AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

December 2024:

Seventh Inning Stretch

Reflection Tokens: Passive Income or Pitfall?

Institutional Adoption

Ethereum’s Beam Chain Vision

AB Portfolio

Seventh Inning Stretch

Crypto has been on a tear since the election. We’re getting texts from friends and family, $100K Bitcoin was a big deal. The vibe has shifted. No longer will Crypto face debanking and hostility. There are many things to look forward to over the next half decade. The incoming administration is unequivocally pro crypto.

That being said, when was the last cycle top? When did this bull run start? How much are Ethereum and Bitcoin up off the bottom?

Ethereum and Bitcoin topped in November 2021, over three years ago

Since June 2022 at ~$900, Ethereum is up ~341% ($3,877)

Since November 2022 at $15,600, Bitcoin is up ~537% ($100,465)

Looking at December 2020, Ethereum was at $600 (+50% below ATH) when Bitcoin reached $20,000 (ATH). Ethereum tends to catch up in the later stages of the crypto cycle.

If crypto’s short but intense history teaches us something, it’s that the space historically operates on a four year cycle. This would mean the peak for this crypto cycle is in 2025. There are many catalysts happening so people always claim it is the supercycle. Maybe this time is different, the cycle does get extended. Once Ethereum rockets past all time highs it will be time to think about selling. Everyone’s situation is different, plan accordingly.

AB Researcher: Whitetail

Reflection Tokens: Passive Income or Pitfall?

Holding these tokens literally pays off.

Reflection tokens have sparked excitement across the DeFi world, offering holders a unique form of passive income simply by holding. Is this model sustainable? Are these tokens innovative or cleverly disguised schemes? Reflection tokens like BasePrinter have gained attention and volume. In the past week, BasePrinter’s price has risen from $30K to $3M (~100x).

At their core, reflection tokens charge transaction fees and redistribute a portion of these fees to holders. Here's a breakdown:

Fee Redistribution: Every transaction incurs a fee, and part of this fee is redistributed to holders pro rata.

Deflationary Mechanics: Many reflection tokens burn a portion of tokens using fees, reducing supply.

Holder Incentives: By rewarding long-term holders, reflection tokens create a strong incentive to hold rather than sell, fostering price stability.

Here is a great overview and a more technical deep dive on these tokens.

Using ChatGPT to audit BasePrinter's smart contract, here’s what it found:

Dividend System: BasePrinter collects a 5% tax on transactions, swaps the fees for a reward token ($USDC) then distributes to holders pro rata.

Exclusions and Gas Optimization: Certain accounts, like the contract itself, are excluded from rewards to reduce unnecessary gas costs. Processing dividends respects a configurable gas limit, ensuring scalability.

Transparency: The contract uses clear fee mechanics, and transaction data is publicly verifiable, ensuring transparency for holders.

Reflection tokens face accusations of being Ponzi-like, but reality is more nuanced. These contracts are built on blockchain technology, where all transactions and logic are public and verifiable. This is a stark contrast to the opaque nature of Ponzi schemes. However, these tokens face challenges during periods of low transaction volume. When activity slows, rewards decline, which can incentivize some holders to sell. Ironically, this wave of selling activity reintroduces transaction fees, providing new incentives for others to buy back in.

BasePrinter and Baby Miggles innovate using smart contracts to incentivize loyalty and create passive income. All tokens have risk—such as dependency on transaction volume and potential centralization—but these offer an exciting glimpse into the evolving landscape of tokenomics. As with all investments, DYOR and remember: fundamentals > pumpamentals.

AB Researcher: Jackson Blau

Institutional Adoption

Curve + Elixir + BlackRock: A $533M Bridge Between TradFi and DeFi

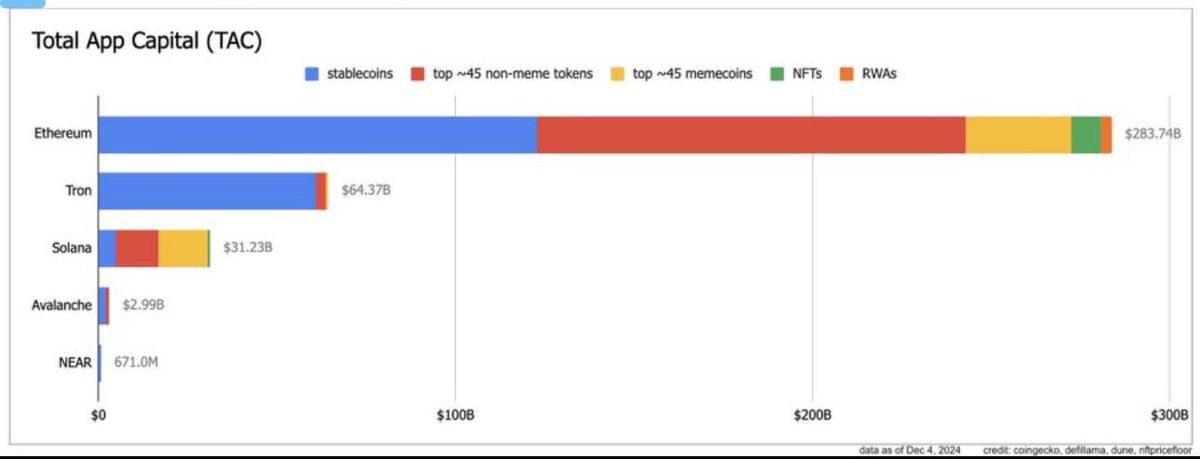

BlackRock has partnered with Curve and Elixir to bridge traditional finance (TradFi) and decentralized finance (DeFi). This collaboration involves BlackRock allocating $530M through Elixir’s treasury management platform, leveraging Curve’s decentralized exchange infrastructure. This initiative creates a more integrated financial ecosystem by allowing institutional capital to access DeFi securely.

Elixir plays a key role by offering tools to manage risk and enhance transparency for institutional DeFi participants. The partnership highlights growing institutional interest in DeFi as it matures and demonstrates how decentralized systems can coexist with traditional financial frameworks.

This milestone is a great example of major institutions having the ability to move real world asset dividends and investment yield into DeFi. As more RWAs become tokenized, there will be a larger pool of investors and capital for DeFi to capture.

US Treasury Acknowledges Bitcoin as ‘Digital Gold’ in Fiscal Report

The U.S. Treasury's recent fiscal report acknowledges Bitcoin as "digital gold," highlighting its evolving role as a significant asset in the financial landscape. The report emphasizes Bitcoin's resilience and its growing adoption as a store of value, akin to gold in traditional finance. This marks a notable shift in institutional perspectives, further solidified by increasing investments in Bitcoin ETFs.

The Treasury's recognition underscores the cryptocurrency's legitimacy and its integration into mainstream financial narratives, reflecting a broader trend of acceptance within both government and institutional sectors. This development is expected to bolster Bitcoin's standing among investors seeking alternatives to traditional assets amid economic uncertainties.

More institutions and governments are giving Bitcoin legitimacy, a self-fulfilling prophecy that crypto people have been predicting for years. With a more pro crypto admin coming into office and more access to the asset class than ever before, expect Bitcoin to continue to pick up momentum for years to come.

AB Researcher: Alec Beckman

Ethereum’s Beam Chain

“Ethereum’s Marketing Team” (there isn’t one) has a new sales pitch, Beam Chain which will usher Ethereum into its ZK era by SNARKing everything. The aim of the Beam Chain proposal is to upgrade the consensus layer of Ethereum - the Beacon Chain.

Why is this important?

The Beacon Chain is based on 5 year old research and since then we have a much better understanding of MEV, SNARKs are much faster, and tech debt that has added up. You can break the roadmap down into 3 categories: block production, staking, and cryptography.

With block production we can add better censorship resistance capabilities (FOCIL), create execution auctions for isolated validators, and quite possibly make faster slots (down to 4 seconds). With staking there are people in the community who believe the staking issuance scheme is broken and needs to be smarter. Decreasing the minimum amount needed to stake (from 32 to 1 ETH) allowing more people the chance to be a solo validator. Lastly, faster finality could improve assurances around transactions if say we brought it down to a 3-slot FFG. Cryptography comes down to snarkification using Poseidon and zkVMs, quantum security with hash-based signatures, and strong randomness from things like MinRoot VDF.

Removal of tech debt will include: no more epochs, only slots, no staking max balance, only minimum balance. Regarding sync committees, only use SNARK proofs, only EVM addresses for withdrawal credentials, only RANDAO for swap-or-not.

As of right now most of these proposed changes can be found in places on Vitalik’s roadmap for Ethereum in The Merge, The Scourge, The Verge, and The Splurge. Historically the consensus layer has had 1 upgrade per year since genesis, once the community runs out of low hanging fruit, this is when the “beam fork” can happen - potentially 2028.

AB Researcher: L2 Explorer

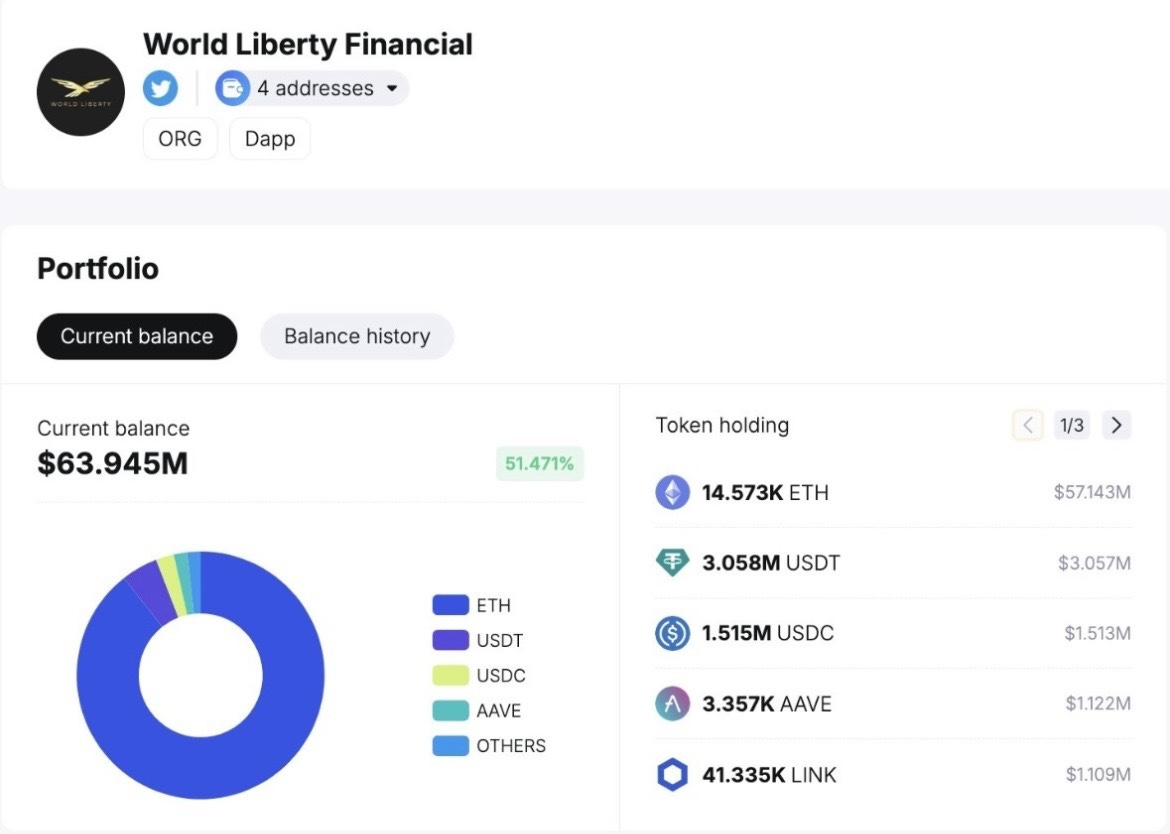

AB Portfolio

Disclaimer: Our buys/watchlist should not be takin as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update.

This is not investment advice, but a view into our strategy for educational purposes.

AB Researcher: @Rocketpilot

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.