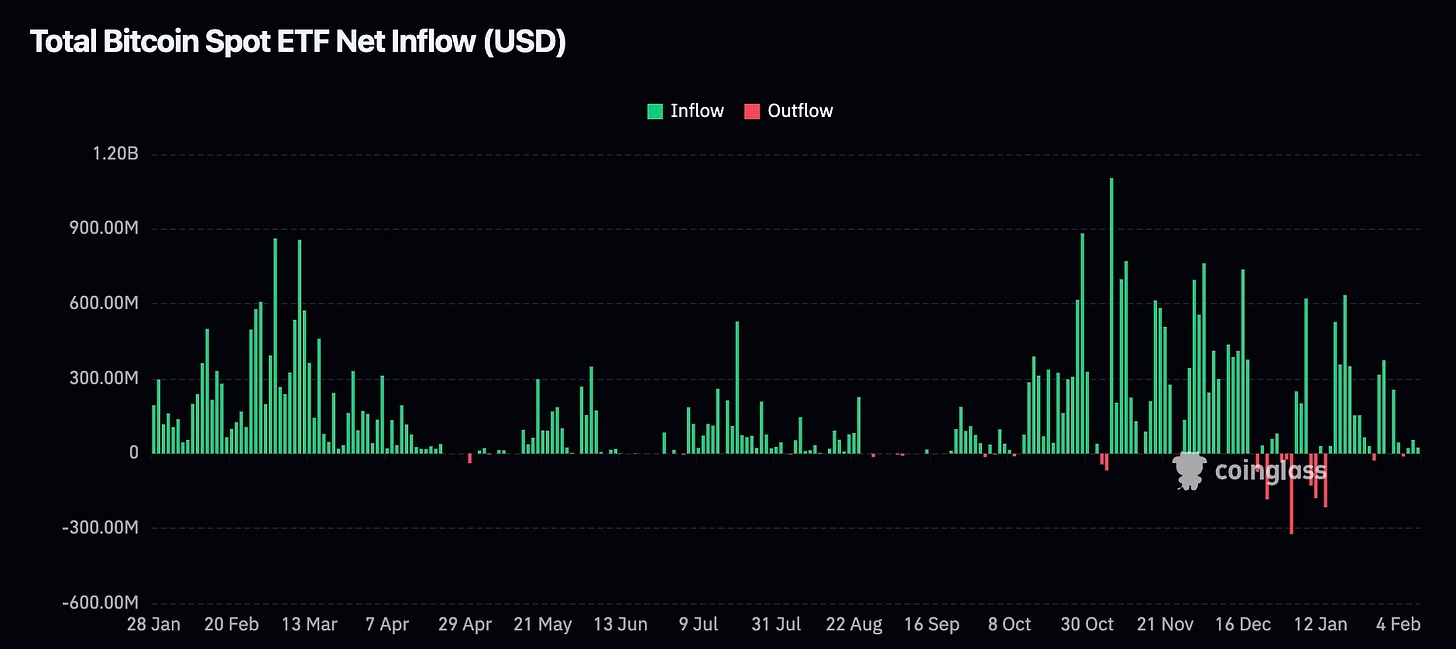

BlackRock’s foray into Bitcoin is a masterclass in institutional adaptation. With over $9 trillion in assets under management, BlackRock doesn’t just dip its toes into new markets—it dives in headfirst. The firm’s recent moves, including filing for a spot Bitcoin ETF and increasing its stake in MicroStrategy to 5%, signal a calculated embrace of Bitcoin as a legitimate asset class. Not to mention that they just recently announced Bitcoin as a “risk-off” asset, which gives Wall Street investors the ability to trust Bitcoin as a safe investment. But what does this mean for BlackRock, and what does it mean for the broader crypto community?

For BlackRock, Bitcoin is a strategic asset. By offering Bitcoin-related investment products, the firm positions itself as a pioneer in the crypto space, attracting institutional and retail investors alike. A spot Bitcoin ETF, if approved, would give BlackRock a first-mover advantage in a market poised for exponential growth. The firm’s partnership with Coinbase for Bitcoin trading and custody services further cements its role as a gatekeeper for institutional crypto access. And let’s not forget the management fees—BlackRock stands to generate significant revenue from its Bitcoin-related offerings, solidifying its dominance in the asset management industry.

But for the average person, the story is less straightforward. While a Bitcoin ETF might make it easier to gain exposure to Bitcoin, it also means investors won’t own Bitcoin directly. Instead, they’ll hold shares in a fund that tracks Bitcoin’s price. This indirect exposure strips away some of Bitcoin’s core benefits, like self-custody and decentralization. Moreover, BlackRock’s growing influence in the Bitcoin market raises concerns about centralization. Bitcoin was designed to empower individuals, not to enrich Wall Street giants. As BlackRock and other institutions accumulate Bitcoin, the risk of market manipulation and control increases, potentially undermining Bitcoin’s foundational principles.

MicroStrategy’s Bitcoin Bet: A Corporate Revolution

MicroStrategy, under the leadership of Michael Saylor, has become synonymous with corporate Bitcoin adoption. The company holds over 152,000 Bitcoin, making it one of the largest corporate holders of the cryptocurrency. Its recent rebranding to focus on Bitcoin development underscores its commitment to the asset. But what does this mean for MicroStrategy, and what does it mean for the rest of us?

For MicroStrategy, Bitcoin has been a transformative strategy. The company’s decision to allocate its treasury reserves to Bitcoin has paid off handsomely, with its balance sheet benefiting significantly from Bitcoin’s price appreciation. MicroStrategy’s stock price has become closely tied to Bitcoin’s performance, attracting investors who view the company as a proxy for Bitcoin exposure. The company’s shift toward Bitcoin development and advocacy positions it as a leader in the corporate adoption of blockchain technology. MicroStrategy is carving out a niche in the growing Bitcoin ecosystem by launching educational initiatives and software tools for Bitcoin analytics. Michael Saylor’s unwavering belief in Bitcoin as a store of value has driven the company’s strategy, which is designed to capitalize on Bitcoin’s potential for decades to come.

For the average person, however, MicroStrategy’s Bitcoin strategy is a double-edged sword. On one hand, the company’s aggressive Bitcoin purchases have contributed to Bitcoin’s price appreciation, benefiting early adopters and long-term holders. On the other hand, for newcomers, this means higher entry prices. As more corporations follow MicroStrategy’s lead, Bitcoin could become increasingly inaccessible to the average person. Additionally, MicroStrategy’s large Bitcoin holdings significantly influence the market. While this has been positive for Bitcoin’s price so far, it also raises concerns about corporate control over a decentralized asset. The concentration of Bitcoin in the hands of a few large holders could undermine its egalitarian principles.

The Bigger Picture: Institutional Adoption vs. Individual Empowerment

The involvement of BlackRock and MicroStrategy in Bitcoin represents a double-edged sword for the broader crypto community. On one hand, their participation brings legitimacy, liquidity, and mainstream acceptance to Bitcoin. On the other hand, it risks centralizing control over an asset that was designed to empower individuals and bypass traditional financial systems.

For BlackRock and MicroStrategy, Bitcoin is a lucrative opportunity. BlackRock stands to gain through management fees, strategic influence, and first-mover advantage in the Bitcoin ETF space. MicroStrategy benefits from Bitcoin’s price appreciation, stock performance, and its position as a leader in corporate Bitcoin adoption. For them, Bitcoin is a strategic asset that strengthens their positions in the financial ecosystem.

For the average person, the implications are more nuanced. While institutional adoption may drive Bitcoin’s price higher, it also raises concerns about accessibility, centralization, and the erosion of Bitcoin’s original ethos. The benefits of institutional involvement, such as increased legitimacy and liquidity, may be outweighed by the risks of losing control over a decentralized asset. Bitcoin was created to empower individuals, not to enrich the giants of Wall Street.

A Call for Balance

The growing Bitcoin allocations of BlackRock and MicroStrategy show off the tension between institutional adoption and individual empowerment. While their strategies are undoubtedly beneficial for them, the broader community must remain vigilant to ensure that Bitcoin remains true to its decentralized roots. For Bitcoin to fulfill its promise as a tool for financial freedom, it is crucial to strike a balance between institutional involvement and individual access. After all, Bitcoin was created for everyone—not just the giants of Wall Street.

Let’s not constrain Bitcoin to a single narrative. It can be a store of value, a medium of exchange, a hedge against inflation, and a tool for financial inclusion. But for it to truly succeed, we must ensure that its benefits are accessible to all, not just the institutions that dominate the financial landscape. The future of Bitcoin depends on our ability to navigate this balance and uphold its original vision.

AB Researcher: Bray

AB Portfolio

Disclaimer: Our buys/watchlist should not be taken as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update.

This is not investment advice, but a view into our strategy for educational purposes.

AB Researcher: @Rocketpilot

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.