AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Research Letter is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

April 2025

Bringing Assets Onchain

Digital Assets: More Than Just Investments

Increasing Crypto Adoption

AB Portfolio

Ethereum is bringing the world onchain via tokenized assets.

I do not like the term Real World Asset (RWA) because I do not believe that it is possible to put a real asset, a house, onchain nor do I believe digital assets are not the real world. What is the “real” world in 2025? Everyone sees reality in different ways.

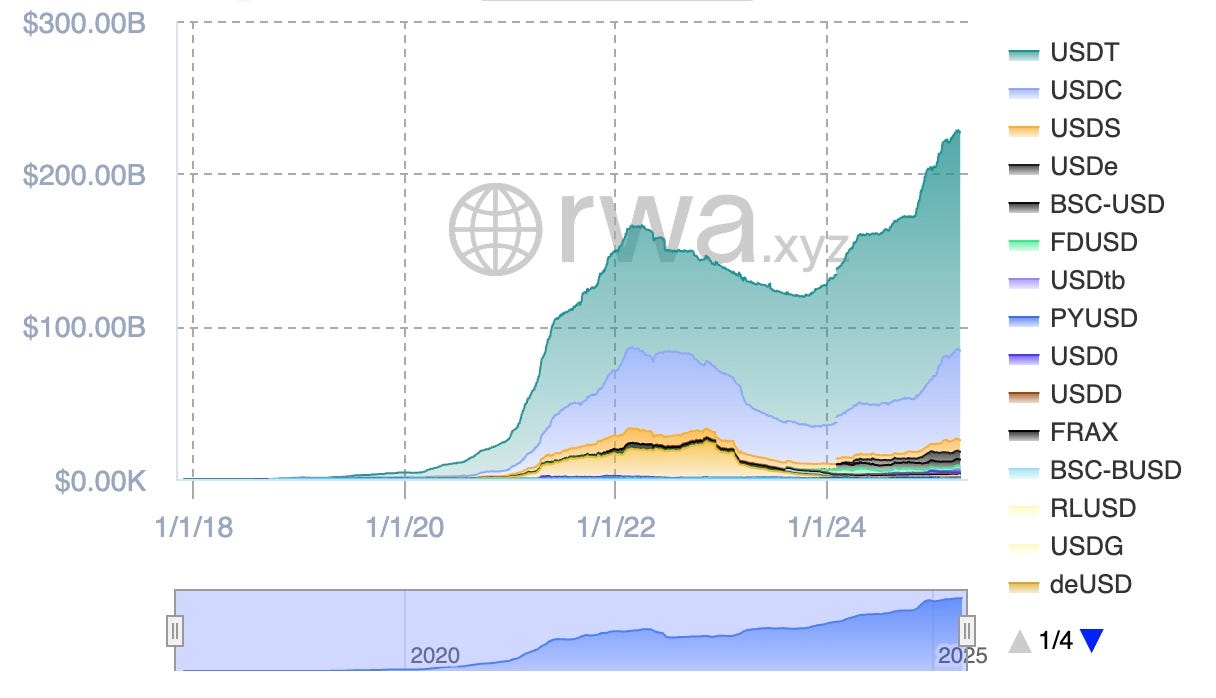

Instead, lets call this onchain value “tokenized assets”. Stablecoins are the tokenized asset with the greatest product market fit. At the beginning of 2020, there were less than $5B in stablecoins onchain, now there are $226B (1.09% of M2 money supply). A stablecoin bill, the GENIUS ACT, making its way through Congress and with regulatory clarity I believe that stablecoins will reach the $1T number.

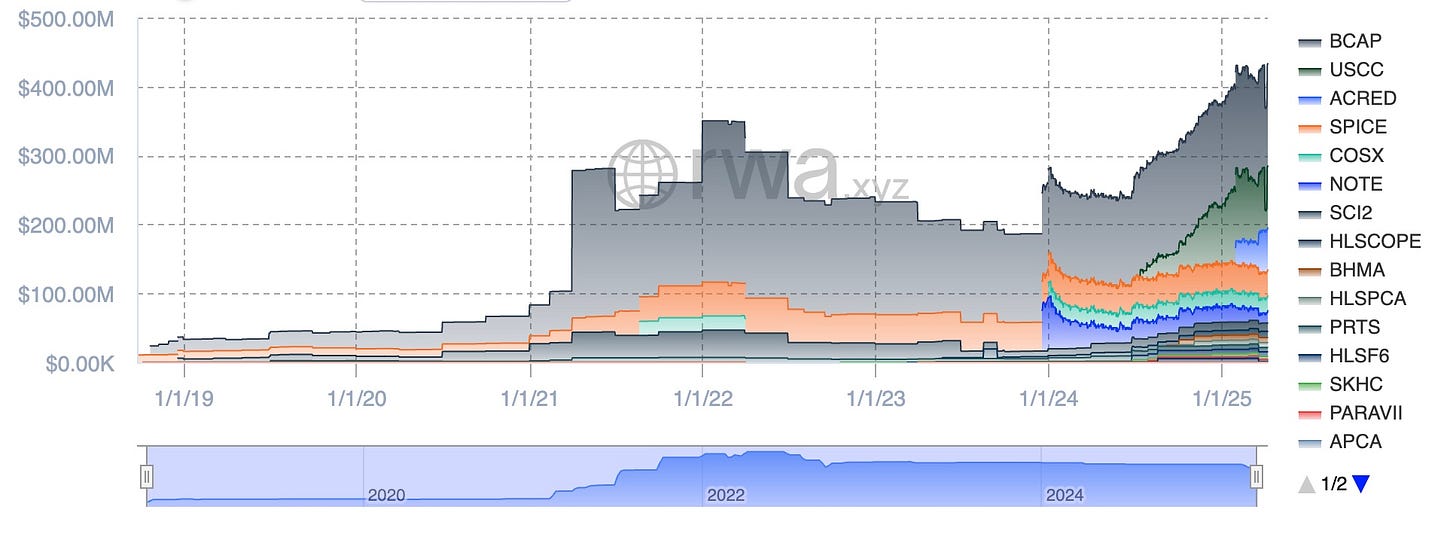

Private credit is the next largest tokenized asset at $12.6B. At the start of 2021, there was ~$30M in private credit onchain. $9.8B is on Provenance blockchain, run by Figure ,which focuses on HELCO loans. In addition there is $440M+ worth of institutional private credit funds onchain with issuers ranging from Securitize to Apollo to Hamilton Lane.

Tokenized money market funds that provide exposure to US treasuries have also seen steady growth with the majority of funds based on Ethereum. These funds provide yield to crypto firms looking to derisk or diversify their treasury without the need to move assets offchain. In addition, these funds trade 24/7 providing constant liquidity.

While the growth of some tokenized assets (stablecoins, private credit, and money market funds) has been impressive, other asset classes lag behind. I believe that tokenized equities are the next asset class to take off onchain. To date, there is ~$15M tokenized equities in the Ethereum Virtual Machine. The reason it haven’t taken off was the risk from regulatory agencies over the past four years. I believe that risk is behind us and firms will continue to tokenize equities at an increasing rate. I predict tokenized equities become the second largest tokenized asset behind stablecoins by the end of 2026. Coinbase seems like the easy candidate to lead the charge with having their stock tokenized.

On April 5th, SEC Acting Chairman Mark Uyeda asked the commission to review the all the rules below and see if they need to update or rescind. I hope they make changes. As of April 9th, Paul Atkins was confirmed as the new SEC Commissioner. The wind is at our back.

BNY, one of the world’s leading asset management and custody firms, is deploying code on GitHub titled “BNY Data Onchain”. This repository will likely be used for managing the infrastructure that enables the secure and efficient delivery of financial data—both onchain and offchain—to Ethereum.

The world is coming onchain and it should be on Ethereum.

AB Researcher: Whitetail

Digital Assets: More Than Just Investments

It is easy to perceive everything through the lens of investment and profit-making, particularly in the realm of finance and cryptocurrency. While many people approach digital assets with a buy-low, sell-high mentality, the blockchain introduces unique properties that distinguish these assets from traditional forms of value.

Understanding these differences is crucial to appreciating the full scope of what digital assets can offer beyond mere speculation.

The method by which digital assets are created varies significantly across blockchain networks. The two most common mechanisms are Proof of Work (PoW) and Proof of Stake (PoS).

Bitcoin (BTC) and Proof of Work (PoW):

Miners use computational power to solve complex mathematical problems.

The first miner to solve a problem gets to validate the next block and receive a block reward along with transaction fees.

This process ensures security but is energy-intensive.

Ethereum (ETH) and Proof of Stake (PoS):

Validators stake (lock up) a certain amount of cryptocurrency as collateral.

Instead of solving mathematical problems, they run software that helps validate transactions.

Validators earn rewards in the form of newly minted tokens and transaction fees.

PoS is considered more energy-efficient than PoW.

Beyond PoW and PoS, blockchain tokens can also be created via smart contracts. These tokens (e.g., ERC-20, ERC-721 NFTs) can be deployed at minimal cost, often requiring only the transaction fee necessary to execute the contract.

UTXO Model vs. Account Model Different blockchains use different transaction models to track balances:

Bitcoin's Unspent Transaction Output (UTXO) Model:

Each transaction creates outputs that must be fully spent in subsequent transactions.

Similar to receiving exact change in cash transactions.

Increases transparency and security but can make smart contracts more complex.

Ethereum's Account Model:

Works similarly to a bank account where balances increase and decrease.

Facilitates smart contracts and decentralized applications (DApps).

More flexible but slightly less transparent compared to the UTXO model.

Divisibility of Digital Assets

One of the unique aspects of digital assets is their high divisibility, allowing for microtransactions that aren't feasible with traditional money:

Bitcoin (BTC): Divisible up to the 8th decimal place, with the smallest unit called a satoshi (sat).

Ethereum (ETH): Divisible up to the 18th decimal place, with the smallest unit called wei.

US Dollar (USD): Only divisible up to the 2nd decimal place (e.g., cents/pennies). This extreme divisibility allows for more precise value transfers and improved accessibility for users across different economic scales.

Programmable Money and Smart Contracts

Unlike traditional currency, digital assets can incorporate predefined rules through smart contracts. These self-executing contracts enable:

Automated payments and escrow services without intermediaries.

Time-lock mechanisms that restrict spending until a future date.

Decentralized Finance (DeFi) applications, enabling lending, borrowing, and trading.

Tokenized assets that represent real-world value, such as real estate, stocks, and commodities. Bitcoin also has basic programmability through scripts and time-locked transactions, though Ethereum and other smart contract platforms offer significantly more flexibility.

Speed of Transfer and Finality

One of the most practical advantages of digital assets is their speed of transfer compared to traditional financial systems:

Bitcoin transactions typically achieve finality within ~60 minutes (after 6 confirmations).

Ethereum transactions finalize in about ~5 minutes (after 10–15 block confirmations).

Traditional systems:

ACH Transfers: 1-3 business days.

FedWire Transfers: Same day but only during banking hours.

Credit Card Settlements: Typically take 2-3 days.

This rapid settlement time makes blockchain transactions more efficient, particularly for international payments, where traditional remittance methods can take days and incur high fees.

While mainstream media often portrays digital assets as mere investment vehicles, blockchain technology provides significant advancements in how value is created, transferred, and programmed. Whether through different consensus mechanisms, transaction models, enhanced divisibility, or smart contracts, digital assets represent a fundamentally new way to interact with money. Understanding these distinctions allows us to see beyond speculation and recognize the broader economic and technological implications of blockchain networks.

AB Researcher: L2 Explorer

Increasing Crypto Adoption

VanEck on Trump Tariffs Leading to De-Dollarization, Increase Usage of Digital Assets

VanEck, a major investment firm managing over $100 billion, recently shared thoughts on how new U.S. tariffs could speed up the world moving away from the U.S. dollar. With Trump proposing new taxes on goods from China and Europe, some countries are reacting by using digital assets like Bitcoin instead of the dollar. For example, China and Russia are doing energy deals in Bitcoin, Bolivia is using crypto to buy electricity, and France’s energy company is testing Bitcoin mining. VanEck sees this as a sign that Bitcoin is starting to be used more like money, not just a risky investment.

They also point out that what the U.S. Federal Reserve does next (possibly lowering interest rates) could push more money into digital assets. If the U.S. dollar keeps losing value (tracked by the DXY index), that could make Bitcoin and other digital assets even more attractive. In short, VanEck believes that global tensions and changing policies are opening the door for crypto to slowly start replacing the dollar in some parts of the world.

Larry Fink Highlights Tokenization in Annual Letter

Larry Fink, CEO of BlackRock, the world's largest asset manager with approximately $8.6 trillion in assets under management, emphasized the potential of tokenization in his annual letter to shareholders. The letter mentioned bitcoin seven times and tokenization thirteen. x\He highlighted that tokenizing asset classes like stocks and bonds could enhance capital market efficiency, reduce intermediaries, and lower costs, thereby improving investor access. Fink noted that while emerging markets such as India and Brazil are advancing rapidly in digital payments, developed markets, including the US, are lagging behind, resulting in higher payment costs.

BlackRock is actively exploring the digital assets ecosystem, focusing on areas relevant to clients, such as permissioned blockchains and the tokenization of stocks and bonds. Fink also underscored the importance of regulation and risk management in the evolving digital assets space, stating that BlackRock intends to apply the same standards and controls to digital assets as it does across its business.

AB Researcher: Alec Beckman

AB Portfolio

Disclaimer: Our buys/watchlist should not be taken as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

We strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each AB Research Letter update.

This is not investment advice, but a view into our strategy for educational purposes.