AB updates are for informational purposes only. Do not construe any of the following as investment, financial, or other advice. You make your own decisions.

The AB Moonletter🚀 is a culmination of research & insights from the diverse capacity of the AB Team. Ultimately our focus & mission is financial freedom.

APRIL’24🤴🌽 Subjects:

The Halving: Bitcoin’s Moment

Market Dump: History Rhythms

BlackRock BUIDL: Institutional Adoption

Scaling Ethereum: Differences Among Layer 2s

Reunderwriting: Admitting Mistakes

Our Portfolio: Holdings, Recent Buys & Watchlist

The Halving: Bitcoin’s Moment

Ladies and Gentlemen, the moment finally happened, the 2024 Bitcoin halving occurred on Friday, April 19th 2024. In a nutshell, this event represents a historically significant shift in Bitcoin supply. Let’s dive into what exactly the halving is, why it matters, and why it could be one of the catalysts for a bull market.

What is the Bitcoin Halving?

The Bitcoin halving is a predetermined event that reduces the reward for mining new blocks in the Bitcoin blockchain by 50% every 210,000 blocks (~4 years). This mechanism is programmed into the Bitcoin protocol to control its supply and maintain its scarcity over time. Essentially, miners receive 50% fewer bitcoins for verifying transactions, leading to a slower rate of new Bitcoin creation. Bitcoin's hash rate, which measures the processing power of the Bitcoin network, has trended upward over time, reflecting increased competition among miners to validate transactions and secure the network.

Why It Matters?

Historically, Bitcoin halvings have had a significant impact on the cryptocurrency market. Following each halving, there has been increased demand for Bitcoin. This phenomenon stems from the reduced supply of new bitcoins entering the market coupled with sustained or increasing demand and awareness. Consequently, investors and traders often anticipate the halving, driving a buildup of bullish sentiment and speculative activity in the lead-up to the event. While past performance is not necessarily indicative of future results, this trend has been observed in the 2012, 2016 and 2020 halvings.

This Time is Different…

In prior cycles, Bitcoin price has surged significantly post halving with the wealth effect bolstering prices for alternative crypto assets like Ethereum and Solana as traders and investors look to rotate post halving profits into higher risk blockchain projects. Why could this time be different? With the recent approval of Bitcoin exchange-traded funds (ETFs), the demand dynamics for Bitcoin experienced significant shifts. ETFs offer a more accessible and regulated means for investors to gain exposure to Bitcoin without the complexities of directly owning it. As Bitcoin ETFs continue to evolve and gain acceptance in traditional financial markets around the world, their impact on Bitcoin's supply and demand economics is likely to become increasingly significant. With that said, AB has positioned its portfolio to benefit from the continued institutional adoption of crypto. Happy Halving!

Author: @8ball

Market Dump: History Rhythms

The crypto market has experienced a significant downturn over the past few weeks. Traders attribute the pullback to factors such as tax selling, USD liquidity, The Middle East, and a typical “buy the rumor, sell the news” response to the Bitcoin Halving event. Despite this, the market has been on an upward trend since October without any substantial pullbacks. Bitcoin surged from 27k to 72k, Ethereum from 1600 to 4000, and Solana from 20 to 200. Many altcoins in the Gamefi, AI, Memecoin and Solana ecosystems have seen gains exceeding tenfold. After such extensive multi-month increases, a pullback is typical, closely resembling the first major downturn during the 2017 rally. Following the 2017 pullback, the market experienced a parabolic surge, suggesting the potential for a similar setup this time around. In the crypto market, the potential for extreme upside is often balanced by substantial downside risks, which seasoned veterans consider a normal part of the journey. Volatility to the upside requires volatility to the downside.

In 2017, Ethereum pullback followed by it rallying 350%. Additionally, this pullback can be viewed as a positive development because it allows the cycle to extend further and reach higher levels. If the market had continued to rise without interruption, it would have been more likely for the bull market to end prematurely. A healthy bull cycle necessitates substantial pullbacks and consolidation periods to establish a sustainable upward trajectory.

Author: @Duke

BlackRock BUIDL: Institutional Adoption

BlackRock, the world’s largest asset manager with over $10 trillion AUM has launched a tokenized fund on the Ethereum network with Securitize.

The fund, “$BUIDL” (a play on the crypto acronym HODL), was launched at $100 million and has now reached $280 million AUM. BUIDL is available to Qualified Purchasers and will distribute monthly dividends via $USDC. This product provides a great example of institutional adoption and a game plan for other tokenized or token based assets on Ethereum.

BlackRock, a known supporter of tokenizing assets, is helping to bring the masses onchain. Larry Fink has been extremely vocal about tokenization being the norm for financial assets in the next 10-20 years.

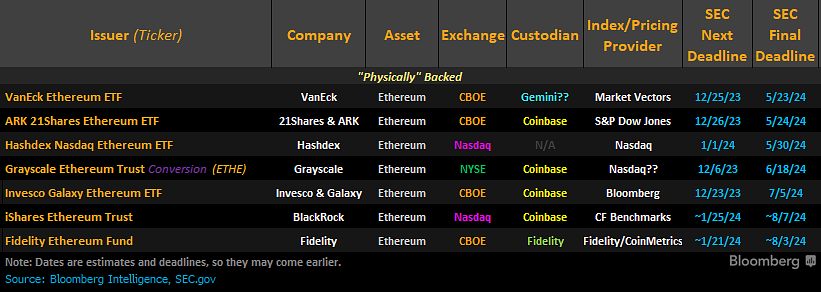

Other large institutions such as KKR, Hamilton Lane, and Wisdom Tree have been at the forefront of tokenized assets as well. Most citing liquidity improvements, transparency, and automation as reasons for moving towards a more digital future. A quick snapshot below reminds everyone of the number of institutions that have applied for a spot ETF. A lot of asset represented on that list.

Author: @Alec Beckman

Scaling Ethereum: Differences among Layer 2s

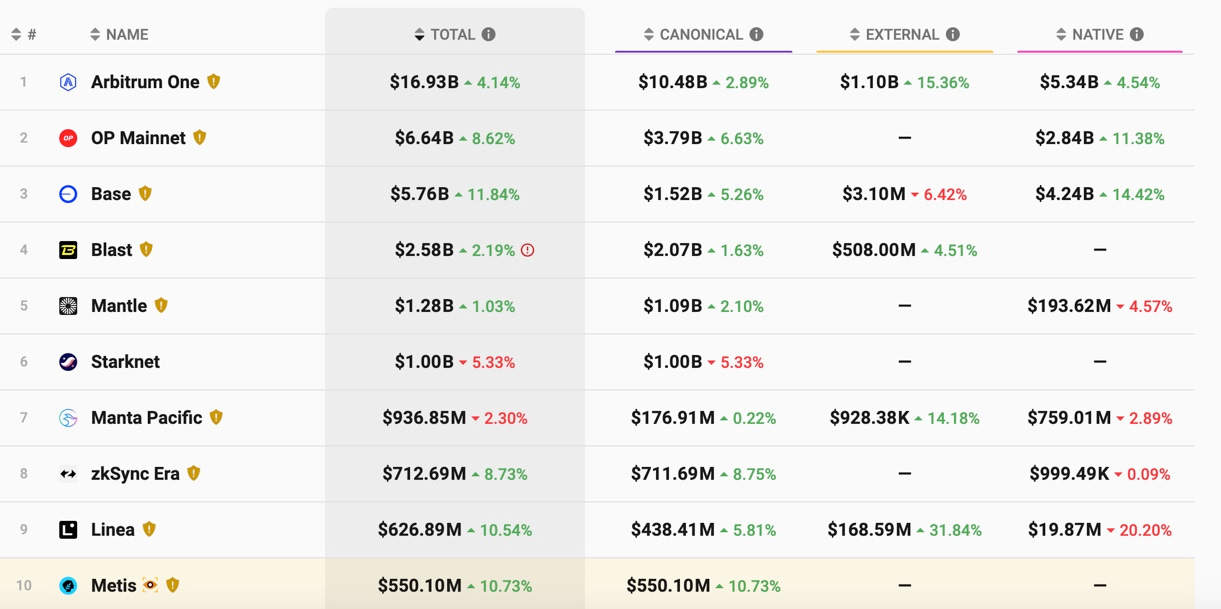

Rollups, a form of layer 2 network on Ethereum, are essentially an Ethereum smart contract enabling scalability for the main Ethereum network. The two types of rollups at the moment are optimistic and zero knowledge. The difference lies in whether or not the state it posts to Ethereum is in fact “true” from the get go or if it needs to be verified/checked by a 3rd party afterward. Optimistic rollups assume what is posted is correct until proven wrong by a 3rd party, whereas zk rollups are correct once posted to Ethereum as the state is verified with zero knowledge proofs.

Considering the hype and use surrounding Coinbase’s Base network over the past quarter, it may be useful to look at how this particular optimistic rollup (based on OP Stack technology) can be beneficial (to a public company, private company, or foundation). Utilizing publicly available data on Dune (dune.com) and a dashboard created by SeaLaunch (sealaunch.xyz), we can dig deeper into the profitability of creating an Ethereum layer 2 as a business product/service.

As of 4/15/24, Base has already had a $10 million profit week (3/25/24), currently maintains a 67% profit margin, and thanks to EIP4844 now pays less than ~$10k per week to post data to Ethereum mainnet.

Below illustrates the revenue and cost structure of running a rollup

Author: @L2explorer

Reunderwriting: Admitting mistakes

In crypto things move really fast.

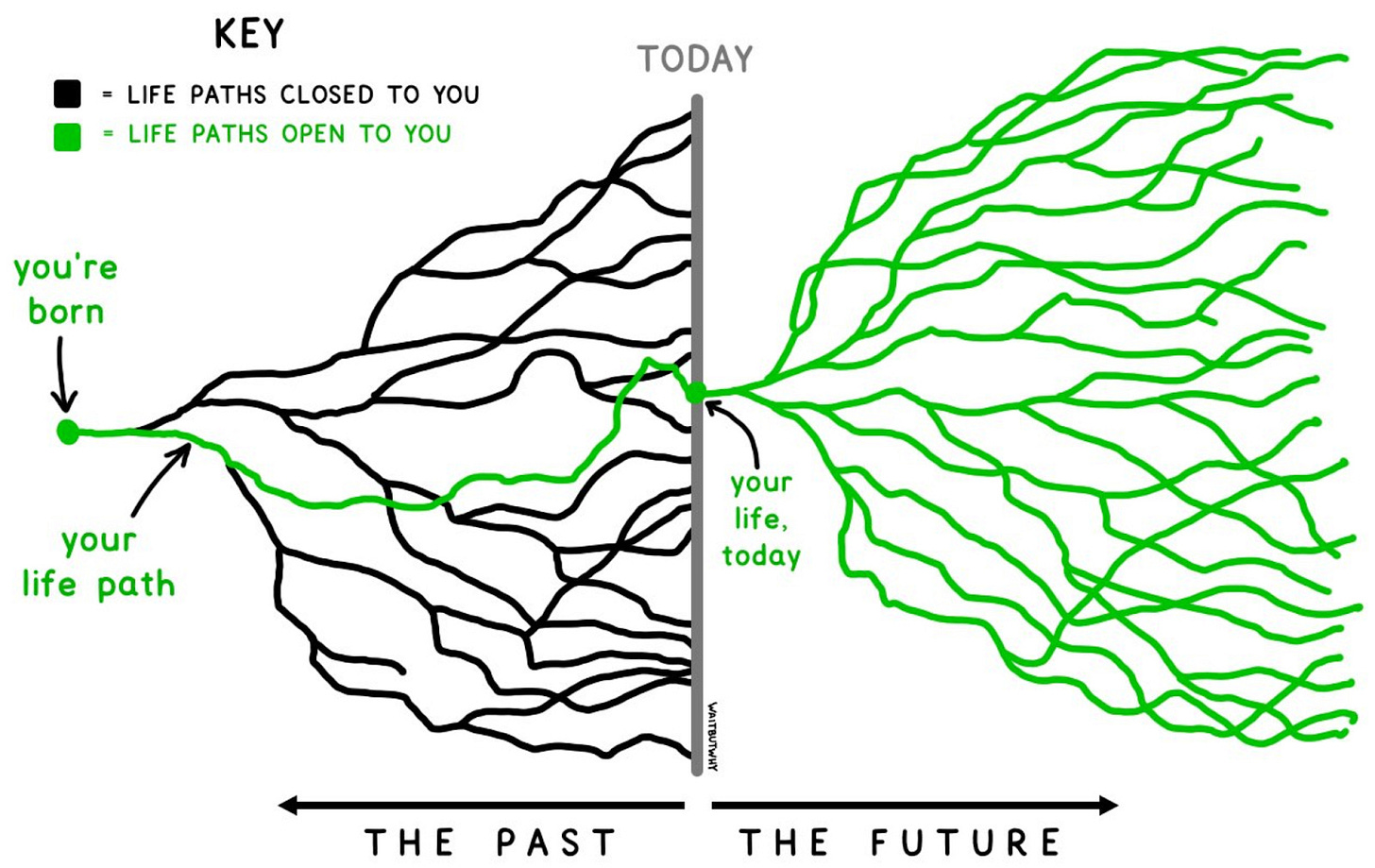

Anyone that has been in the industry longer than me (class of 2020) knows that is an understatement. As such, investors in this space must also be flexible with their investment thesis and adapt to market conditions. It was on the Empire round up in March where Santiago (host) discussed his previous failures to constantly re underwrite investments (even at higher valuations) as facts change.

Recently, I had something similar with $degen. I personally have a rule where I sell almost every airdrop to Ether because it is really f*****g hard to outperform Ether. I followed it initially with $degen and moved on. Free $150, nice. Later at an AB Team dinner, memecoins were discussed but $degen wasn't mentioned. One AB Team member warped that they were so early because we weren't even discussing it. At the time, I didn't own any memecoins and saw that degen had ripped but was bottoming out - insert chart bottoming out.

Up 10x from where I sold it. Yet, this felt like a solid memecoin play at $50M FDV, basically a bet it would be the meme on Base similar to WIF on Solana. I mean, what else would degens bid up? I bought a lot more at a much higher valuation. The coin ripped over the next week and launched its L3 and here we are building games and experiences on it.

We're not in the market where time is an asset. New things fly. It is important to be able to make decisions quickly in bull markets. Personal failures from the last cycle include SOL + MATIC. This cycle, I'm focused on constantly underwriting when buying and selling. Remember at the end of the night, it only matters how much ETH, BTC, USD you have when the party ends.

Author: @Whitetail

5. Our Portfolio, Watchlist & Additional Alpha

Disclaimer: Our buys/watchlist should not be takin as financial advice/investment suggestion. We share this information in the nature of education & transparency. We value the ability for our network to be aware of new projects & ecosystems we’re actively researching, participating & investing in. Always invest responsibly. And remember… Fundamentals > Pumpamentals !!

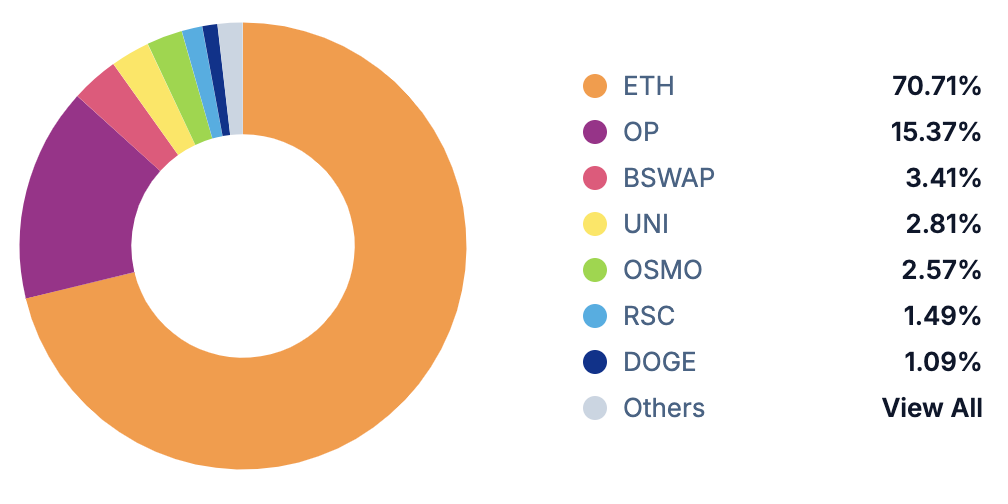

Our Portfolio

In 2024 we strive to continue helping as many people as possible understand more about the blockchain ecosystem. A large part of this, is investing. Against traditional norms of gatekeeping trading strategy or portfolio positions, Advantage Blockchain seeks to help the world understand our approach to investing granted our intensive research / interactive background. In the name of transparency, we share AB Fund’s current portfolio each Moonletter🚀 update. This is not investment advice, but a look into our strategy for educational purposes only.

Watchlist

Author: @Rocketpilot

Additional Alpha

Ethereum Investors Club

Morgan Housel

Van Eck Report into Ethereum Rollups