AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

August 2024 Subjects:

Why Are We Here?

The 2024 Crypto Election

Ethereum Lands ETF

T-Bills Expand to L2s

Illuvium Update Three

AB Portfolio

Additional Alpha

Why Are We Here?

Why are we here?

This is a question that I asked myself as Ethereum plunged from $3,500 to $2,200 over a few days. Did anything fundamentally change with the asset that caused it to drop 37%? What other reasons could be affecting the price?

One of the best investors I know says his favorite time to buy is from “forced sellers”. That is what we saw last week. Many people onchain expected $2,700ish to be the floor which resulted in cascading liquidations down to $2,200. Leverage is visible onchain. I didn’t snipe the bottom or try to catch a falling knife but once the price had settled a bit, scooped some ETH at $2,450 because nothing had fundamentally changed with the asset!

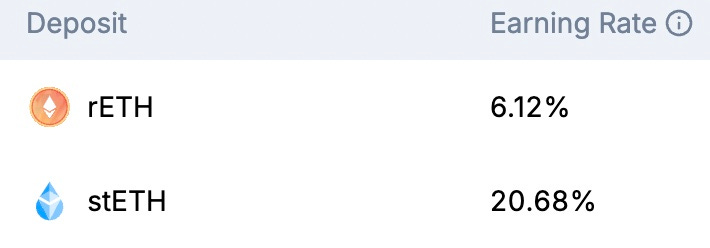

Crypto is the only liquid market that trades 24/7. This means that when bad news hits, it is often the first option that firms have to de-risk their portfolio. As stated above, in selloffs correlations go to 1. Ethereum for example, while many people were in panic, we looked at fundamentals. The price was down 37% (well in the realm of normal bull market corrections), yield was almost 2x the prior week due to demand from DeFi, and the ETF buying/selling was playing out in similar fashion to Bitcoin.

Risk/reward seems good.

Governments around the world will continue to print money, crypto will continue to grow as advisors offer the ETFs to their clients, and institutions will continue to build on Ethereum. These are long term trends that we’re only in the first decade of.

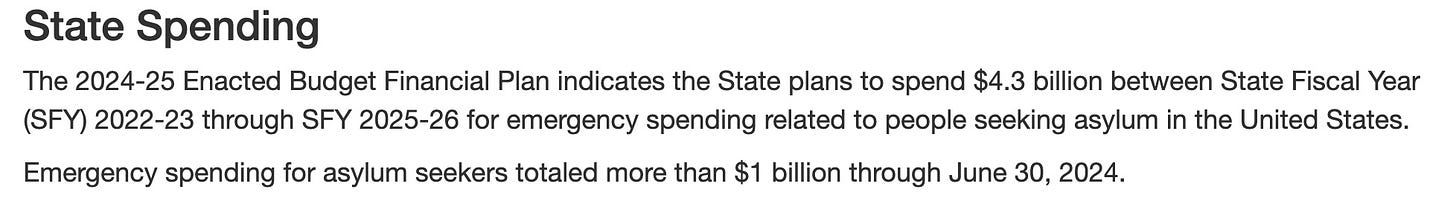

There is often a conversation about raising taxes and the increasing federal debt. To make it short, the federal government has a spending problem not a revenue problem. No matter what taxes are, the government will spend more than that. Increasing taxes will kill growth and suffocate the economy because the government is often a poor allocator of capital. Just look at New York State below.

There is not unlimited money or resources. What programs will New York State have to cut from its citizens to pay for these illegal immigrants? Crypto provides an out to people like us that see this wasteful spending as a ticking time bomb. This is one tiny example that is happening across every level of government - local, state, and federal - in America.

Here are great charts that show the effect of leaving the gold standard in 1971

Here is the rate that the federal debt is growing

Here is a list of companies accumulating Bitcoin

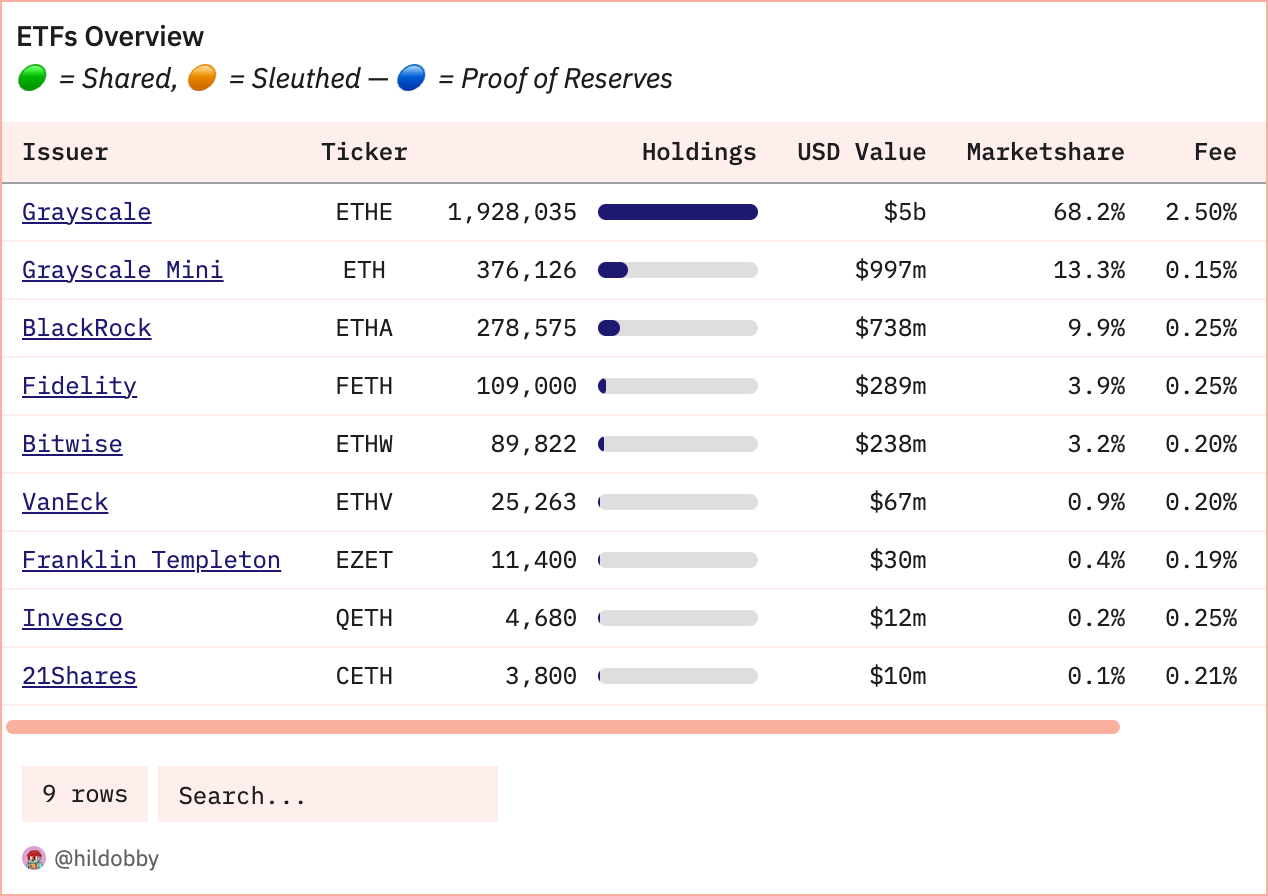

Here is a list of Ethereum ETFs using onchain data

All of these trends will continue to increase. Choose your portfolio and asset allocation wisely.

AB Researcher: @Whitetail

The 2024 Crypto Election

We are ~80 days away from one of the most important elections in United States history and all three major candidates—Donald Trump, Kamala Harris, and Robert F. Kennedy Jr.—are scrambling to appeal to the fastest-growing voter base in the country: Independents. While each candidate has their differences, they surprisingly agree on one key issue: crypto is here to stay.

In a pivot from previous positions, Democrats recently held a Crypto4Harris event where Senate Majority Leader Chuck Schumer signaled a shift within the Democratic Party by expressing optimism that U.S. crypto legislation could be passed this year. Schumer, alongside other Democratic leaders, emphasized the importance of establishing clear, supportive regulations to foster innovation while protecting consumers. It is yet to be seen if this is an actual policy shift or just the typical pandering to voters. To be frank, it is hard to be in crypto and vote democratic currently as they have targeted our industry (sometimes illegally!) throughout the current administration. As of now, Democrats do not deserve the crypto vote. Actions speak louder than words. Fire Gary Gensler!

This development comes on the heels of both former President Trump and Robert F. Kennedy Jr. speaking at last month's Bitcoin conference in Nashville. Both candidates publicly endorsed cryptocurrency and discussed its potential benefits for the U.S., particularly Bitcoin, as a means to address the national debt. Trump suggested that adopting crypto could help pay off the country’s $35T debt and emphasized the importance of staying competitive with China. Kennedy also addressed the current state of crypto regulation, stating, "We need sovereignty over our own wallets, transactional freedom, and a currency that is transparent. We need to make sure America remains the hub of blockchain technology. I'm going to ensure cryptocurrency is regulated in a way that protects consumers from deceptive schemes. I purchased 21 Bitcoins since I started this campaign. I also bought three coins for each of my kids."

It has become abundantly clear that this year marks a historic turning point as crypto has emerged as a critical issue in U.S. politics. The potential shift in the Democratic stance, combined with Republican and Independent support, underscores how crucial cryptocurrency has become in shaping economic strategies and influencing both national and international financial landscapes. As digital currencies gain traction globally, leading presidential candidates are now compelled to define their positions, reflecting crypto's growing impact on the political and economic future of the country.

AB Researchers: @8Ball

Ethereum Lands US ETF Day After 10th Birthday

On July 23rd, 2024, nine Ethereum Exchange-Traded Funds (ETFs) began trading on traditional stock exchanges cementing Ether (ETH) as a commodity in the United States. An ETF is a type of investment fund that is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold or in our case Ethereum’s native digital asset - Ether. This type of product has been on everyone’s radar since the Winklevoss Twins started applying a decade ago. With so much back and forth between Congress, the SEC, and CFTC on how to classify digital assets like Bitcoin and Ether, it is refreshing to get definitive answers on both. It was only 10 years ago when Ethereum launched a crowd sale offering Ether in exchange for BTC at 1 BTC : 2000 ETH ratio on July 22nd, 2014. Those who purchased 2000 ETH with 1 BTC and have managed to hold the whole time have turned $600 into ~$5 million, however there aren’t many of those instances left. The most famous exception however is Rain Lohmus who bought 250,000 ETH for 125 BTC during the presale and lost access to his ETH, yes he lost access to what is now worth $650,000,000… You can see his wallet here.

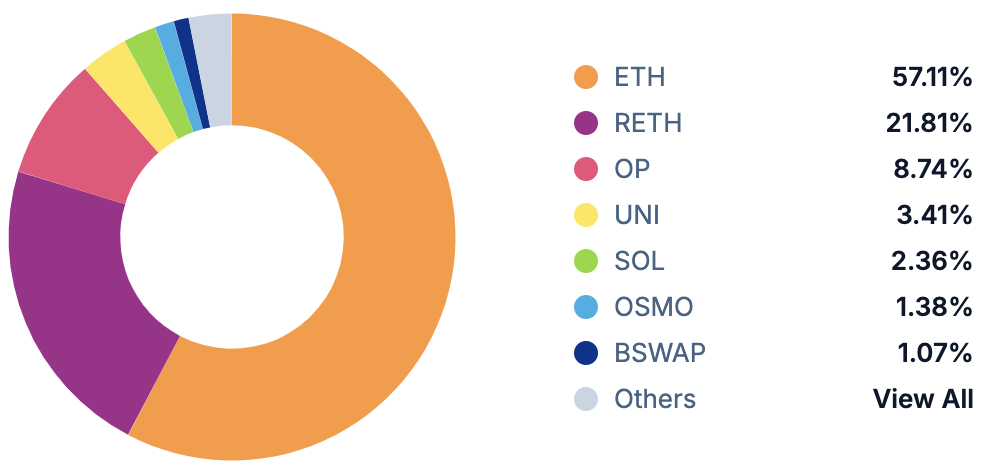

But back to the ETF. On the first day of trading the Ethereum ETFs did over $1B in trading volume. Inflows have been net negative due to the large outflows from Grayscale’s $ETHE vehicle but August 12th was the first day without any outflows from ETHE. When considering performance based on the Bitcoin’s launch earlier this year, Bitcoin ETFs did about $4.5B in volume on the first day of trading. This equates roughly to the market cap ratio of the two assets. An interesting point to make here is Grayscale’s ETHE Trust (same as Grayscale’s GBTC Trust) was the “incumbent” with ~$10B in assets. However, a few months ago Grayscale decided to create a mini ETH ETF and seed it with 10% of the assets from $ETHE. This vehicle was not available for GBTC holders on the first day of trading for Bitcoin ETFs, as a matter of fact the Grayscale Mini BTC ETF just launched last week. The other players providing Ethereum ETFs are BlackRock, BitWise, Invesco, Fidelity, Franklin Templeton, 21Shares, and VanEck. While the majority (7 out of 9) use Coinbase to custody, Fidelity has went the self-custody route, and VanEck is using Gemini. My quick opinion on this is we should see another top tier exchange like Kraken/Binance as a custodian along with a major bank such as JPMorgan.

So what does this all mean to the everyday person? Well Bitcoin and Ethereum, the two largest digital assets by market cap, now have ETF products available to anyone with a brokerage account. Yes, that is anyone with a 401k through work, a retirement account like a Roth IRA, or even people speculating on Robinhood. Another way of putting it is 158 million Americans. Estimates from prominent names put net inflows to ETH ETFs at anywhere from $500 million to $2 billion per month. Looking toward the future, there are still plenty of traditional market products to be created to complement the current spot ETF offerings. One thing I could foresee happening is the ability to trade options contracts on all the major BTC and ETH ETFs. This will unlock new strategies for more sophisticated holders and traders. It is also very likely we will see new ETFs which hold both BTC and ETH at certain weighted positions (75% BTC, 25% ETH), giving investors exposure without needing to pick how much of each. We will also see Staked Ethereum ETFs which holds Staked Ether securing the Ethereum network. For doing so, Ether stakers are paid fees generated by the protocol. Right now that annual payment comes out to about 2 - 5% depending on network usage.

Researcher: @L2explorer

Franklin Templeton Expands On-Chain Treasuries Fund To Arbitrum

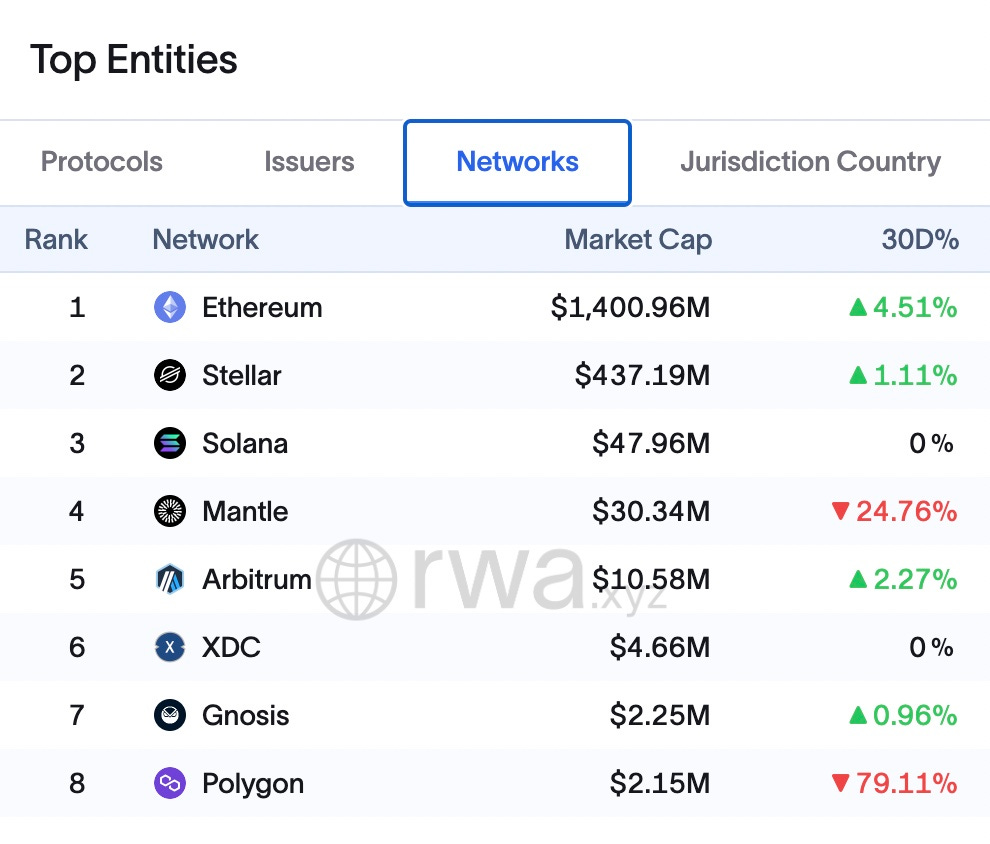

Back in 2021, Franklin Templeton, the $1.6T+ asset manager, issued an onchain Treasury Fund (FOBXX) on the Stellar blockchain. In 2023, Franklin Templeton expanded FOBXX to the Polygon blockchain, making it more accessible across different chains. Last week, Franklin Templeton announced it would be further expanding access to FOBXX on the Arbitrum blockchain.

“Expanding into the Arbitrum ecosystem is an important step on our journey to empower our asset management capabilities with blockchain technology,” said Roger Bayston, head of digital assets at Franklin Templeton. “The partnership will accelerate the integration of decentralized finance within traditional financial services”.

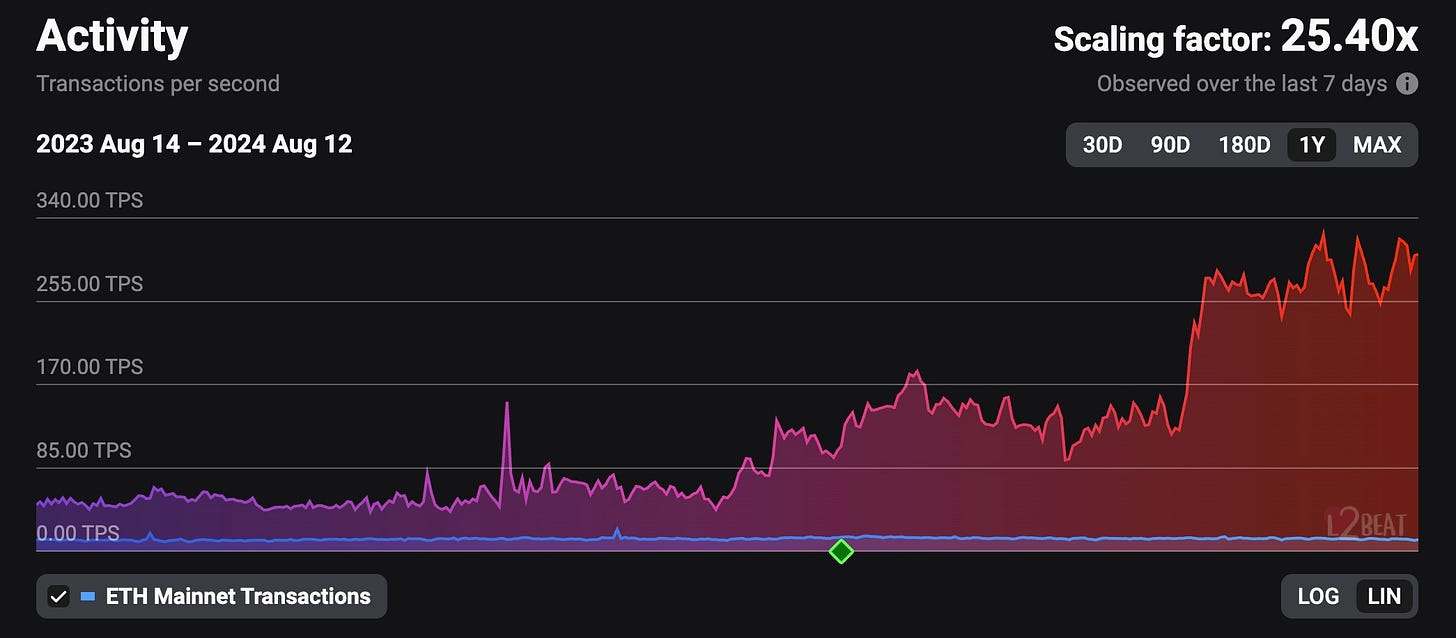

In the past, Franklin Templeton has cited stablecoin settlements, reducing middleman friction, better transfer of ownership, and improved data capabilities in real world assets using blockchain technology. Arbitrum has over $14B in total value locked (TVL), making it the largest Ethereum layer 2 by that metric. Franklin Templeton’s has an app (BENJI) for retail access to FOBXX and a Web portal for institutional investors.

AB Researcher: @AlecBeckman

Onchain Gaming: Illuvium Update Three

On July 25th, Illuvium officially launched the first AAA blockchain-based game, EVER! The game debut featured a stunning three-minute intro cinematic, outlining the founding story of the Illuvium universe. Players then proceeded through an introductory tutorial before being set free to explore the expansive Illuvium universe. The launch has been widely regarded as a success, with the blockchain elements on ImmutableX—a gaming-focused Ethereum Layer 2 chain—working seamlessly. Players can now capture, buy, and sell creatures and items in-game for real ethereum tokens, equating to real monetary value.

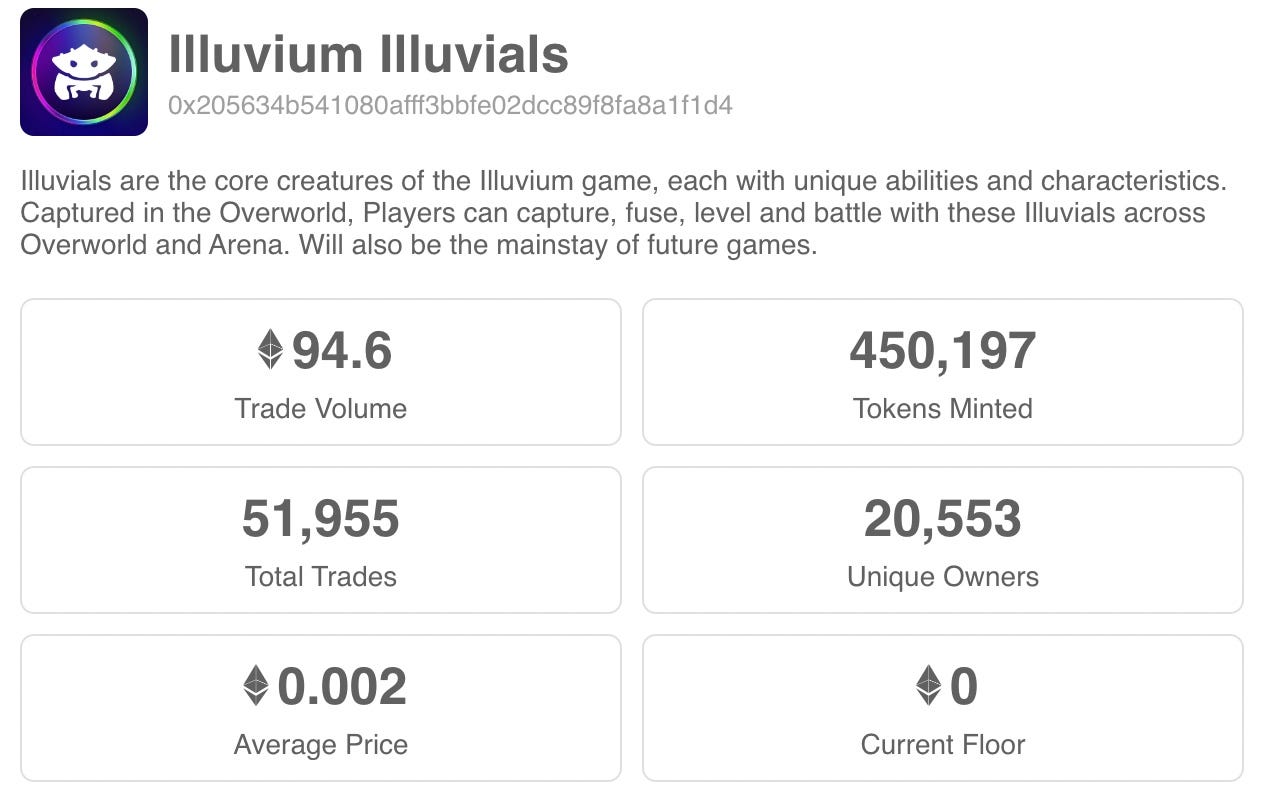

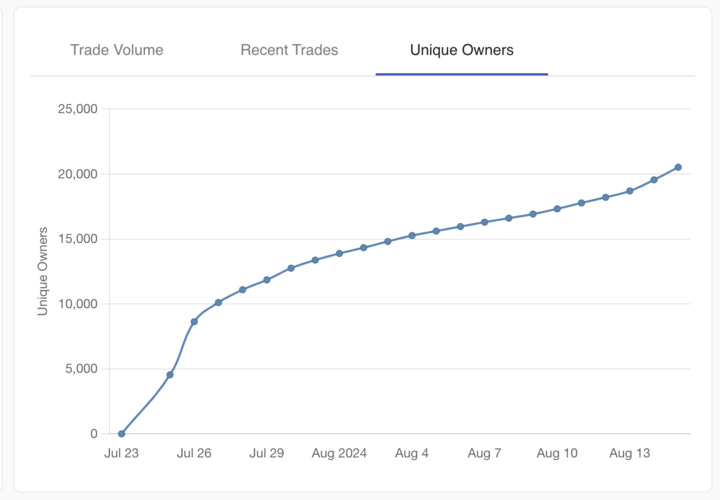

Three weeks into the launch, Illuvium’s overworld has attracted over 20,000 players, with 450,000 creatures captured and more than 50,000 trades completed. The Illuvium team committed to an “open beta” release, meaning the game is incomplete and will continue to be improved with regular updates to ensure the ecosystem’s sustainable growth over time.

Axie Infinity, the first and only real Web3 gaming success, at its peak in 2021 had millions of players and generated billions in revenue. However, Illuvium is already showing promise, boasting more monthly active players within its first three weeks than Axie did in its first couple of months. Additionally, Illuvium has generated significantly more revenue in its first month.

As Illuvium gains momentum, we expect it to continue accelerating towards success as more features and improvements are implemented. The Web3 ecosystem currently has only a handful of quality projects with both users and revenue, and Illuvium is joining that group.

AB Researcher: @Duke

Our Portfolio

Disclaimer: Our buys/watchlist should not be takin as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update. This is not investment advice, but a look into our strategy for educational purposes only.

Recent Buys

Solana ($SOL) @ $140

Degen ($DEGEN) @ $0.018

Aerodrome ($AERO) @ $1.07

Velodrome ($VELO) @ $0.14

Additional Alpha

Throughout the month, the AB Research team gathers and curates a list of high quality resources for readers to continue learning outside of the content we produce. Crypto is open source, the alpha is out there. We’re here to help you find it.

Basic:

Advanced:

BCG Estimates Asset Tokenization to Reach $16 Trillion by 2030

Blockworks Write Up on Reth, an Ethereum Execution Layer Client

Pantera August Blockchain Letter

AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

Great memes!